Innovation drives the digitalization trend

Established financial services providers cannot sit back and be content with their current market position—at the end of the day, the size of a company is not decisive. In fact, an innovative approach combined with proficiency in the use of new technologies and flexible process models, which form the basis for a USP in the increasingly digital financial sector, will more likely be the factors that count. From this perspective, the multitude of startup companies collectively constitutes a strong competition that generates innovation more or less randomly by trial and error.

From the customer perspective, innovation brings about new needs that force the banks to react. In this context, significant developments can be observed at present with regard to sales platforms, promoting alternative advisory approaches with keywords like multi-channel strategy (cf. Advising customers personally and securely on the web). Considering the expected declining importance of extensive branch networks, the potential loss of the primary point of contact for customers is a serious issue.

In addition, the focus of attention shifts more and more towards the integration of downstream settlement processes, meaning that media disruptions can be overcome through systematic digitalization. A good example for this is the opening of a bank account, which—at least in Germany—still requires the “Post-Ident” procedure (cf. At eye level with new digital competitors).

Double trouble—disruptive at the wrong time

The big change that has taken place in other industries has not yet occurred. One important reason for this is that the financial industry is still a highly regulated market with considerable market entry barriers. In this regard, the “regulation frenzy” is both a blessing and a curse. Since the financial crisis, increasing regulatory requirements have put the financial services industry under intense implementation pressure that places a heavy burden on the banks’ cost side. However, compliance with regulatory measures does not have the positive effect of a distinguishing feature on the income side in the market. Thus, an efficient implementation is the only means of limiting the burden. At the same time, the low interest phase has an aggravating effect, adding pressure on the income side in the financial services sector due to margin erosion. Thus, the banking sector suffers from cost and income problems at the same time.

Digitalization—internal operations units amidst conflicts of heterogeneous goals

To master the challenges of digital developments in the given market situation, both the income and the cost side have to be addressed. Internal operations units such as IT and back office services will be important facilitators in this context, but also a cost factor. In times of digital change, internal operations units of banks thus find themselves caught in the middle of heterogeneous goals in view of shrinking budgets. At the same time, the units are asked to standardize commodity services and facilitate the business with a tangible value contribution and delivery capacity.

However, the fact that requirements are heterogeneous does not imply at all that they are contradictory and cannot be pursued at the same time—it is simply necessary to take a perspective that allows differentiation. The key element is the right strategy, which involves internal and external capacities in the value creation (sourcing) as required. In this context, it is decisive to consider sourcing not only from a cost-based point of view. Making the right sourcing cut, i.e. choosing the right level of vertical integration, addresses the standardization of commodity services as well as the transformation into a promoter of innovation and an enabler through active knowledge management.

A decision-making model—sourcing beyond cost cutting

A differentiated approach to the sourcing strategy for each project / process or service goes beyond a traditional make-or-buy decision. As per textbook, a general direction for the sourcing strategy can be derived based on the strategic value of the required resources and the internal availability of suitable resources[1]. In this context, the term “resource” refers not just to employee capacities but also considers their skills and expertise.

