Thesis: there will be no more local card schemes (e.g. Girocard) in Europe

One important cornerstone for local card schemes is the co-badging with Maestro and V-Pay. This allows them to be used abroad. Mastercard has now announced the discontinuation of Maestro. Most likely, V-Pay (Visa’s equivalent to Maestro) will be discontinued as well. The American players want to increase their market power and gain visibility in the retail market by increasing the amount of debit cards. As a consequence, several European banks have already made Mastercard or Visa debit cards their top-of-wallet cards and thus contributed to the extinction of local card schemes.

Even if Visa continued V-Pay, they would be in a monopolistic position and the continuation of local card schemes would lose attractiveness from a price perspective. Additionally, first shock waves will incentivise banks to start talking to Mastercard and Visa very soon, since they will attract the first banks by offering favorable conditions.

Thesis: the end of local card schemes increases the pressure on EPI

Due to the end of co-badging with Maestro and V-Pay, European banks are forced to act. In 3 to 5 years, they will have to replace the local cards with something new. This can be a blessing or a curse for EPI.

On the one hand, if they manage to make a decision and bring a solution to the market before the end of local card schemes, European banks will (at least consider to) switch to EPI instead of giving market power and data to Visa and Mastercard.

On the other hand, if they are too slow in making decisions and implementing solutions, EPI will lose the chance to gain a critical mass and fail. This sounds harsh, but the incentives for banks to change the card scheme twice within a short timespan would have to be so high (e.g. extremely low prices) that achieving this seems entirely unrealistic.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Thesis: with the support of the EU’s largest economies, EPI is doomed to succeed

According to a joint statement, the governments of Belgium, Finland, France, Germany, the Netherlands, Spain and Poland are backing the EPI idea. Those countries account for around 60% of the European population. If European banks shoulder the financial burden and implement EPI with the features announced, the user base will be large enough to realize significant economies of scale.

Many large European banks are also involved in the discussions around EPI and advocate the idea. However, real financial commitment is rather rare or at least not publicly known. So far, the German savings banks for example have expressed their commitment with a proud share of EUR 150 million in the project. Apart from this, little monetary commitment has been observed in the market.

The development cost of EPI, however, is estimated at EUR 1.5 billion and will probably turn out to be much higher. Thus, it seems that further financial commitment is required to start the implementation. Banks from Germany and France could take the lead and responsibility for the project and follow the savings banks by providing money and know-how for the development.

Furthermore, political reactions should go beyond mere words and should point out how corresponding initiatives can support the development and operationalization of EPI. Europe and the members of the European Union should be highly interested in a European payment solution, since this could prevent important revenue streams and data from leaving the continent. Furthermore, EPI will leverage other European solutions, such as Instant Payments or Request to Pay, which will not gain noteworthy traction without a European payments solution.

Thesis: EPI has to convince banks and consumers – with regard to both pricing and functionality

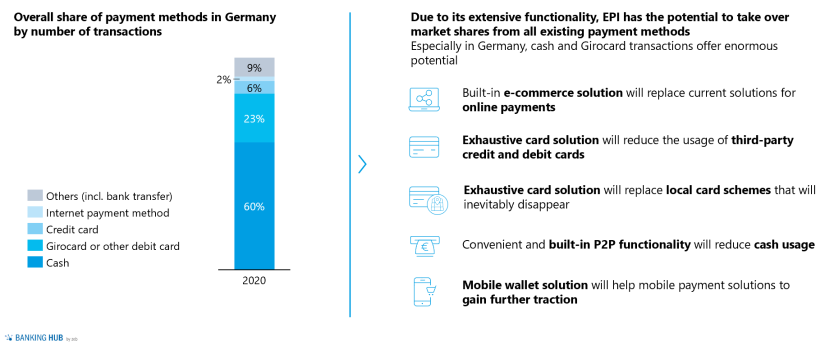

If EPI manages to bring a payment solution to the market in time, it is likely that most European banks that are currently running a local card scheme can be convinced to join EPI rather than switching to Mastercard or Visa – provided that EPI comes with the features announced (e.g. merchant payments, instant payments, mobile, cards and P2P) and competitive pricing. Given a coherent offer, even European banks that are currently with Mastercard or Visa might be convinced to switch to EPI.

If EPI is not up and running before the end of local card schemes, the pressure will increase even further. Banks will need to migrate to other (interim) solutions and will think twice about migrating again. As a consequence, EPI must be even more convincing in both pricing and functionality. Even if EPI’s pricing can compensate for the banks’ extra costs, strategic considerations might prevent the banks from switching to EPI.

Thesis: EPI should remain an industry initiative with market infrastructure incentives

EPI faces the classic free rider problem. Due to high uncertainty, most banks are currently waiting for others to take the first step. Once enough institutions are financially committed to the project, the large majority will follow. European market infrastructure providers should seriously consider incentivizing first movers to ensure the initiative gains the necessary traction.

Meanwhile, European banks should now start to develop individual roadmaps and carefully consider EPI for their payment strategies. Furthermore, banks should think about possible interim solutions to bridge the time between the end of local card schemes and a possible migration to EPI (e.g. via interim continuation of local card schemes without co-badging).

Furthermore, the members of EPI should promptly provoke a decision as to whether they want to financially commit to EPI or leave the playing field to the competitors from overseas. Ultimately, committing financial resources and know-how can be worth it, since EPI offers serious opportunities to create strategic and financial value.

Conclusion about the Euopean payment initiative

In conclusion, we believe that EPI is a unique chance for European banks and the European Union: it prepares Europe for the single payment market based on a state of the art payment solution. If broad adoption succeeds, upfront investments will pay off.

With EPI, banks will be able to shape future payments and offer innovative and convenient products to their customers while at the same time decreasing processing costs and achieving strategic independence from third parties.