Digital customer expectations are currently hardly feasible

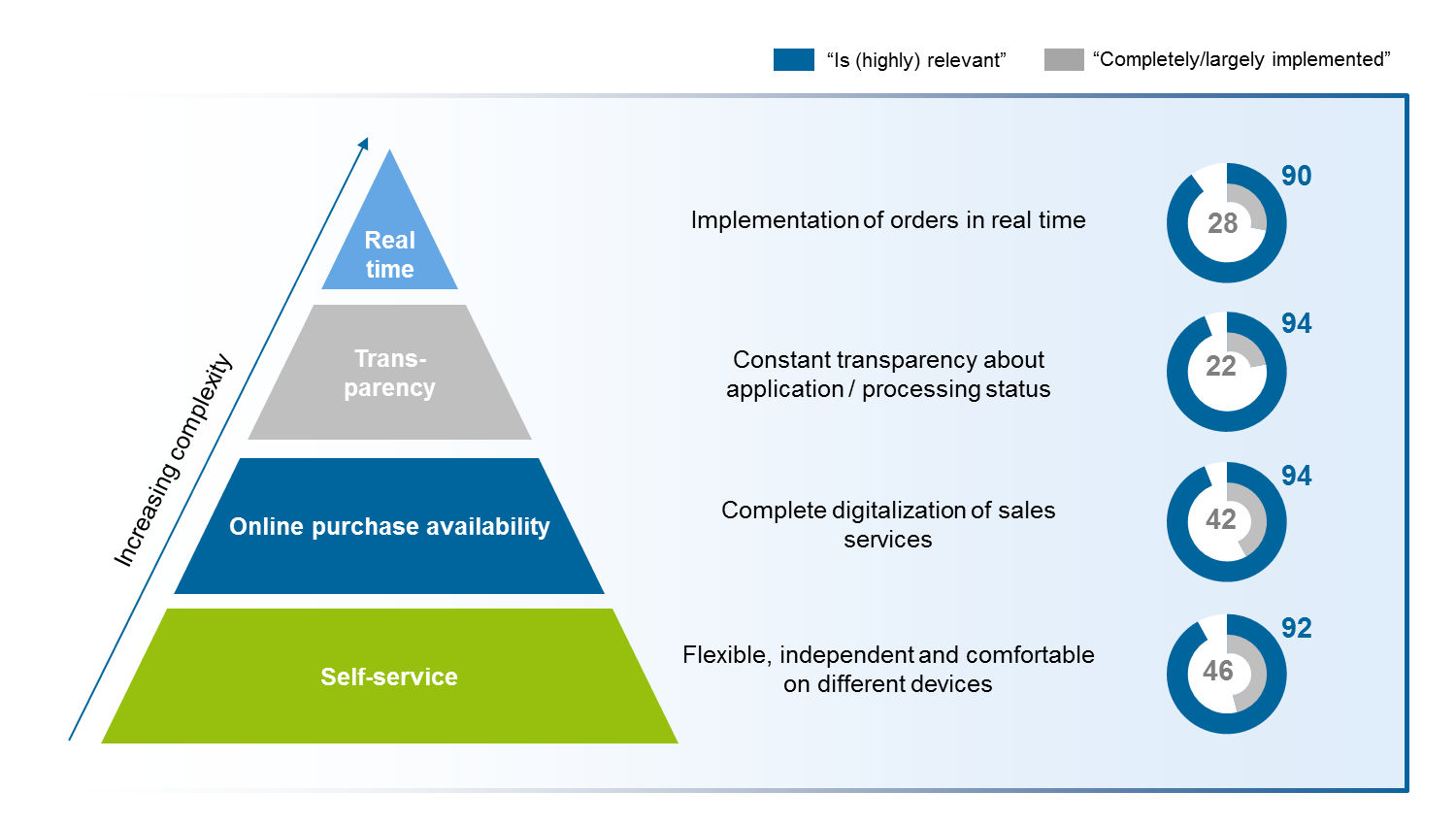

Customers are spoiled in terms of digitalization—however, not by their banks. While comprehensive self-service offers, online purchase availability of products, order transparency and processing in real time have been a matter of course in many sectors for years, nearly 90% of the participating institutions have indeed realized their importance for the customers, however, they significantly lag behind in terms of implementation. As a consequence, less than one-quarter of the institutions provide constant transparency about e.g. the status of a construction loan application and only a shade over 40% offer online products including legitimization. According to the study results, they lack the basis for increasing these ratios. Without eliminating paper-based forms as well as standardizing and automating processes (even lower implementation statuses from 15 to 20%), the service commitment for the customer at the front end cannot be fulfilled—or only at high costs by means of manual workarounds.

