Survey on Process Management 2020—overview

The surveyed institutions specifically believe that the relevance of process management in the future will increase and expect its contribution to success to be very high.

In this context, the current drivers of the industry are also moving into focus: all respondents regard cost pressure, digitalization and standardization as the main arguments for professionalizing process management. The last two correlate with the main objectives of process management, with customer satisfaction ranking unbeaten in first place among all goals.

And although the participants of the survey are evidently aware of the relevance, goal and drivers of process management, a third of them are dissatisfied with its implementation status within their organization: none of the participating banks or Sparkassen (savings banks) believe that they have their process management “well under control”. Among the reasons given are employees’ reluctance to change, missing support from managers and a lack of competence.

The following article reveals some surprising findings that our survey has brought to light:

- Participants and structure of the survey

- Relevance, drivers and objectives of process management

- Regulation and process management

- Responsibility and roles in process management

- Technology and people

- Summary and outlook

Participants and structure of the survey

In view of the current challenges in the banking sector, in late summer 2019, zeb surveyed the executive boards, managers and experts from medium-sized banks on the importance of process management and the status of its implementation in their institutions.

This survey covered various process management topics, including relevance, drivers and goals, responsibilities, methods and IT deployment. Furthermore, we identified success factors and challenges when implementing professional process management and thereby leveraging efficiency gains.

A total of 51 medium-sized banks took part in the survey, of which 36 banks belonged to the cooperative sector, 10 institutions to the Sparkassen sector and 5 banks to the broader regional banking environment. The size of the participating institutions ranged from EUR 375 m average total assets to EUR 15 bn ATA, whereby the majority (43%) reported total assets of between EUR 1 and 3 bn.

The detailed result analysis was presented to the participants together with an assessment of their own institution in comparison with those of the others.

Relevance, drivers and objectives of process management

As regards the relevance topic, the surveyed institutions expressed a very high level of agreement: process management will become increasingly important in the coming years and contribute directly to success.

While it has grown in importance over the last 10 years, only 58% of the participants stated process management to be important or very important today (see figure 1).

When questioned about the reasons for this assessment, almost all institutions surveyed cited cost pressure (96%) and digitalization (90%) as drivers for process management. The sustained low level of interest rates continues to put pressure on companies to make processes as efficient as possible and thus reduce costs.

The objectives of process management reflect this trend. Besides an increase in customer satisfaction, process standardization, automation and digitalization are the most important goals. However, when assessing how well the institutions have already achieved these goals, their answers vary. In recent years, companies have focused more on process standardization and have thus reached a good level. Nevertheless, we still see considerable room for improvement, and continue to tap efficiency potential in our projects, e.g. by omitting process steps or implementing modules so far missing within the IT system.

There is a very high need for action with regard to process digitalization and automation, where the achievement of objectives is still very low. The main objective in digitalization is to satisfy changing customer needs and to offer existing or new (banking) services online and ideally on a case-by-case basis. Ultimately, all services should be offered 24/7. This requires new processes and also new ways of thinking, especially within the regional banks.

At most medium-sized banks, process automation is still in its infancy. To be able to use RPA (robotic process automation) or AI (artificial intelligence), most institutions first have to do their homework by optimizing their processes and ensuring their system has been administered carefully. Some medium-sized banks are setting out to automate their processes with the new technologies in order to increase efficiency potential.

Regulation and process management

Only a few companies are currently aware of the interplay between regulation and process management and monitor this consistently. From zeb’s point of view, this interaction is gaining in importance as a means of ensuring compliance with the increasing and sometimes excessive regulatory requirements. MaRisk highlights the importance of clear processes and their documentation in a number of sections.

In our opinion, institution-specific process maps in various forms are suitable for this purpose. Many banks, however, especially in the cooperative banking sector, do not even have process maps as an instrument. The cooperative banks surveyed confirmed this zeb project experience; almost 50% of the cooperative banks admitted to not having a process map in place. Yet, the process map instrument is predestined to ensure an overview of the (essential) processes and to provide employees with orientation in the increasingly complex command and control landscape.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Responsibility and roles in process management

Process management lies within the organizational department of 40% of the institutions participating in the survey. This applies to small banks with less than EUR 1 bn of ATA, and larger institutions (over EUR 5 bn).

Larger banks and Sparkassen with over EUR 5 bn of ATA are more likely to have a dedicated process management department (33%). A strikingly large number of rather small institutions have pointed out that the responsibility for process management is distributed across several departments, which suggests a need for further professionalization.

More than 70% of the respondents have process managers who perform specialist tasks in the process design, and process organizers who model and analyze the processes and master the methodology for process improvement. At this point, however, it usually stops, because only half of the participating institutions assign concrete responsibilities for each process.

Moreover, most institutions also fail to define the responsibility for process performance. A straightforward case of: “Yes, we do have specialist managers, but haven’t exactly defined which individual person is responsible for which processes and which goals this person should achieve”.

