Asset management industry: market developments + challenges

Especially energy price increases resulting from the Russian invasion as well as the rise in product prices due to supply bottlenecks and material shortages have led to a sustained wave of inflation in recent years. Consumer prices temporarily rose by an annual average of over 5% in the US and by as much as 10% in the European Union. The resulting interest rate hikes are making financing conditions more difficult, especially for real assets, which means that the asset management industry has to undergo a structural transformation in order to remain attractive to its clients.

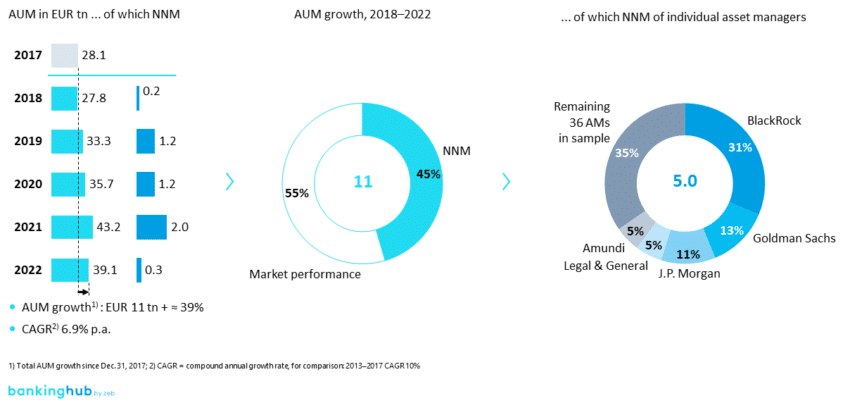

In addition to the tense macroeconomic situation, structural pressure in the asset management industry has been steadily increasing for years. For the first time since 2018, assets under management in our study sample[1] declined, with market performance continuing to be the main driver of AUM growth, accounting for over half of the growth over the period as a whole.

In terms of market concentration, large market players are increasingly dominating much of the market. In our study sample, the five largest market players generate around 65% of AUM growth, and the trend keeps rising (see Figure 1).

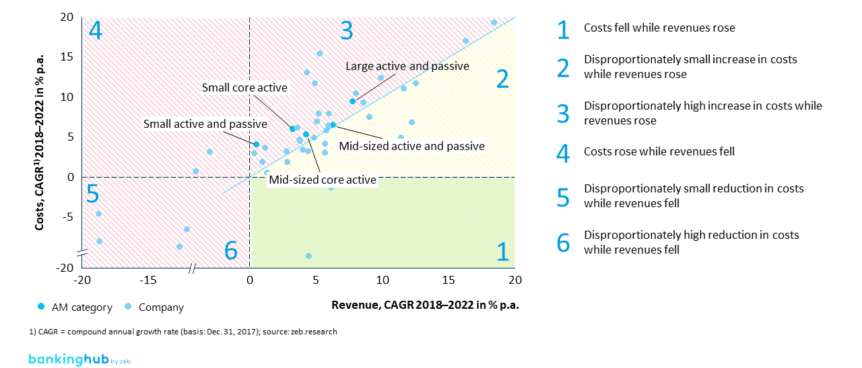

Despite the stable revenue situation due to the performance of selected asset classes, for most players costs have been rising faster than income for years, leading to declining or stagnating profit margins (see group 3 in Figure 2). So far, only a few market players have managed to introduce structural measures to control costs (group 2) or even reduce them (group 1).

Contrary to our expectations, it is mainly small market players with assets under management of up to EUR 350 billion, in addition to the large, broad-ranged asset managers, that showed a low cost-income ratio (CIR) and positive net new money (NNM) developments between 2018 and 2022. The reason for this was that small market players were able to benefit disproportionately from economies of scale when they concentrated on niche products and selected asset classes.