Digitalization—Win-win situation for customer and bank possible

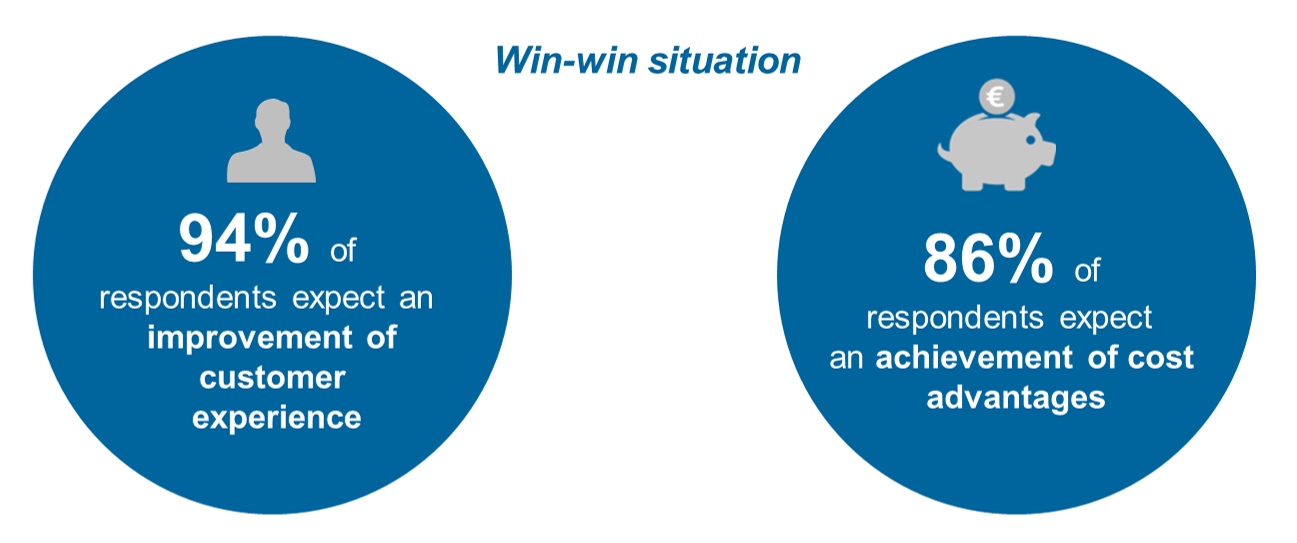

Banks still shy away from investments necessary for the overhaul of their technological platforms—even if they are indispensable in the medium term in order to remain competitive, acquire customers and retain them. But it is not only the customer who benefits, e.g. through online purchase availability and self-service offers. The assumption of parts of the value-added chain by the customer substitutes tasks that have previously been part of the middle and back office. In combination with a significantly increased standardization and automation rate—the digitalization of data serves as a catalyst here as well—the job profile in the processing units of banks changes. If simple activities are automated or outsourced to the customer, only complex processes, special cases and the 2nd level support of customer requests will remain in the middle and back office. All in all, the banking sector will experience a major decrease of employee requirements in these areas. The participating COOs expect a reduction in employee capacities in the middle and back office by more than 20%, one-third expects even more than 30%. More than 75% of the study respondents additionally expect growing qualification requirements for the employees remaining in the middle and back office.

Against this backdrop, the low implementation level of the “digital bank” all the more comes as a surprise, as the study respondents assume a win-win situation for customers and banks as well: More than 90% expect an improvement of the customer experience and a comparably high percentage estimates an optimization of the cost situation.

