Omnichannel Management provides an edge – OCM leaders across industries show superior capital market performance

OCM has successfully been applied by industry leaders since approximately 2014. Corporations like Apple, Nike, Grainger, Singapore Airlines and others have not only shown that OCM is a cross-industry topic, but also that a successful application centered around the customers’ needs can lead to a significant performance boost.

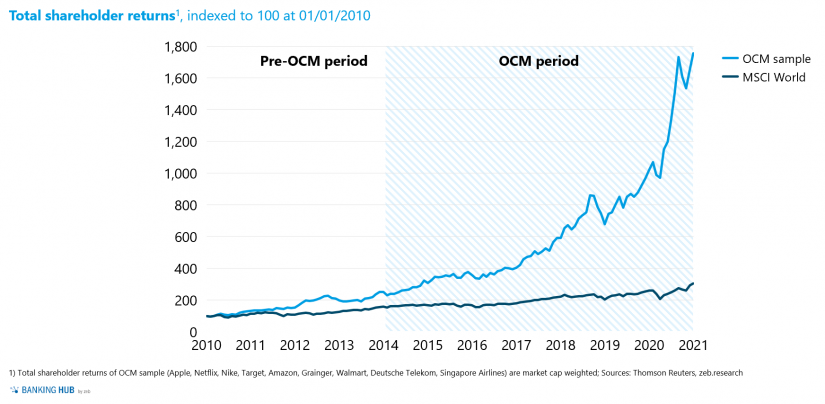

Looking at nine well-known examples of OCM leaders[1] across different industries and their capital market performance in comparison to the MSCI World since 2010, a clear outperformance that gained significant traction from 2014 onwards is visible. The market capitalization weighted total shareholder returns of the OCM leaders increased by +602% from 2014 to the end of 2020, that of the MSCI World only by +99% in the same period (see figure 1).

The impact of OCM on the performance of these innovative companies has attracted a large number of followers copying the concepts and also transferring them to other industries.

OCM in banking is a success story – OCM leaders with better net promoter scores (NPS) and higher revenue growth rates

One of the industries that have started adopting OCM concepts since 2015 is the banking industry which has also faced significant changes in terms of customer expectations. How OCM is applied in the banking industry is illustrated in the BankingHub article “Omnichannel banking and its implications for bank management”:

The article highlights the paramount importance of OCM in a world of digitalization and customer centricity and shares the results of a survey among major European banks covering five dimensions: omnichannel strategy, customer focus, steering model & KPI, organization, and technology & infrastructure. Overall, the study finds that most banks have an intermediate maturity level in OCM, with a handful of outliers leading the group and a few banks lagging behind the overall market.

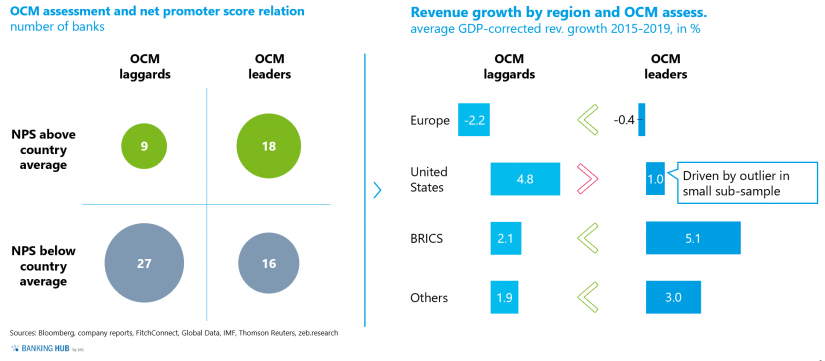

But the question remains whether banks leading the pack with regard to OCM also show a measurable financial outperformance. To answer this question, an analysis of the global top 100 banks by market capitalization with respect to their net promoter score, revenue performance and OCM maturity has been performed. The study shows that OCM leaders have NPSs above the country average far more often than OCM laggards – demonstrating a clear link between successful OCM and customer satisfaction. In addition, OCM leaders are typically able to significantly outperform their regional peers when it comes to average GDP-corrected revenue growth rates from 2015-2019 (see figure 2).