The analysis of the situation confirms the ongoing transformation in the industry, which continues to be dominated by a few large asset managers while at the same time experiencing increased demand for passive investment solutions. In this context, smaller asset managers in particular are constantly faced with new challenges that require active measures and rethinking in order not to be left behind in a “winner-takes-all” market environment with a focus on scaling. The business development of asset managers is heavily dependent on macroeconomic changes, as our simulation shows (details below).

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Business development in the asset management industry

The definition of levers for profitable and competitive positioning in the long term first requires a look at the coming years: What market developments may occur? What impact will they have on business development in the asset management industry?

In view of the uncertainties described above, forecasting the future development of the asset management industry is particularly difficult – macroeconomic and political decisions can lead to short-term shocks in the markets at any time.

Trends in European asset management

Based on a survey of industry experts, we have identified key trends that will shape the European asset management industry in the years ahead:

- Continued growth in assets under management for the next 2–3 years

- Higher market volatility, especially for fixed-income securities

- Expected decline in demand for real assets (especially real estate investments) due to higher interest rates

- Anticipated decline in investments in the retail sector due to inflation and interest rate pressure

- Increasing demand for alternative investments, especially from institutional clients

Forecast for the development of asset management over the next five years

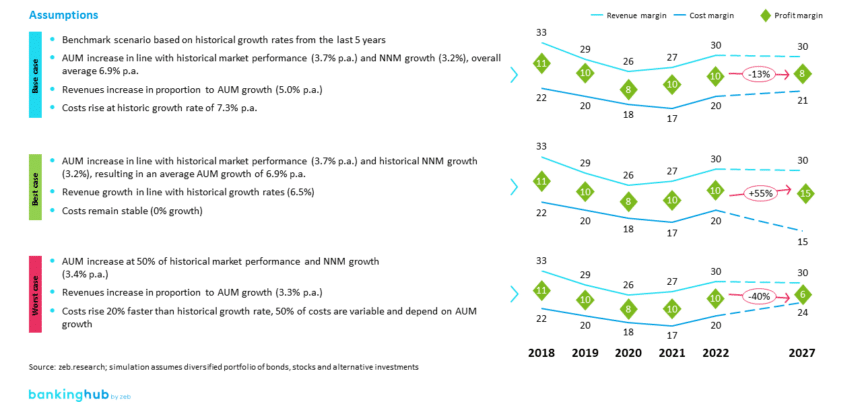

To supplement these qualitative findings, a five-year simulation was carried out to forecast the key figures of over 40 asset managers in three selected scenarios (base, best-case and worst-case scenarios).

- In our base scenario, which continues the trend of the last five years, we assume a modest increase in AUM (7%), revenues (5%) and costs (7%). A sharper rise in costs compared to income results in a continuously declining profit margin (-2 bps from the current 10 bps to 8 bps).

- Our worst-case scenario is based on an increase of 50% compared to the historical development and thus foresees a weaker performance in the development of AUM (3.4%) combined with a disproportionate increase in operating costs (+20% compared to the historical development) for asset managers. This would result in a sharp drop in earnings, which could cause the profit margin to collapse to around 6 bps.

- In contrast, our best-case scenario assumes stable AUM growth rates in line with the base case, with revenues increasing by 6% and costs remaining stable (+0%). As the best-case scenario assumes greatly reduced costs and realized efficiency potential, the profit margin here is around 50% higher compared to the current development (from 10 bps to 15 bps). Larger asset managers in particular are able to achieve this and benefit from scaling and standardization.

Despite short-term volatility due to geopolitical uncertainties, the base scenario is considered the most likely over the five-year period. Rising costs for implementing regulatory requirements, investing in digitalization and building up expertise will result in a further deterioration in the profit margin in the short to medium term.

Based on this observation, four success factors were identified that allow asset managers to ensure a competitive and efficient positioning for the long term. While short-term measures such as cost programs can achieve a temporary reduction in costs, in the long term they lead to a loss of competitive advantage due to a lack of innovative strength – for this reason, such measures were not analyzed further in our study.

Success factors for competitive positioning

According to our simulation, the current situation in the asset management industry is characterized by numerous developments that call strategic positioning into question. Asset managers now need to identify which levers are available to them to realign services, products or processes to ensure their efficiency and competitiveness.

