Foreword on earning potential in the securities business: Seizing opportunities in the low interest rate and COVID-19 environment

For the first time since the turn of the millennium, in 2020 the equity culture in Germany experienced a renaissance. At this point, around 12.4 million people – almost 2.7 million more than in 2019 – invested their money in equities, actively managed equity funds or equity-based ETFs, through savings plans or nonrecurring investments. This development was driven by various factors: lower consumer spending in 2020, for example, coincided with a lack of investment opportunities and a low-cost access to the equity markets facilitated by so called neo-brokers. In addition, due to the ongoing low interest phase, the “custody fees” issue is also a factor that can drive customers to shift from deposits to investments.

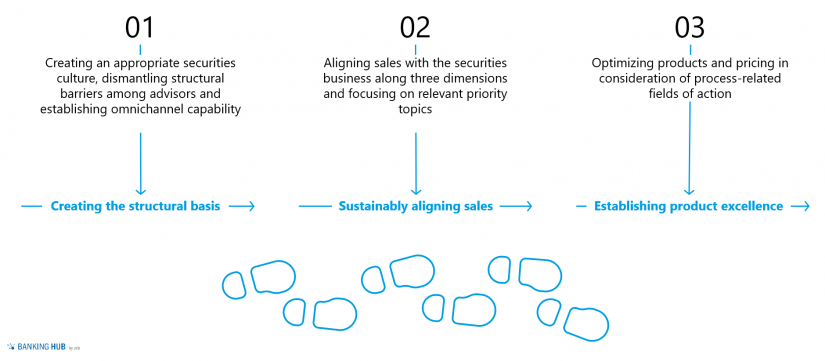

The resulting income potential in the securities business offers medium-sized banks the opportunity to sustainably boost their commission income by optimally exploiting this potential. This requires operational measures along the following three steps.

Building the structural basis: Securities culture and omnichannel capability

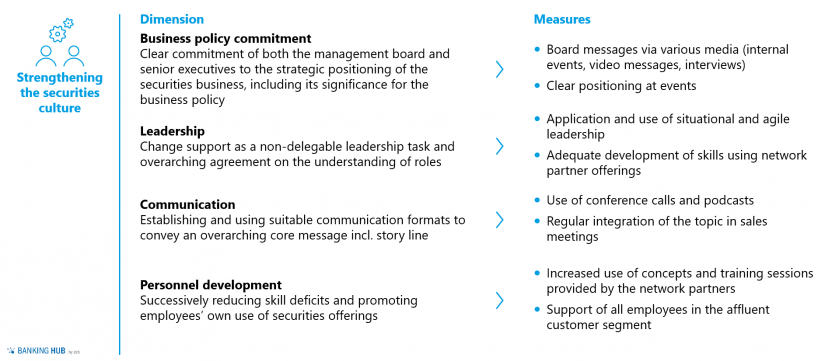

A key element in building the foundations is the creation of an appropriate securities culture. Especially in retail sales, banks are faced not only with their customers’ low affinity for securities, but also with structural obstacles in providing advice. Establishing an overarching securities culture is therefore not just a matter of change, but also an integral part of a clear sales strategy.

The implementation of measures along the following dimensions has proven to be particularly critical to the success of strengthening the securities culture:

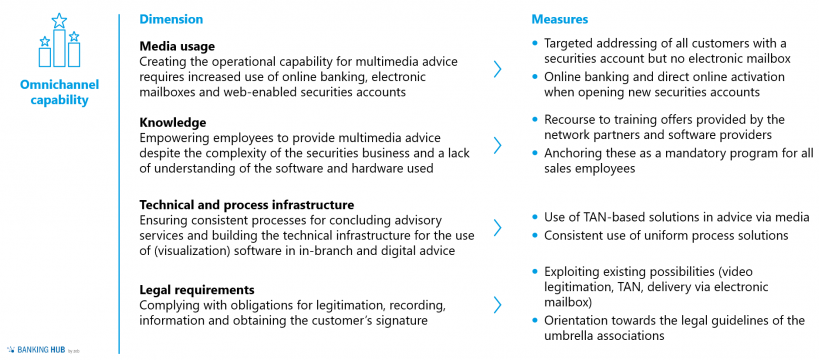

In addition to strengthening the securities culture, the company should also focus on its own organizational empowerment to expand its securities business. The era of COVID-19 has shown that it is necessary to ensure interaction options for the customer beyond in-branch channels. To withstand the competition, regional banks should strive for a full omnichannel capability in the securities business. In addition to an expanded online offering for customers who rather decide on their own (without being tied to opening hours), this also includes an expansion of in-branch as well as telephone and digital advisory services.