Effective and efficient compliance—Still a long way to go

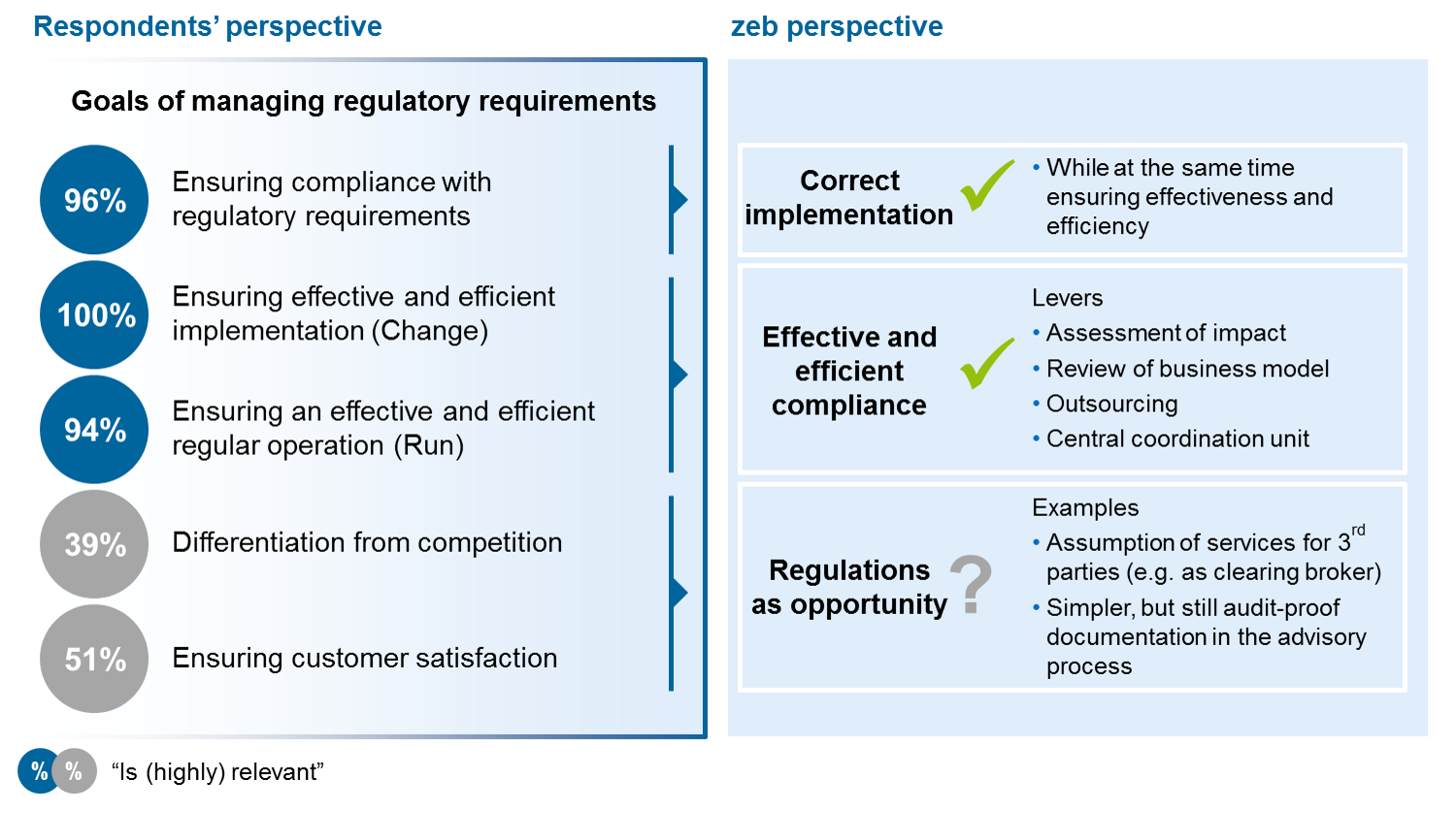

It is no surprise that the correct implementation of regulatory requirements comes first in the active management of regulatory requirements. Shortly afterwards, an effective and efficient compliance both in projects (Change) as well as in regular operation (Run) ranks second (see figure 3). However, there is a notable discrepancy between expectations and the actual implementation status. Still nearly 50% of the participating institutions assess the impact of the regulatory requirements on Run prior to their implementation and question aspects of their own business model depending on the result. Only one-third of participants consider the outsourcing of fulfilling regulatory requirements to a third party to be relevant, and less than 10% actually have outsourced activities.