Based on the survey results and our extensive project experience, we have been able to identify the following key success factors shown in Figure 4.

A) Development of new client groups (B2B2C)

Our survey of European asset managers shows that 40% of respondents consider changes to their sales strategy to be inevitable. Reduced ability to save, uncertainty in investment decisions and branch fatigue are just some of the effects of the difficult (macro-)economic developments seen in recent years.

A decline in attractiveness is forecast, particularly in the mass retail business. Margins are falling due to increasing standardization and passive investments. Declining savings rates in the current environment are putting additional pressure on addressing this target customer group. In light of this, the focus is shifting towards business with affluents, characterized by the relatively high stability of the clients’ ability to invest.

With the onset of the baby boomer spending spree, asset managers are increasingly recognizing the importance of young affluents, i.e. wealthy young savers and investors from generations X and Z, as an up-and-coming target group. Adapting the existing product range (including individuality and asset classes) and brand identity (including expertise and beyond banking) is important in order to attract these new clients.

In view of the needs and preferences of the younger generations, it is therefore essential that asset managers adapt their sales strategies accordingly to address attractive target client groups in the future.

B) Strengthening distribution partnerships

According to the asset managers in our survey, traditional distribution partnerships in the private client business (B2B2C) are still crucial for most of them. These partnerships make it possible to improve client reach and benefit from the brand impact of the respective partner. However, these partnerships also bring challenges, including dependence on current product preferences and clients, as well as regulatory concerns regarding the payment of benefits to distribution partners.

The European Union recently published a proposal on bans on inducements in execution-only business. These would supplement the existing ban in discretionary asset management. The collection of commission would therefore be reserved for investment advisory business.

Due to these developments, but also the increasing search for profitability and customer retention, it is now more advisable than ever to evaluate sales channels and derive strategic options. Asset managers who do not have their own sales channels in the retail business are increasingly investigating the implementation of their own digital channels in order to establish direct contact with end clients. A fundamental reassessment of the sales strategy is therefore essential to ensure that the business model is profitable in the long term, even without incentive payments to any sales partners.

C) Increased focus on attractive asset classes

The asset managers surveyed in our study have observed that investors are focusing on more diverse alternative asset classes for successful portfolio diversification. Geopolitical developments, which have led to an increase in volatility, an end to the low interest rate policy and more difficult financing conditions, are rendering the real estate investment business less attractive, causing investors to reorient themselves. Although 50% of asset managers continue to regard real estate as a safe investment, they expect investor interest to decline.

As regards commodities, however, asset managers do not see a trend away from traditional commodities towards alternative ones. However, other alternative asset classes such as private equity and private debt are also becoming increasingly important to investors looking for diversification options. Our survey also shows that asset managers are expecting a sharp increase in demand for digital assets.

However, high minimum investments, time-consuming due diligence and a lack of expertise currently make it difficult to include alternative asset classes in traditional processes. In order to meet these requirements, the majority of the asset managers surveyed rely on procuring external expertise as part of cooperations and offering white labeling / third-party products. In the long term, additional capabilities need to be built up in the context of tokenization in order to remain competitive in the business with alternative asset classes and also to increasingly launch products for retail investors.

D) E2E digitalization in the operating model

Due to the increasing risks from falling net inflows, lower margins and the impending shortage of skilled workers, two thirds of the asset managers surveyed are certain that digitalization and automation of non-value-adding processes are important for efficient production. Increasing cost pressure demands additional efficiency in operating and business model solutions in order to operate fund management that is attractive to clients.

Asset managers have a wide range of opportunities for implementation along the entire value chain. From bots in the front office to trading algorithms in the front/middle office and smart contracts in the back office, asset managers can trade in purely automated and digitalized ways. Despite regulatory hurdles and the challenge of integrating different IT systems while ensuring cybersecurity, asset managers should expand their expertise and create acceptance among clients as the basis for a digital operating model.