Achieving omnichannel capability presents challenges along the following dimensions:

In addition to omnichannel capability, organizational empowerment should ensure a high level of (E2E) process efficiency in combination with a clear understanding of the roles of advisors and specialists. Together with a strong securities culture, this allows the institutions to build a sustainable and solid foundation for the securities business.

Sustainably aligning sales on the securities business

In order to increase income from the securities business, it is essential to sustainedly focus the sales force accordingly. On the structural basis, sales is considered along the three dimensions of planning, management and process/support. In addition, it is necessary to focus on priority topics (e.g. sustainability) and anchor them in the relevant dimensions.

Planning

Ambitious sales planning is the basis for regional banks to implement sales measures. The key point is the potential-oriented definition of an ambition level. For this purpose, it is important to gain clarity about one’s own market position in the current market. The zeb.potential model supports regional banks in identifying their individual market position and the existing potentials in the securities business. Taking into account relevant market data, it is possible to determine the institution-specific pool of income and to test it against a comprehensive benchmarking database.

In comparison with current business targets, we then derive a strategic level of ambition that serves as a (growth) target for the next three to five years and is incorporated into the institutions’ medium-term planning. Experience shows that a large number of institutions are already planning for income growth rates from the securities business of over 10% per year up to 2026.

However, an overarching target for the entire organization is not sufficient to translate the defined growth path into concrete operational sales planning. The overall corporate target for the securities business must be specified at lower levels. Exemplary levels for defining target shares in medium-term planning include:

- Determination according to customer segments: g. retail customers, affluent customers, private banking, commercial and business customers, corporate customers

- Determination according to products/asset classes: g. equities, bonds, funds, certificates

- Determination according to investment frequency: g. nonrecurring investments and savings plans

The systematic inclusion of plausibility parameters is also useful to finally derive central planning parameters and to avoid planning errors. The following levers, among others, can be used for this purpose:

- Consideration of overall market developments to further specify the general level of ambition

- Consideration of customer behavior and trends to specify income targets at segment and product level

- Comparison of target values with current employee capacities and qualifications to derive personnel measures

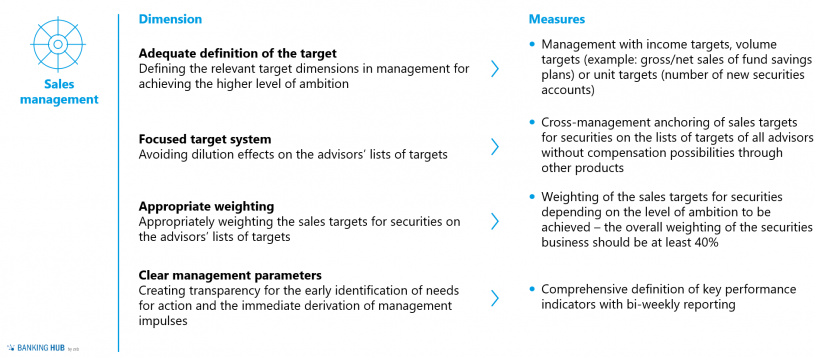

Management

Sales management forms the basis for successful market cultivation and, with appropriate control processes, ensures the sustained focus of sales on the securities business. Particularly important in this context is defining the right sales targets for securities and avoiding sales mismanagement. As regards regional banks, this involves anchoring defined targets on the advisors’ target lists and continuous reporting to derive management impulses. In addition, this dimension is supplemented by overarching securities business topics. Regular savings, for example, can be positioned as a key sales focus in order to generate sustainable income from the securities business. Further fields of action and measures within sales management are detailed in the following figure:

Process/support

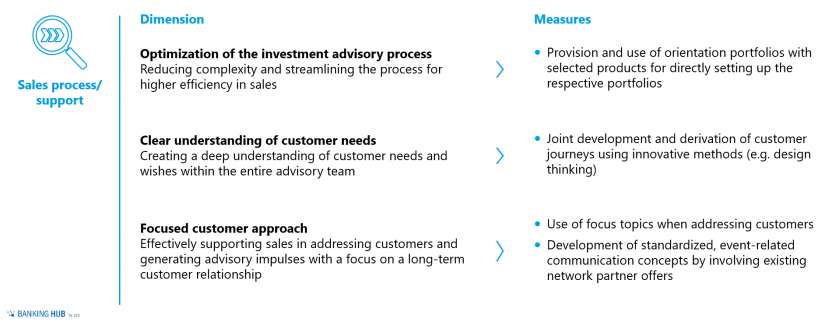

The sales process also plays a key role in increasing income from the securities business. This also highlights the close interconnection with the structural basis of organizational empowerment and the securities culture.

