Challenges in payment operations

Two dimensions are significantly impacting the area of finance operations

The European payments landscape is constantly evolving and at present there are two dimensions significantly impacting the area of finance operations.

Firstly, technology is rapidly shaping new customer demands: customers increasingly expect a high degree of simplification, usability, speed, and an enjoyable user experience. As a consequence, changing customer demands call for end-to-end resolution. It is no longer enough to adjust the customer-facing front end, as back end services are also crucial to meeting customers’ needs. They are expecting instant payments, transaction tracking, low fees for international payments, and utilization of opportunities created by PSD2.

Secondly, financial institutions are facing high cost pressure due to low interest rates and the economic recession caused by the coronavirus pandemic. Since all of these trends have an immediate effect on banking operations, a complete reshuffle of them becomes inevitable.

Payments operations: Zero Ops is of course not the only approach

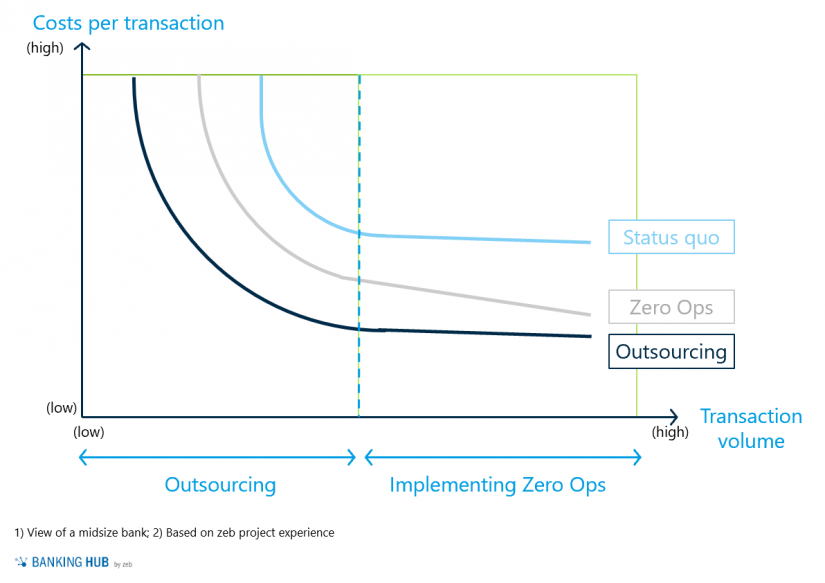

Another option is sourcing (third party outsourcing, shared services, or nearshoring). Especially for lower transaction volumes, outsourcing (BankingHub.de: “Outsourcing in der Finanzindustrie“, article only available in German language) may be a good solution: it can lead to cost savings of up to 40% – and even more in some cases – with correspondingly lower transformation costs (although there might be a VAT disadvantage that has to be set off).

But with increasing transaction volumes, Zero Ops tends to be the better option as it avoids the major disadvantage of sourcing, namely that economies of scale are paid by inflexibility. Zero Ops retains flexibility and the bank’s control over their processes.

Deciding between the two setups in payments operations

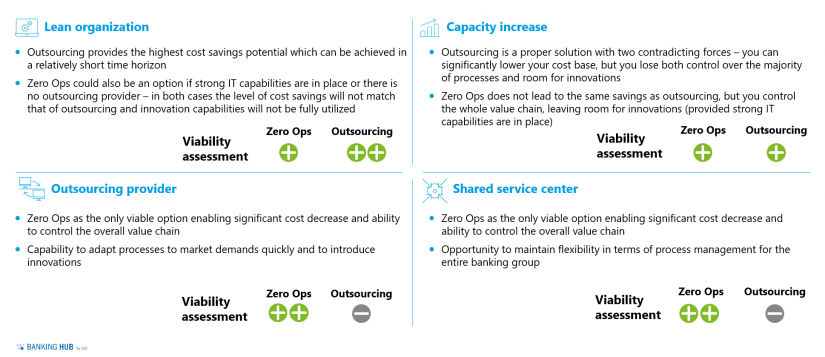

When deciding between the two setups, we recommend a thorough qualitative assessment of both alternatives and of overarching business goals with regard to payment services in the particular organization. Additionally, assessment should be conducted separately for different payment instruments and their required market flexibility.

For instance, FX payments might be subject to sourcing, whereas domestic schemes might be optimized by leveraging Zero Ops. The overall viability of outsourcing vs. Zero Ops, based on the specific environment, is presented in the chart below.

Zero Ops transformation involves a complete restructuring of processes and of their logic – and it requires high efforts to achieve the target picture. Conversely, the biggest advantage of the outsourcing approach is a relatively quick transition to improved speed, service quality, or efficiency due to economies of scale. In this case, however, the bank loses a considerable degree of control and expertise over outsourced areas – and increases its dependency on the provider.

There is no “one-size-fits-all” solution. Elements of the specific case should be considered to make a successful decision. For this purpose, the scheme below describes the viability of each option based on an organization’s specifics.

Zero Ops implementation benefits (solution)

Target concept of Zero Ops

zeb is convinced that operations will be significantly reshaped in the next decade: automation of the majority of processes, E2E processing, and cross-functional teams will be the “new normal” of back office operations, including cards and payments operations.