The zeb reference model Target Operating Model 4.0 shows a clear IT and data strategy, end-to-end process optimization, promotion of an adaptable culture and adaptation of the governance structure. Increasing efficiency through automation requires the targeted identification of fields of action along the value chain in order to smoothly implement specific measures for an automated and digitalized operating model.

Asset managers in Europe: conclusion and outlook

Our analyses and survey confirm that asset managers are becoming increasingly aware of the changing nature of their industry and see a future-proof operating model as essential in the face of rising challenges in ensuring competitiveness.

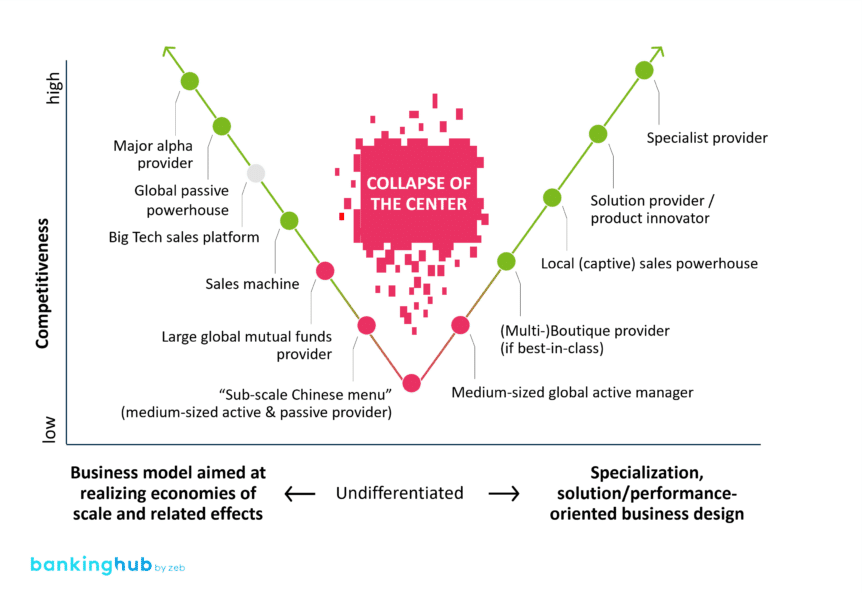

In addition to the existing macroeconomic impact of the Russian attack on Ukraine, for example, further geopolitical developments need to be observed. The escalating conflict in the Middle East in particular is influencing global trade and driving additional uncertainty in the markets. These influencing factors will put market players with an undifferentiated offering or a lack of scalability under even greater profitability pressure in the medium term if they fail to reassess their positioning (Figure 5).

zeb supports clients in asset management in defining a long-term positioning that ensures competitiveness and withstands ongoing market fluctuations and developments. Both the operating and business model need to be rethought and may require asset managers to step out of their comfort zone in order to make strategic and sometimes drastic fundamental decisions.

In summary, zeb sees the following factors as crucial for success:

- Focusing on clients who are willing to invest, especially younger affluent savers and generation X and Z investors in the retail segment as well as institutional investors

- Maintaining important distribution partnerships

- Expanding asset classes to include suitable alternatives that enable clients to diversify their portfolios in a profitable manner

- Keeping pace with the accelerated implementation of disruptive technologies that are increasingly shaping digitalization and automation in the asset management industry

About the zeb European Asset Management Study 2023

zeb’s European Asset Management Study 2023 takes a granular look at these factors and provides a comprehensive analysis of the current market dynamics within the European asset management industry. The study combines a data-driven analysis of the key performance indicators of more than 40 asset managers and a qualitative survey conducted among more than 20 selected asset managers in Europe.

Based on the findings, zeb has carried out a simulation of possible developments in the industry over the coming years and derived a series of selected recommendations for asset managers. Given the troubled economic outlook as well as demographic and social developments, these are intended to ensure that European asset managers are profitably and competitively positioned in the long term.

You can download the zeb.European-Asset-Management-Study here!