In recent years, banks throughout the world have faced new and complex issues resulting from the growing volumes and associated costs of market data access. In Europe, from 2015 to 2018, wholesale banks were affected by a steady increase of expenditure for financial information, with an annual growth rate of approximately 6% CAGR.

In a typical commercial bank today, this cost category accounts for between 1.5% and 2% of the total OAE (Other Administrative Expenses, non-HR costs): the total market data costs of a mid-sized institution can easily exceed € 20 m per year, depending on the bank’s business model and business diversification.

“Market data” represent a wide range of financial information used by banks: from quotes and prices (real-time and historical), to ratings, news, terminals for financial data monitoring and analysis as well as trading desks. Supply markets are often concentrated and dominated by several leading data vendors (such as Bloomberg, Thomson Reuters, Refinitiv, FactSet, S&P, Moody’s, Fitch, MorningStar), in other cases fragmented into a large number of (local or “market specific”) players.

In recent months, zeb has analyzed the financial data vendor management models of international banks to highlight the correlations with their business model, size, complexity and governance structure and to identify leading practices and best solutions.

Market data cost increase: How banks should approach an increase in expenditure

The market data cost increase might accelerate further in the short/medium term, in light of the growing need for Bank 4.0 data, also referred to as “data-driven banks”.

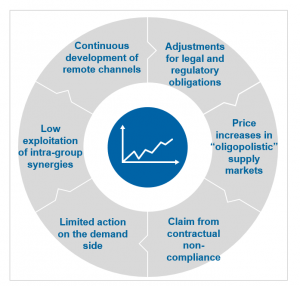

Root causes for the cost increase can be attributed to several factors:

- continuous development of remote channels

- evolving legal and regulatory obligations

- limited negotiation capacity (in particular in oligopolistic supply markets)

- low exploitation of synergies (at group-level)

- claims for contractual non-compliance

- ineffective demand management processes

- lack of control

In such a complex scenario, a bank willing to optimize its financial data vendor expenditure by reducing annual costs by as much as 10% would need to proactively identify and address these issues, adopting an approach that combines technical and managerial competences.

Figure 1: The main drivers of financial data vendor expenditure

Source: zeb elaboration (Financial data vendors’ benchmark)

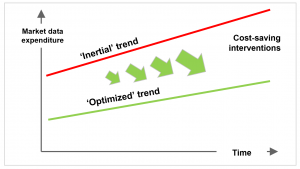

In recent years, many banks have tried to reduce financial data vendor costs, mainly by undertaking initiatives that aim at short-term savings. Examples of “quick-win” optimizations, generally with low operational and IT impact, include the reduction of the number of terminals (shutting down extra or unused terminals and replacing them with web-based or shared accounts), downgrading service levels, substituting service providers with cheaper alternatives or contractual renegotiations (leveraging the economies of scale, scope and “threats” from substitution).

However, in most cases, especially when it comes to larger banks, only a structural and long-term approach, which has an impact on organization and processes, can guarantee cost optimization and significant savings over time.

Figure 2: The inertial and optimized trends for financial data vendor expenses

Source: zeb elaboration

Demand for market data: Critical issues in financial data vendor management

The large number and variety of vendors, products, user requirements, contractual agreements and pricing solutions all contribute to the complexity of financial data vendor optimization. Moreover, the banks’ demand for market data, driven by their attempt to meet the users’ evolving requests and adapted to the continuous market changes, puts constant pressure on external data costs.

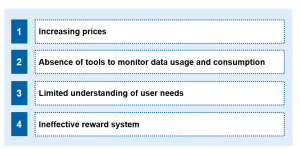

One major reason why it is so hard to contain financial data vendor expenditure is the high bargaining power of market data vendors and their strong market position often deriving from a monopolistic access to data sources. This forces banks to accept expensive (and sometimes byzantine…) pricing conditions. Secondly, without structured processes and solutions, it is difficult to monitor user behavior (often leading to non-compliant usage or license abuse). Furthermore, the partial understanding of user needs makes it particularly difficult to profile users and define an adequate policy for assignments and licenses (entitlement management). Finally, the absence of an effective reward system stimulating “virtuous” behavior encourages neither financial data vendor cost reduction nor correct data usage.

Figure 3: Reasons financial data vendor costs are hard to control

Source: zeb elaboration (Financial data vendor benchmark)

The financial data vendor management value chain and the advantages of a “dualistic” approach

The first thing that stands out when looking at the financial data vendor management value chain is the cross-functionality and the wide range of functions involved (procurement, IT, market data governance, controls, sales, treasury, trading, risk, compliance).

Figure 4: The financial data vendor management value chain

Source: zeb elaboration

In order to effectively manage financial data vendor expenditure, it is necessary to govern all phases of the value chain, engaging different actors (from procurement to IT and end users). In this respect, transparency, clear responsibilities, direct budget allocation to end users and an effective incentive system (rewarding savings or reduction in data consumption) is the key to overcome internal resistance that often hampers the success of optimization initiatives.

Combining technical and managerial skills is necessary when facing such a complex scenario. If, on the one hand, specialized and technical knowledge is essential to check data quality and IT impact/development, on the other hand, the definition of policies, controls and incentives require strong managerial skills.

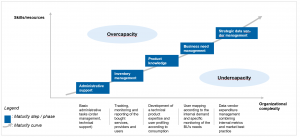

Naturally, the more complex the environment, the harder it will be to manage multiple, often opposing, interests. The financial data vendor management maturity curve shows how dimensions (in terms of total spending and users) and business diversification increase complexity and determine the right sizing and skills profiling for the financial data vendor management team. Furthermore, the necessity to combine managerial and relational skills with technical expertise grows with the bank’s dimension.

Figure 5: The maturity curve of financial data vendor management

Source: zeb elaboration

Three lines of action to start a financial data vendor optimization process

Establishing the operating conditions necessary for an optimized management of financial data products and services also depends on the processes and, more importantly, on IT tools. The following three lines of action are generally pursued by leading best practices:

- Selection of financial data vendor management tools: in order to track and manage data and information (on contracts, users, products) it is essential to select appropriate tools for inventory and entitlement management, consumption monitoring, reporting at user and central level;

- Creation of a competence center and enhancement of demand management processes: a group-wide (centralized) financial data vendor competence center (CC) would allow users’ emerging needs and requests to be kept under control by means of centralized validation and rules definition. The CC would gather individuals with cross-functional competences (technical/commercial knowledge of the various services in use and functional understanding of the main areas of business). Furthermore, the bank would define guidelines for the CC to validate new incoming requests and introduce specific organizational rules to coordinate relationships and offers with vendors and providers;

- Transparency and accountability: the third guideline with potential “virtuous” behavioral effects is the implementation of an effective incentive system and the allocation of financial data vendor cost budgets (including related claims) directly to end users. This should limit inappropriate use and excessive consumption of data and guarantee more transparency and self-consciousness to users.

Finally, it is relevant to understand that there is no “perfect solution” or an “ideal operating model”, but considering the complexity, the volumes and the wide span of actors involved, each bank should refer to its own “ecosystem” (and specific constraints) and progressively design an ad hoc operating and governance model for financial data vendor and market-data management.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Conclusion

Data consumption will become a growing problem for banks in the near future, and only few players are prepared to take up the challenge.

zeb was able to support players in this challenge through its 360° financial market expertise and a deep understanding of business requirements. In several recent projects, zeb has helped banks achieve savings from € 3 to € 15 m (from 5% to 15% of total financial data vendor expenditure) and supported them in identifying an appropriate governance model.

In conclusion, zeb positioned itself as a leader in designing the best solutions for banks willing to face the market data trap in the near future.