Figure 2: Net promoter scores and average GDP-corrected revenue growth rates of global top 100 banks

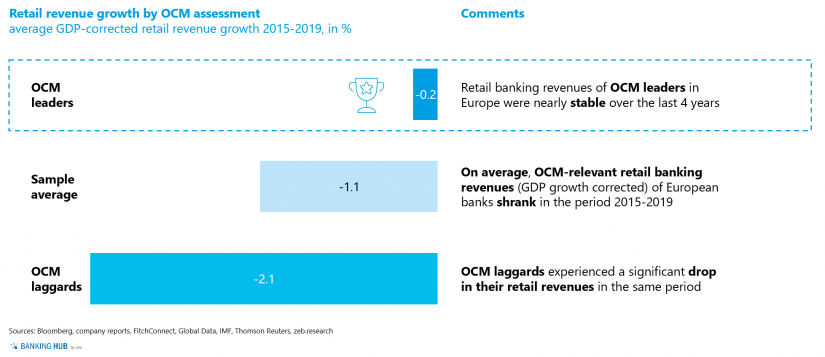

Figure 2: Net promoter scores and average GDP-corrected revenue growth rates of global top 100 banksEspecially in European retail banking, banks must cope with significant pressure on revenues and a silver bullet to resolve the issue is urgently needed. For the 19 European banks in the global top 100 sample, we went one level deeper and retrieved their retail banking revenue performance from individual segment reports. The results show that at -0.2% average GDP-corrected retail banking revenue growth rates of OCM leaders were nearly stable from 2015 to 2019, while OCM laggards experienced an average revenue decline of -2.1% in the same period (see figure 3).

Figure 3: Average GDP-corrected retail banking revenue growth rates of European banks from the global top 100 sample

Figure 3: Average GDP-corrected retail banking revenue growth rates of European banks from the global top 100 sampleUltimately, the question whether OCM can drive financial outperformance in the banking industry can therefore be answered with a clear yes.

No “one size fits all” approach when it comes to OCM implementation – distinctive success patterns are observable

There is no universal blueprint to implement Omnichannel Management in a bank. Specific conditions and the DNA of a bank must always be considered. Depending on the strategic positioning, successful OCM implementation stories can differ significantly in some respects as the two cases of Singaporean DBS Bank and that of Lloyds Banking Group showcase.

Lloyds, as a former traditional “brick and mortar” bank, now serves its diverse customer base with a multi-brand, multi-channel customer proposition and a data-driven customer experience. Instead of going “digital only”, Lloyds went “digital first” – traditional branches remain a key strategic supplement to the digital channel offerings and are seamlessly integrated into the customer journey. A driver for the success of implementing OCM at Lloyds has been the strict management of the transformation project with clear targets and a common vision. A multi-year plan with specific targets has been laid out and closely monitored – ultimately, Lloyds was able to deliver fully against the plan and the targets.

For DBS Bank, client centricity is deeply anchored in the DNA and strategy. They have created an open ecosystem with the largest number of open APIs among banks in the world, offering end to end coverage of customer needs with banking products being integrated into the customer journey. Unlike Lloyds, DBS Bank followed the paradigm of “digital only” and embedded physical channels only into processes if mandatory.

Three key elements stand out as drivers for DBS Bank’s OCM success. First, a superior harmonization of channels: DBS Bank succeeds in creating identical views between customer devices and the bank employee’s front and back end systems, integrates offers and promotions from multiple channels in the main banking app, and evolved its branches to central “pickup points” in relevant customer journeys. Second, customers are provided with enriched offerings – in-house data science teams develop algorithms to apply recommendation models to each customer group, ensuring relevant content and offers.

Last but not least, a clear vision, tone from the top, and management walking the talk can be identified as further success factors for the transformation of DBS Bank. Ten guiding principles that served as a blueprint for every decision have been defined at the beginning of the transformation. Among those principles has been the postulate “no branches” and at the same time “no lay-offs” which ensured that the employees actively supported this transformation.

More details on DBS Bank can also be found in the exciting article “Die Bank, die sich als Big Tech ausgibt” (only available in German, paywall) in the Börsen-Zeitung – here, Laura Pfannemüller and Axel Sarnitz, Senior Manager and Partner at zeb, share their impressions from an on-site visit in Singapore.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

In banking, solving four key challenges when implementing Omnichannel Management, is key

As these two examples show, there is no unique approach to OCM that leads to success in banking – whether a “digital only” or “digital first” paradigm is applied does not impact the success of the transformation towards client centricity.

In our discussions and projects with clients, we typically find that there are four pitfalls banks face when embarking on their OCM journey – solving these challenges is a precondition for success:

- Client centricity: a clear focus on the customer experience along the whole customer journey is paramount. Just selling a certain product should not be center-stage – instead, it will be a byproduct of a well-supported customer journey.

- Organization: channels should be organized in a synergy-promoting way – silo organization of the different channels hinders the provision of a seamless customer experience.

- Technical capabilities: setting up a working, interconnected and easily accessible digital infrastructure is key, but integrating or replacing legacy systems can be a big task.

- Steering: a customer centered strategy can only be executed when embedding client centricity into bank management. Besides output-oriented KPIs for client-responsible units, input-oriented KPIs for different channels in the customer journey are essential – see our BankingHub article: