Digitalization offers new possibilities

In times of persistently low interest rates, everyone is talking about the future of banks. These discussions often focus on the general changes that digitalization enables. In this context, portals, platforms and ecosystems are considered to be particularly future-oriented and critical for success, not only for the financial industry. Opinions vary as to whether portals, platforms or ecosystems are the real success factors—or indeed almost the saviors—of the future.

Yet a common understanding appears to be missing. The terms are often mixed up and not properly defined. But before classifying and evaluating concepts and deriving strategic options, banks or enterprises first need to have a clear understanding of the terms used.

This is where our three-part series of articles—with this one being the first—comes in.

In our first article, we define and clearly distinguish the terms portal, platform and ecosystem before presenting fields in which banks may assume strategic positions. The series of articles is designed to help decision makers understand portals, platforms and ecosystems and derive possible actions for their own institutions.

To part 2: “Analysis of the current market offering”

To part 3: “Recommendations for developing”

What exactly do the terms portals, platforms and ecosystems mean and how can they be differentiated?

The concepts of portal, platform and ecosystem are closely connected but still need to be distinguished in order to identify areas of application and implement possible actions.

For this reason, this article starts by providing definitions of the relevant terms:

Portal: A portal simply represents an access point to any type of digital service. However, it would not be sufficient to reduce the role of a portal to a mere access channel. As a “single point of contact”, it rather acts as a central interface between customers and the full extent of a bank’s service portfolio. To fulfill this role, a portal has to be compatible with omnichannel use and be available over the web as well as apps (optimized for smartphones and tablets). Someday, a multichannel portal providing corresponding services will surely replace online banking and thus represent a strategically important customer contact point. Hence a portal is more than just an access channel, as it provides the customer with all relevant digital services of a bank in one place.

Digital platform: Basically, a digital platform is an online marketplace that combines supply and demand similarly to a “real” (offline) marketplace. Banks or companies offer services and compete on portals.

Traditional marketplaces have existed as long as anyone can remember. Now, however, the possibilities created by digitalization are changing strategic imperatives, which enable digital platforms to play to their full strengths.[1]

- Easy to scale: The cost structures of platforms are characterized by (very) high fixed costs and very low or no marginal costs for additional customers.

- Marginal transaction costs: Marginal transactions costs are either too low to be considered or nonexistent, which facilitates scalability. Thus, platform owners benefit disproportionately from each additional customer.

- Network effects: The (added) value of a platform for providers and for customers depends on the counterparty count. The more providers who use the platform, the bigger the portfolio and the more attractive the platform will become for customers. The more customers who use the platform, the more profitable it will become for providers to offer their services there. Together with the first two imperatives, this creates incentives for collaboration and exponential network effects for successful platforms.

A digital platform provides the infrastructure for connecting providers with customers. Value is not only added by selling services, but also by bringing together competitors, thus increasing availability and comparability for customers.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Ecosystem: An ecosystem is a combination of several providers—managed by the orchestrator—who orient their services towards customer needs. An ecosystem can focus on one or more customer needs. Similarly to platforms, ecosystems act as intermediaries between supply and demand, i.e. consumers and several providers, but ecosystems are also used by various providers to link their differing service portfolios to better satisfy overall customer needs. An important aspect of ecosystems is the direct approach to fully (end-to-end) satisfy one or several customer needs. Due to the interaction of the different providers, the overall value is characterized by the “1+1=3” principle: the customer gains more value than from services provided individually. This causes two major strategic changes:

- Banks no longer need to be strong in every aspect of service provision; instead, they can focus on individual value creation steps in their portfolio.

- Higher customer satisfaction also increases the willingness to pay for a comprehensive service, which entails higher earnings for the individual providers despite the larger number of service providers.

An ecosystem can consist of several platforms—an isolated platform, however, does not represent an ecosystem. Similarly to platforms, ecosystems also benefit from additional participants and related complementary and network effects in terms of increased (added) value for customers and providers. An ecosystem can be expanded both digitally and offline.

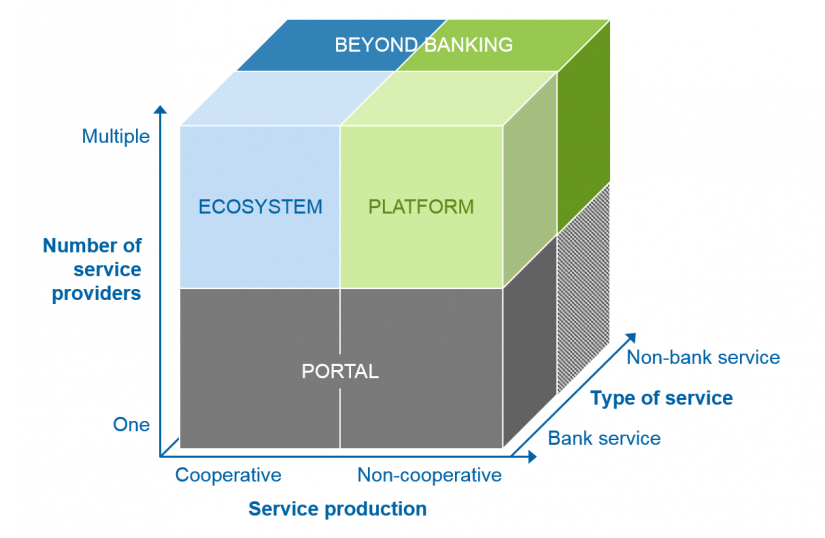

Linking online with offline services offers particular opportunities. To better distinguish the terms, they can be classified along three differentiation dimensions (see Figure 1).