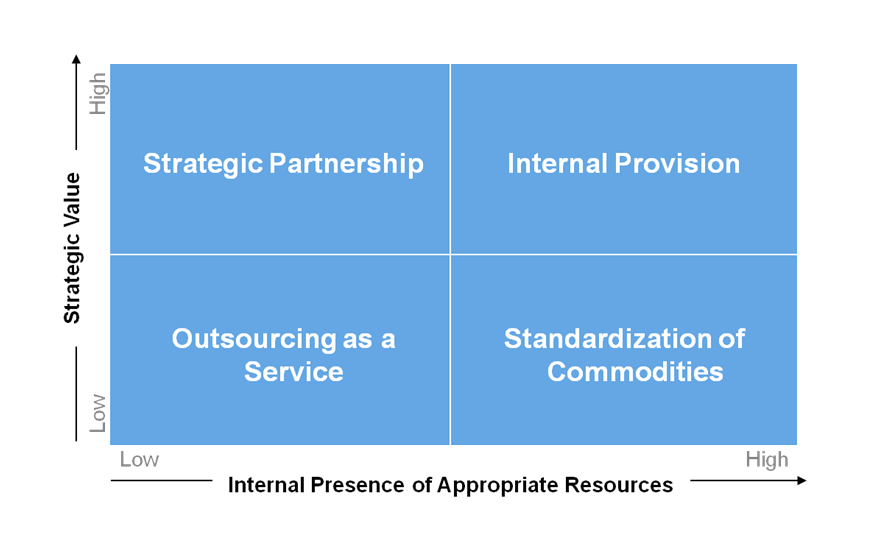

The two dimensions Strategic Value and Internal Presence of Appropriate Resources result in a decision-making model with four sourcing options (see Figure 1):

- Strategic Partnership: a low level of internal expertise combined with a high strategic value requires competence to be build by way of a strategic cooperation with external partners

- Internal Provision: a high level of internal expertise combined with a high strategic value constitutes a distinguishing feature—service provision should be strengthened internally

- Outsourcing as a Service: a low level of internal expertise combined with a low strategic value constitutes a scenario where full outsourcing of the service is recommendable

- Standardization of Commodities: a high level of internal expertise combined with a low strategic value offers the opportunity to standardize internal services and leverage economies of scale in the market—no risk of losing a distinguishing feature.

More boldness in sourcing

In view of the challenge to drive the standardization of commodity services and to promote innovations in line with the trend of digitalization, banks are well advised to rethink their sourcing strategy. Commodity services such as regulatory, IT and back office services should be considered more closely as possible outsourcing candidates. However, with a view to digital competitors, strategic partnerships with experts should be the method of choice for banks to build expertise, keep pace with progress and ultimately profit from innovations in the market.

Among German banks, certain developments in this direction have already been initiated: In 2014, Commerzbank founded an own venture capital subsidiary, Main Incubator, which already made first investments in startup companies such as Traxpay AG. In the same year, Deutsche Bank and Postbank established innovation labs in different places around the world, in cooperation with technology groups from outside the industry, namely IBM and Microsoft. The savings banks association (Sparkassenverbund) has also started to take action, clearly stating its intention to become Apple’s cooperation partner for the implementation of the payment system ApplePay.

Risks and side effects

Notwithstanding the above, it is true that increased sourcing activities necessitate efforts, especially with a view to developing new skills and expertise. The main challenge is to identify relevant innovations in the market and to position one’s business accordingly in time. Moreover, cooperation partners are likely to be young enterprises with unconventional structures. This entails new challenges for the management of cooperation models with a multitude of companies. However, multi-provider management should not be understood as an administration of cooperation relationships. The focus should be on a collaboration with the aim of exchanging knowledge and skills, which requires an integrated management of the project objectives. Thus, a cultural change will be necessary to manage innovative approaches.

At the same time, innovation management requires a systematic governance of project risks with a willingness to stop projects immediately in case of changed goals, regardless of already incurred “sunk costs”. This type of decision-making capacity requires corresponding management tools. In this context, one means is the use of flexible development methods such as rapid prototyping, which can be measured continually by their “executable” (interim) results (cf. Innovation by script).

There is nothing more constant than change

In the light of digital change and the future competitive environment, the financial industry is facing decisive transformation processes. On the one hand, the digitalization “pressure” aggravates the market situation, which unveils and punishes inefficiencies and, thus, non-competitiveness in a merciless—i.e. mercilessly quick—way.

At the same time, the financial industry is about to evolve with regard to digital competition, which is already bringing about new market participants. For this growth trend as much as for others it holds true that only taking new risks will enable market players to participate in the change process. Thus, established players of the financial industry will have no choice but to see digital change as an opportunity. As a consequence, it is time for them to redefine their market approach proactively with regard to products, processes and markets, creating structures that pave the way for innovations.

Both from the point of view of efficiency and innovation, the decision about the degree of vertical integration is the crucial aspect. It is no longer possible to have all kinds of irons in the fire. Instead, it is necessary to define an efficient degree of vertical integration in consideration of the own expertise and skills and their strategic value. The focus here is on understanding sourcing as a strategic instrument, be it for the purpose of outsourcing commodity services or for the purpose of entering into strategic partnerships.