The responsibility for managing and implementing regulatory requirements and thus also for achieving the aforementioned goals are distributed over many areas depending on the activities to be carried out. The fact that key responsibilities are lacking is not deemed important. There is no weight given to the lack of central responsibilities. The COO area shows a high level of contribution due to its strong responsibility for budget issues. This also applies to the management of regulatory requirements. It is leading in conducting impact analyses and challenging planned costs for Change and Run. The fact that other departments and IT are also involved is due to the nature of regulatory requirements that is more and more cross-departmental.

Cost reduction as a permanent task—Sustainability not yet satisfying

But not only digitalization and a more efficient implementation of regulatory requirements could reduce costs. The study respondents have identified potentials by improving the capacity and provider management as well as the optimization of the structural organization (high rates of approval of more than 70% for each). Nearshoring / offshoring and outsourcing only achieve a rate of approval of 40%. In our opinion, this can be explained by the fact that simple functions have largely already been outsourced and many institutions still shy away from sourcing more complex activities. The efficient management of different providers, e.g. through centralization of provider management, now presents banks with new challenges.

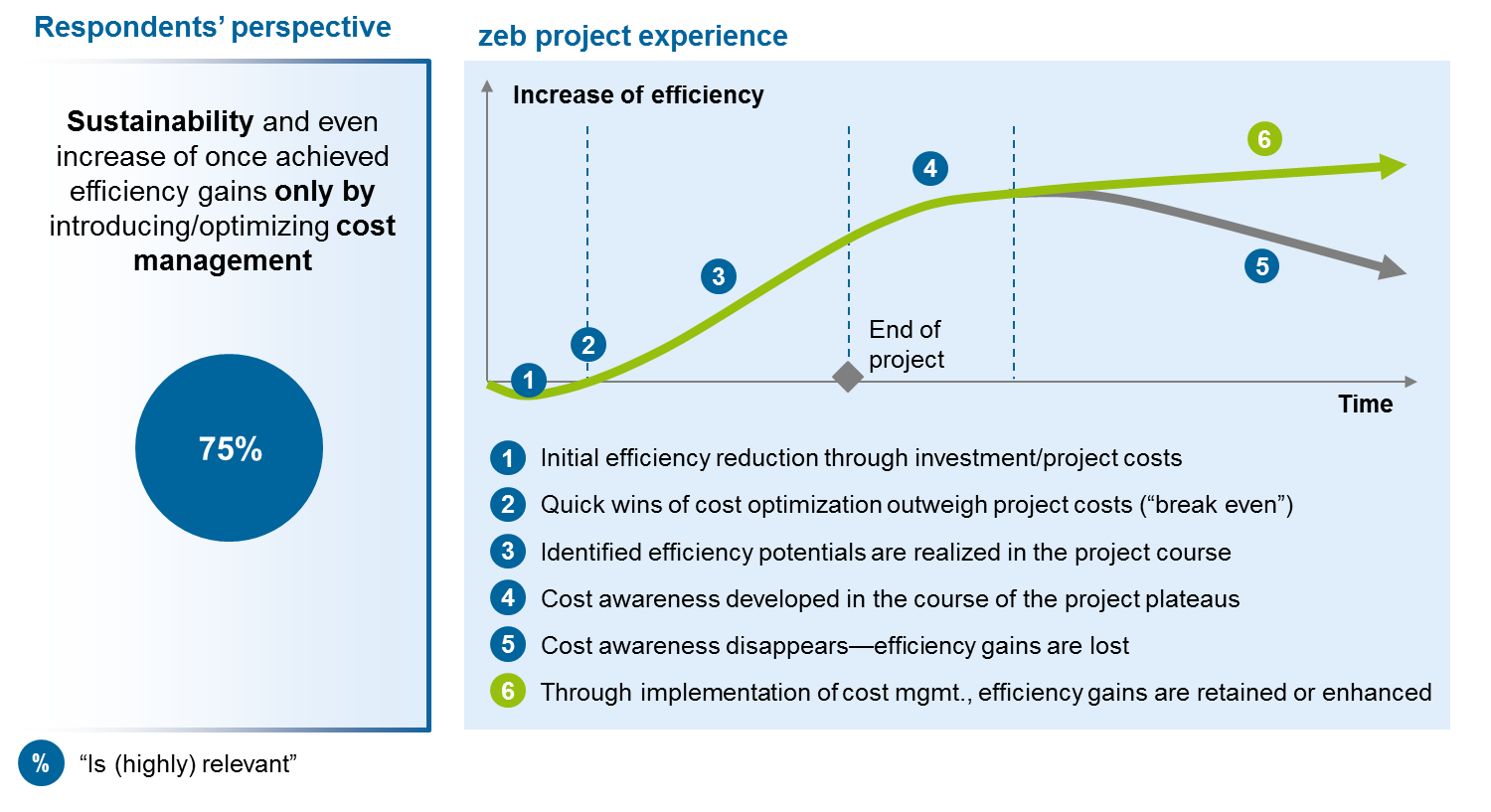

Many banks have experienced in the past years that initial significant efficiency gains due to cost optimization programs diminish shortly afterwards until the cost basis plateaus somewhere significantly above the initial level. This is among other reasons due to a decreasing cost awareness. Therefore, 75% of the study respondents rely on an optimization of their cost management.

While the communication of clearly defined cost targets and a process for ongoing cost reduction have nearly become a standard already, the implementation status of the establishment of a complete matrix structure from cost center and cost type responsibility, for example, is comparatively low. The high efficiency of these and other elements of the cost management approach is confirmed by nearly all COOs who have already implemented them.

Embracing and shaping change—COO from the “chief operations officer” to the “chief operating officer”

