Rethinking the service model of mobile banking

To adjust to this reality, banking apps are evolving from mere advisory tools to key elements of the value proposition. Indeed, while in the past the sales strategy was focused on the branch, today the customer relationship moved to digital channels: it follows that the service model of banks needs to be rethought. As a matter of fact, improving the proposition of mobile banking no longer means enriching the app’s functionalities, but defining a strategy that sets the app as the primary touchpoint and center of the customer relationship. The necessary transition requires banks to combine the benefits of the “branch experience” – which primarily consists of access to specialist knowledge and human contact – with the convenience and simplicity of digital channels.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Italy a step behind Europe in mobile banking apps

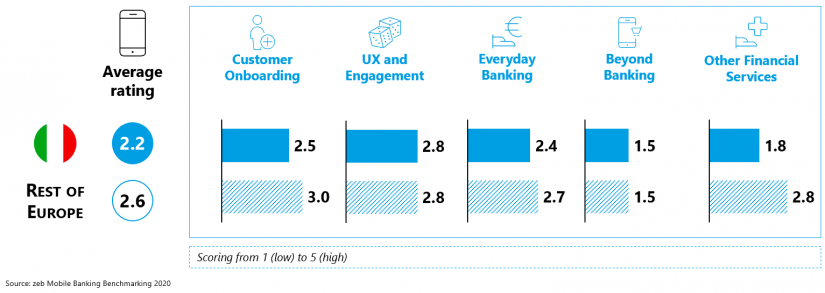

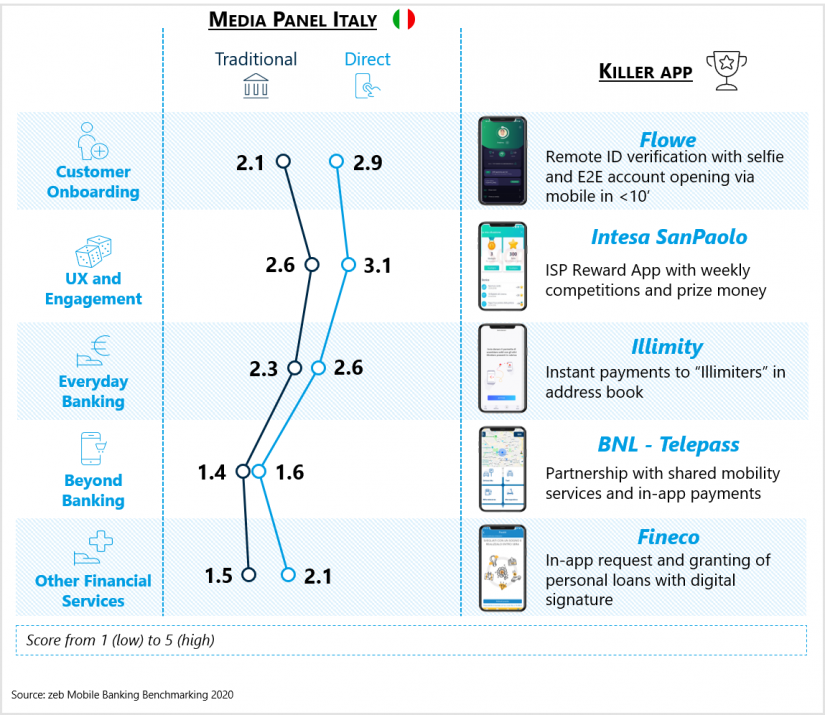

To assess the level of maturity of mobile banking in Europe and identify the key elements to define an effective digital strategy, we examined around 100 banking apps from 18 countries. Among them, the Italian apps (6 of direct banks and 6 of traditional banks) were considered on the whole less evolved than those provided by other European banks. Nevertheless, considering single features, there is no lack of excellence in the Italian app landscape, and even “traditional” banks have in some cases developed advanced solutions.

Mobile excellence in Italy

The benchmark we developed is based on clients’ assessment of more than 120 banking app features across 5 macro-areas. The main results of the Italian banking apps are described below.

- Customer Onboarding

When opening a new current account, a quick and simple process and ID verification (e.g. via selfie or video) seems to deliver the main added value, yet this feature is only offered by one third of the traditional banks. The major weakness identified by customers, however, is the lack of an end-to-end mobile process to open a current account. Moreover, especially customers who are less digitally-savvy appreciate the possibility to contact bank staff in real time via the app to receive support during the onboarding stage. - UX and engagement

Performance in terms of user experience and ease of use shows vast room for improvement, especially among traditional players. Among non-digital natives, in particular, access to support features (e.g. requesting support via phone/ chat/ video) is regarded as essential. Yet, on average, Italian banks are currently only offering half of the contact options available. Features such as cashback and loyalty programs, access to platforms for purchasing goods and the possibility to take part in competitions or win prizes (exploiting gamification) are also appreciated. Such features help to promote customer engagement, but again they are only available in less than a third of the apps analyzed. - Everyday Banking

Moving on to everyday banking activities, the survey revealed that most of the analyzed apps offer basic account and payment features. However, when considering a complete digital offer, respondents pointed to the need to combine access to standard information and transactions with personalized specialist advice. In addition to that, the ability to perform more complex or innovative in-app transactions, such as instant payments to contacts, are particularly appreciated. In fact, with most traditional banks still clients are required to visit the branch to carry out standard transactions, such as ordering a debit card or checkbook. - Beyond banking

Features linked to services that go beyond traditional banking offerings are becoming more and more important. These features actually help to redesign the banking app as a multi-service hub for daily use, thus promoting its use and exponentially increasing the opportunities of interaction with the bank. This category includes features related to shared mobility services, e-government (e.g. digital signature, digital e-card wallet) or personal concierge services. However, only very few players are currently exploiting these features. - Other Financial Products

Overall, access to additional financial products via apps is still underdeveloped. The main pain point identified in the survey is the lacking possibility to complete transactions such as financing requests, investments and insurance policies’ purchase directly in app. Yet these functionalities are crucial not to lose opportunities for monetization and customer retention. When taking a closer look, we see that customers are particularly interested in the possibility to purchase insurance policies based on geolocation thanks to instant insurance solutions (e.g. health insurance for travels abroad) and in rapid access to pre-approved personal loans.

A mobile offer for everybody

To date, a mobile service offer that is easy to use for less experienced customers and at the same time meets the expectations of the more demanding and digital-friendly customers (e.g. millennials, 97% of whom regularly use their banking app) is crucial for the success of any retail bank. The main challenge lying ahead for Italian and European banks in the coming years will be to successfully transfer the previously branch-based interaction and relationship aspects into the mobile channel.