The first dimension is the number of service providers. Here, the portal is opposed to platform and ecosystem. Since a cooperative service provision or competitive situation requires several providers and someone who controls the interaction, these concepts only work with more than one service provider.

The second dimension is the type of service production. This makes it possible to distinguish between platforms and ecosystems. A platform can be used to compare providers. Does provider A offer different prices or services than provider B? Can users recognize the differences and increase their own benefit by selecting the better offer? As of this point, providers who have not been selected no longer deliver any value. Ecosystems work differently. Here, both providers complete the service. Provider A delivers one part of the overall benefit and provider B the other—a cooperative service provision, as it were.

The third dimension is the type of service. The service portfolio does not necessarily need to be limited to traditional bank services, but may well go beyond (“beyond banking”). Beyond-banking services refer to all services that cannot be attributed to traditional business areas of banks. Consequently, banks benefit from additional monetization opportunities and data access, while enterprises benefit from an all-in-one sourcing partner in terms of their main bank. The services offered in this dimension are currently evolving at high speed. Services that have already been established include accounting services or secure data rooms.

Which roles can be assumed by banks?

It is important to understand the capabilities of portals, platforms and ecosystems, but it is also essential for each bank to evaluate possible roles for itself. The scope varies according to the concept.

Portals offer the fewest possibilities for positioning oneself. Since services are produced and provided by the same player, this is the only positioning. However, this does not mean that portals may be neglected; in fact, they represent the first step towards a comprehensive digital service portfolio and full multichannel availability.

Generally, banks can assume three different positions within platforms and ecosystems. The theoretical positions are the same, but the range of tasks in an ecosystem is much more complex due to the interconnectivity during service provision.

- Owner (orchestrator): The owner provides the platform or the infrastructure of the ecosystem and orchestrates the various services. In ecosystems, the vertical combination of producers imposes additional requirements.

- Producer: The producer provides one or more services or products on the platform. In ecosystems, producers build a network to manage and strengthen the collaboration for service provision.

- Consumer: The role of the consumer is the same for platforms and ecosystems—the consumer simply buys services or products.

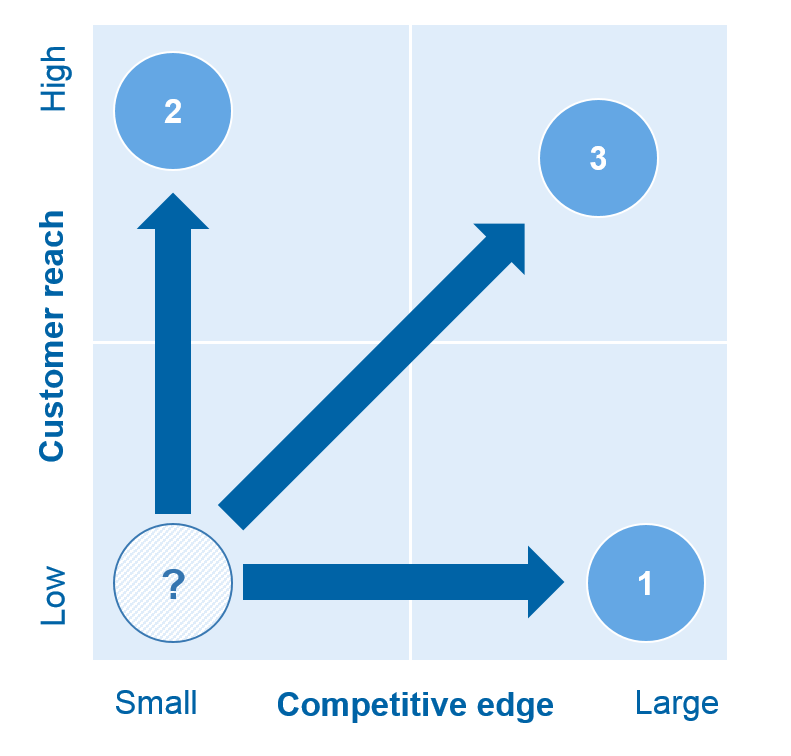

- Players can also combine the different positions. The player’s goals (What do I want?) and the customer reach and competitive edge (What can I provide?) of the product or service offered determine the positioning.

The competitive edge dimension determines to what degree a bank can leverage its own product expertise on a platform. By offering own products on platforms, banks may be able to increase their reach. The customer reach dimension determines to what degree a bank is able to generate traffic on a platform. Banks with a high customer reach may offer additional value to their customers when owning and offering a platform.

Various combinations are possible, depending on the bank’s strength in both dimensions:

- Role of producer: The bank positions itself as a producer and uses a big competitive edge in one product category, e.g. the bank has achieved process excellence and a comparative advantage and can thus offer the most favorable credit conditions. By participating in a platform/an ecosystem, the bank is able to use this competitive edge to provide its products to a larger target group.

- Role of owner: The bank positions itself as an owner and uses its vast customer reach to become attractive for other producers who then offer their products and services to the bank’s customers on the platform.

- Role of owner and producer: A bank may also position itself as both owner and producer if it has a considerable competitive edge and a vast customer reach. In this case, the bank provides the platform/ecosystem infrastructure, orchestrates the offers of the various producers and uses the platform/ecosystem to offer its own products.

Conclusion—portals, platforms and ecosystems

The clear distinction of the terms is essential to fully understand the concepts of portals, platforms and ecosystems. This lays the foundation for evaluating strategic options and striving to achieve the best possible role for the individual bank. In a last step, it is important to systematically realize the identified goals. The second article of this series will therefore look at the current market situation to derive factors for successful application as well as concrete measures for the individual bank segments.