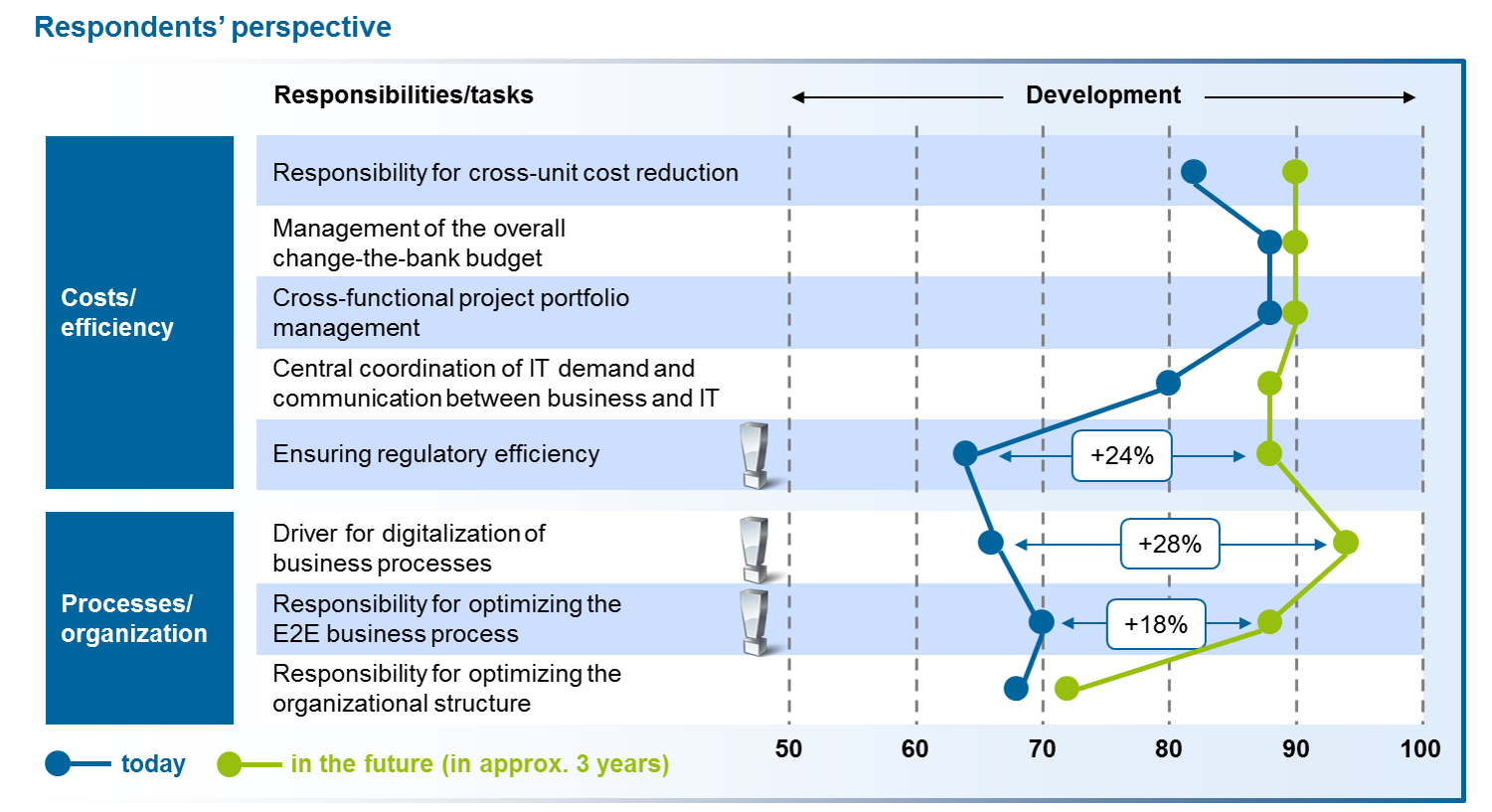

The challenges described cannot be coped with a mere function as cost manager or guardian of efficiency, that the COO undeniably already has today. Besides responsibility for end-to-end process optimization, the COO also needs to fulfill the role of driver of digitalization of business processes. “In future, the COO will also be partly responsible for implementing a customer experience that distinguishes their company from competitors”. A large majority (80%) of the participating COOs could identify with this statement even today. The COO area is developing by moving away from the most efficient implementation of requirements of business units alone and towards overarching coordination and active design of change. For the COO, this means moving away from being “chief operations officer” towards “chief operating officer”.

Growing momentum—More and more and faster and faster

The pressure on the COO area is increased by a phenomenon that does not only affect the banking landscape. More than 90% of the participating COOs stated that the number of initiatives and projects which they are responsible for has increased in the past three years. 60% of the respondents even experienced a distinct increase. Over three-quarters believe that the amount will even continue to grow in the next three years. As well as this, the speed at which initiatives need to be completed is increasing. Whereas approximately three-quarters of the study respondents stated that the required implementation speed has increased in the past three years, nearly 80% expect a further acceleration in the future. The situation—“more and more and faster and faster”—presents the COO area and the other CxO areas alike with major challenges. It can only be managed through cooperation, i.e. by working across fields and departments. In doing so, the COO area as designer of the operating model plays a key role in coordination and implementation.

COO agenda 2020

An active restructuring of their own area needs to be on the agenda of each COO just as for the other fields of action triggered by the current issues of digitalization, regulations and profitability pressure. The Agenda 2020 can be summarized as follows:

- “Be digital”—Digital readiness of the operating model

- “Be compliant”—Effective compliance of the operating model

- “Be efficient”—Efficiency of the operating model

- “Be agile and fast”—Flexibility and agility of the operating model

Here you can find our study available for download.

We would be happy to answer your questions – please contact us!

One response to “COO agenda 2020: Trends and need for action in banking from a COO perspective”

Ravishankar Krish

This was a very good read, talks about the crucks of operational challenges in the banking sector. Would be a pleasure to have something equivalent for Operations in the Service Industry, startups in specific