From zeb’s point of view, it is therefore important to clearly define tasks, competences, responsibilities and communication channels and to communicate them transparently in order to establish a professional process management. In our projects, setting up agile and interdisciplinary process teams has proved successful so that we can examine each business process from a customer-centric perspective and model it end-to-end.

A process team usually consists of three members: a process organizer, who assumes methodological responsibility and administers the processes, and one process manager each from the front and back office, who carries responsibility for specialist details. Each process team works on a process cluster and is responsible for about 25 to 40 processes. The process teams optimize the processes independently within a given framework (see also “Agile process management – processes reinvented“).

Technology and people

Our expectations regarding the success factors and challenges in process management prior to the survey were roughly as follows: while we expected most institutions to complain about IT systems that are not very process-oriented, they will also complain about the lack of suitable tools and methods for process management. In our projects in medium-sized banks, we often come up against limits because, for example, certain automation options are not (yet) available in the IT systems and therefore require us to build workarounds.

But this couldn’t be further from the truth: the greatest success factor and at the same time the biggest challenge in process management is the human factor. 96% of the institutions surveyed consider competent employees to be the biggest success factor.

At the same time, however, they encounter a shortage of qualified employees in process management, and also find that employees are not ready for change. Where is the qualification supposed to come from, when the relevance of process management is still considered rather low today?

Judging from their job offers, the medium-sized institutions have recognized this need. But there is hardly anyone on the market with process management expertise. Therefore, we see only one way to meet this challenge: getting the institution’s own team ready for process management.

This is certainly easier said than done, because as everybody knows, it is not enough to send staff on a one-day seminar and expect them to come back as process experts. A seminar can explain the tools for process management in theory but usually does not change the employees’ mindset and willingness to change.

Building a process management mindset and adopting new patterns of thinking and behavior is a process that may take years. It requires the integration of agile instruments into the employees’ daily routine in order to initiate a continuous change process. Our zeb approach is to trigger this change process via agile process teams and thereby to gradually implement it throughout the bank. This is often the first step towards an agile organization.

Summary and outlook

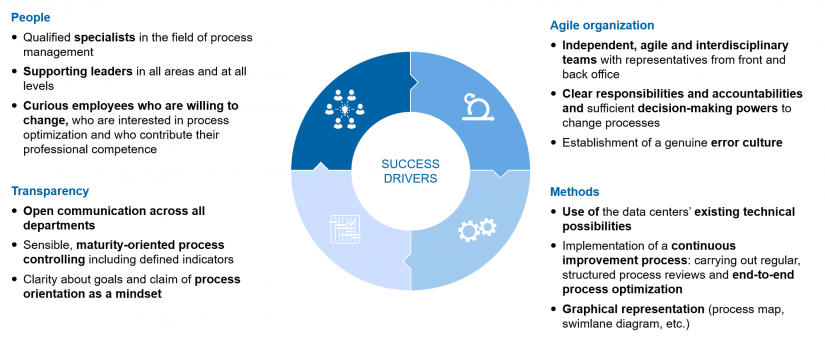

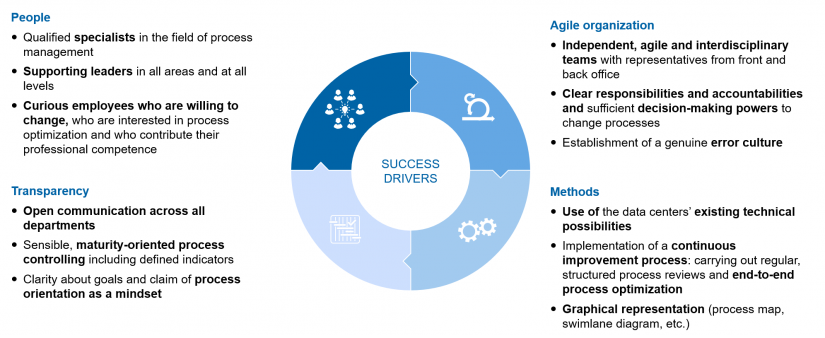

We are convinced that four cornerstones are crucial for the professional and successful implementation of process management in the future (see figure 2).

The most important driver is the human being. Both managers and employees represent the success factors of change. They should contribute methodical and professional input to process management and ideally have a “desire for change”.

Furthermore, we need agile, interdisciplinary teams to implement process management. Clearly defined responsibilities and individual decision-making powers as well as fast decision-making channels help to establish a genuine error culture within the banks and Sparkassen.

In addition, data centers should first make full use of their technical resources in order to optimize processes end-to-end and, ideally, to prepare them visually as part of a continuous improvement process.

Finally, it is important not only to create transparency by means of process management, but also to transparently communicate the goals and results in process management: process indicators only create added value if we have selected the right ones and if these indicators are also aligned with the maturity level of the bank and all departments are able to understand them.