Advisors’ own attitudes towards and skills in the securities topic are often reflected throughout the entire investment process. The sales process should therefore not only be adjusted along a procedural framework such as efficient advisory processes, but should also include comprehensive sales support.

In this respect, besides reducing complexity for both advisors and customers, the institutions should also particularly focus on efficiently addressing customers. Regional banks should therefore not only aim to achieve the highest possible number of customer appointments, but also a high quality of advisory services in terms of sustainable sales transactions.

The following areas of action are particularly suitable for implementing measures:

The sales process is closely linked with the securities culture and organizational empowerment. As a result, the development and training of skills within the advisory service is highly relevant to the sales process. This process is further supported with the use of innovative tools such as data analytics in order to select not only the right occasions for addressing customers, but also the right times and the right channel. These tools are particularly effective when used for media channels.

Establishing product excellence

In the low interest rate environment and the current competitive situation, optimizing their own products and pricing is an important field of action for regional banks to increase income from their securities business. In addition to purely focusing on the product portfolio, process-related fields of action should also be included to support sales. Streamlined product selection and administration not only create efficiency, but also significantly reduce complexity in the advisory process. The following measures in particular are suitable for comprehensively supporting the sales process:

- Uniform company view: definition of a uniform company view (also of product partners) to derive product recommendations for the sales department

- Thematic focus: overarching management of product offering through current investment topics adapted to customer needs, for example: “regular savings”, “sustainability”, or “investing in the low interest rate environment”

- Optimized product portfolio: inclusion of innovative products covering the relevant asset classes, closely aligned with the sales focus

- Streamlined product offering: limitation of the number of products (e.g. selection of real estate funds), closely aligned with the use of orientation portfolios

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Especially in times of digital asset management and emerging “neo-brokers”, regional banks need to focus on innovative and sustainable products more than ever. To optimize the product portfolio, the following product solutions, among others, can be developed and expanded:

- Personalized securities account management: holistic portfolio analysis and support in combination with flat-fee models – customers benefit from “all-inclusive” packages, and regional banks can make further pricing readiness accessible; clear growth focus, especially in private banking.

- Regionally branded certificates: a collaboration with network partners could be used to launch a regional product to generate commission income with a reasonable amount of resources – also possible for sustainability topics.

- Asset management: establishing an in-house asset management service increases awareness of their expertise and skills among customers and offers the opportunity for additional income – smaller institutions are well advised to make use of existing services offered by network partners.

- Own mutual funds: administration and management can be taken over by network partners – setup creates the opportunity to boost trailer fees.

The pricing policy is of general importance when it comes to optimizing products. The securities business plays an important role for customers as a “way out” of the low interest rate phase. At the same time, however, customers are well aware of the prices on the market and are becoming increasingly price-sensitive.

In terms of fees for services in the securities business in particular, customers not only demand a high level of transparency in the fee structure, but also increasingly question it. Regional banks should therefore review their pricing strategy both at analytical level, with a focus on custody and transaction services, and at sales level.

Besides focusing on classic pricing ranges, the topic of price enforcement should also be anchored in training and coaching sessions for securities advisors. Other exemplary levers for optimized pricing in the securities business include:

- Adjusting review cycles: the list of prices and fees for securities services should be reviewed at least every three years.

- Increasing flexibility: review of securities account models and introduction of needs-based solutions, for example: differentiation by single price or “flat fee” vs. package solutions (basic model plus add-ons)

- Using value-added services: introduction of value-added services for deliberately linking price and service, for example, combination with individual securities account support, introduction of stock exchange newsletter or free settlement account

Pricing therefore also plays a fundamental role in establishing product excellence. Together with a close involvement of cultural, structural and sales aspects, this reveals a further field of action for regional banks, on the basis of which they should implement appropriate measures to increase their income from the securities business.

Conclusion about earnings potential in the securities business

Increasing income from the securities business is a necessary measure for banks to strengthen fee and commission income and compensate for declining interest margins. Additionally, in the context of the advisory mandate of medium-sized banks, the accumulation of assets in periods of negative interest rates also proves to be a quality feature. In combination with increasing competitive pressure, ongoing regulation and economic uncertainty, it is therefore all the more important for regional banks to build their securities business on a sustainable basis.

The development and expansion of the securities business along the fields of action listed above represents an important transformation for regional banks in order to sustainably position themselves for ongoing challenges. In addition to a cultural and structural foundation, the appropriate orientation of sales to the securities business in combination with the establishment of a high level of product excellence is particularly crucial in this respect. In conclusion, regional banks should always regard the expansion of the securities business along the aforementioned fields of action as an opportunity that needs to be exploited – now more than ever.