In this context, Zero Ops refers to a target state where the majority of processes are fully automated and processed straight through. Only individual and/or complex processes like exception handling and IT development are to be performed manually, however they are also subject to continuous automation. The higher degree of automatization results in a shift of staff from repetitive tasks to the handling of more complex activities; commodity activities are either automated or outsourced.

Following the implementation of straight-through and e2e processing, the old logic of organization/product-based operations design is no longer valid and a clear process-oriented structure is necessary. Cross-functional teams, including “ops change” teams, manage the whole process end-to-end. “Ops run” teams handle selected processes and support agile DevOps structures. This allows for a fast time-to-market even in a Zero Ops environment as this setup enables a great degree of flexibility and responsiveness to constantly changing market needs. Organizations are therefore better prepared to respond promptly to emerging challenges and to sustain their competitive advantage.

Nevertheless, the transition to Zero Ops is complicated by multiple aspects: first and foremost, excessive manual processing and outdated IT infrastructure stand in the way of full-scale automation. This results in time-consuming and inefficient backtracking processes. Additionally, a growing number of exception drivers decrease the STP (straight-through processing) rate, thus strongly reducing overall process efficiency. In combination with high fees (especially for international payments) and low transparency of actual costs incurred, overall customer satisfaction is greatly deteriorating.

Challenges and gradual approach

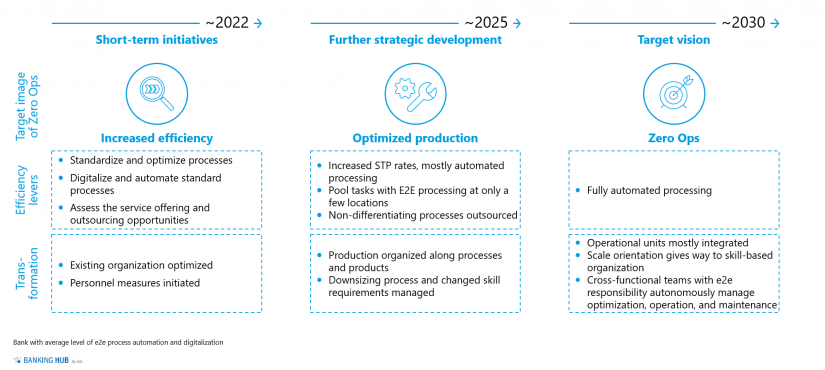

From a management perspective, it is important to underline that Zero Ops is the target picture which has to be implemented gradually. In a first phase, short-term initiatives focus on increased efficiency by standardizing and optimizing processes, digitalizing and automating these standard processes, and assessing service offerings and punctual outsourcing opportunities.

The project example below shows that even at this stage up to 50% of the manual effort can be reduced, simply by optimizing the existing processes either through digitalization, automatization, and/or outsourcing.

In order to fulfill customer expectations regarding end-to-end resolutions, further operational adjustments are required mid-term: outdated back-end IT infrastructure must be gradually replaced by one that includes robotization and automation with a clear end-to-end orientation. This allows for new innovative and flexible processes that ensure a positive customer experience and lead to an increase in process cycle-times.

Within the next 1–3 years, all commodity activities should be either outsourced or fully automated and processed in a straight-through manner. As automation promotes an end-to-end view of separate process steps, it results in an overarching and holistic view of accountability. Consequently, the organization has to transform its dedicated operations unit to cross-functional teams with e2e responsibility, which autonomously manage optimization, operation, and maintenance.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Use case “cards and payments operations”

In a project for a universal bank, zeb achieved an overall efforts reduction of 50% for cards and payments operations. The project team analyzed the processes that are involved along the full E2E value chain (origination, transaction processing, maintenance, and termination) for both cards and payments products.

During an as-is analysis, zeb identified that payments efforts were mainly driven by origination, while cards efforts mostly stemmed from maintenance activities. By benchmarking the respective processes against market practice and peers, it was found that the biggest effort savings in payments origination were reached through disincentivizing paper-based payment orders supported by increasing the attractiveness of digital products.

Similarly, in the cards area, zeb uncovered that providing more self-servicing functionalities for debit and credit cards not only reduces manual efforts by 40% but also increases customer satisfaction. Customers neither have to speak to a call center agent nor visit the branch any longer. More than 60 efficiency measures were identified which led to a significant effort decrease of ~50% for payments and ~45% for cards across the E2E value chain.

The optimization measures were projected over a range of two years, with the majority taking place in the first one. Prioritizing IT resources adequately was crucial to the implementation of digitalization measures. This project example clearly depicts how banks can successfully manage the first phase of their journey towards Zero Ops.

Conclusion back office processes in payments

Ongoing trends in the banking industry concerning increasing digitalization and changing customer expectations will definitely have a huge impact on back office processes. Due to its specifics, the payments industry will be strongly affected. In future, operational units will be fully automated through new technologies such as AI, robotics, and OCR. In order to gain a competitive advantage, banks will be forced to take directional decisions regarding their optimization approach.

The Zero Ops approach is an innovative and beneficial solution if organizations want to keep their payments operations inhouse and retain their specific know-how. This is especially important when payment services are regarded as their value enablers. If, however, they are not seen as value drivers, a smart mix of insourcing, outsourcing, and Zero Ops, depending on the specific features of each area, offers the best solution, ensuring a proper balance between flexibility and cost reduction.