Background

Beside more extensive reporting requirements due to the implementation of the CRR / CRD IV package with far-reaching implications for Corep, Finrep and disclosure, additional requirements can be seen in terms of statistical reporting (e.g. AnaCredit). Regardless of these specific reporting requirements, the RDARR principles (BCBS #239) specify fundamental requirements for managing data within institutions. While they were initially only compulsory for globally systemically important banks (G-SIB) and nominated domestic systemically important banks (D-SIB), they meanwhile represent basic principles for all institutions.

These increasing reporting requirements impose major challenges to numerous European banks. For additional and new requirements, responsibilities & ownership need to be specified on the business side; the relevant data have to be provided by the available core systems and integrated into the existing reporting systems. Beyond this, budget and resource limitations need to be taken into account.

In this environment, many institutions have implemented solutions that, while fulfilling the current requirements, have led to deficits in their overarching IT-architecture: Many of the solutions generate major “run the bank” costs (e.g. for manual corrections, interim solutions, data consistency solutions) along with high “change the bank” costs (e.g. expanding existing reports to include the new information or incorporating new data sources in a data warehouse). They are characterized by repetitive processing of the same data in various steps for various reports.

On the other side, European as well as and national competent authorities are themselves facing comparable challenges as the institutions: systems on the side of the competent authorities have also evolved over time and need to be expanded and adjusted in order to receive and assess the new data deliveries. Methods are needed to check the plausibility of data. Besides the analysis of data on single institution level, a consistent view of the overall European economic area shall be facilitated. Finally, from the centralization of European banking supervision, the ECB and the national supervisors both need additional data, and in many cases, these data are overlapping. The task to ensure high quality data from all institutions and efficiently organize the long-term expansion and maintenance is also posed to the supervisory authorities.

In this situation, regulators have recognized that it is required to standardize data management between the supervisory authorities and also between individual supervisory authorities and institutions.

BIRD / ERF / SDD

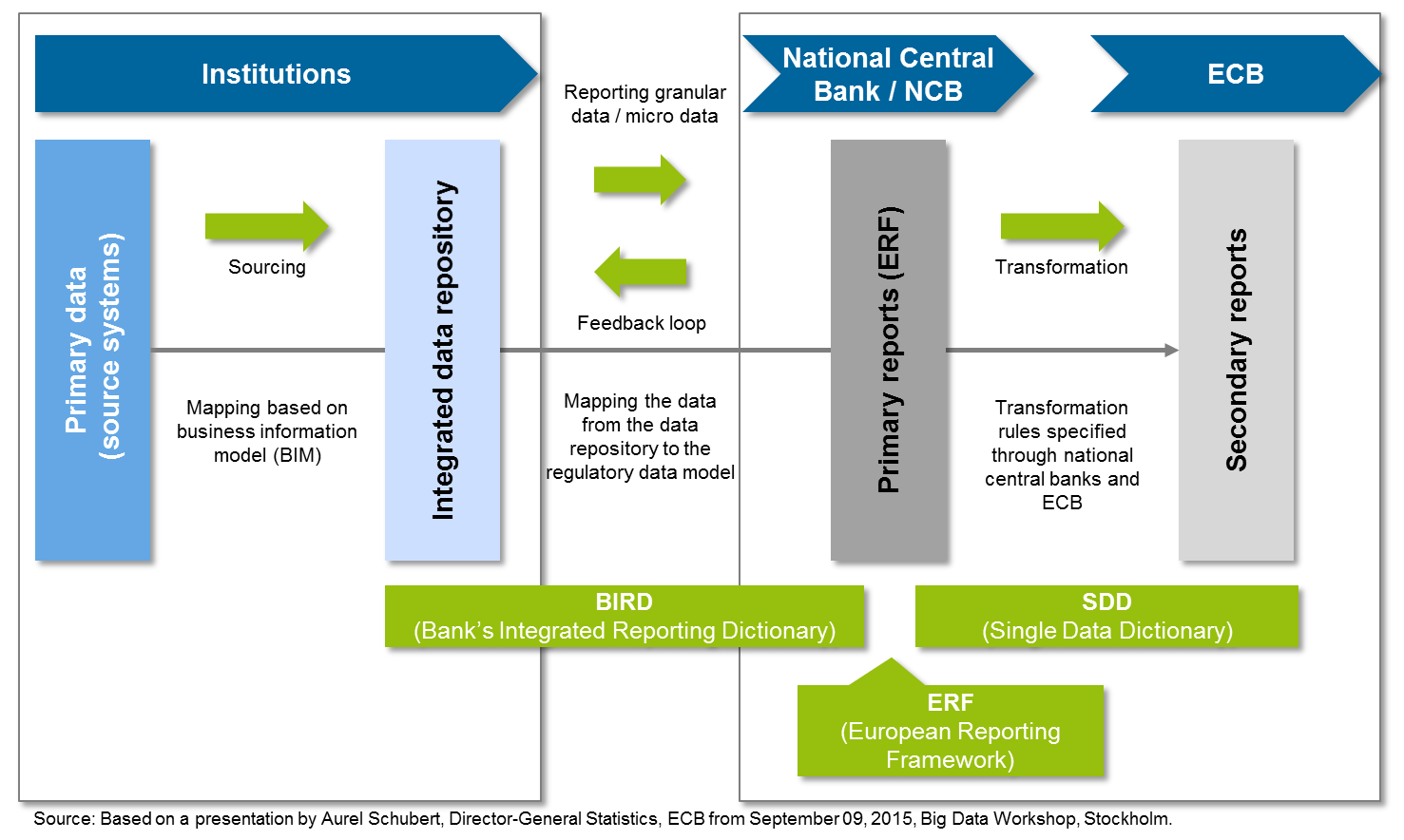

As a reaction, the European System of Central Banks (ESCB) has set up a joint project (source: ERF key facts and information (June 2015)) with the financial sector for the conceptual design and development of coordinated data management. This project is still at an early stage, but has the potential to lead to massive changes to regulatory reporting. There are three main components under discussion:

1. Banks’ Integrated Reporting Dictionary (BIRD)

This relates to a data dictionary which describes data elements on their granular level and defines them in a standardised way. This may also include transformation rules, such as calculation of result data based on other individual data. BIRD should establish a common language for data within the European banking sector. The common language should then be referenced in the reporting requirements from the regulator.

2. ECB Single Data Dictionary (SDD)

In the same manner that BIRD defines a common language for the data to be provided by banks (here, the common language predominantly serves communication with the institutions), a common language will also be developed within the ESCB for all reports, KPIs, etc. that are generated from the data delivered by the institutions.

3. European Reporting Framework (ERF)

A major component for assessing the data should make up the ERF in future. The aim is to establish an integrated framework for all data requirements of the European Central Bank (ECB) and the requirements of “Implementing Technical Standards” (ITS) from the European Banking Authority (EBA) within the EU. This framework will replace the existing practice of numerous overlapping reports of various granularities.

As the ESCB project is currently at an early stage, its implementation cannot yet be predicted in terms of precise dates or technical and regulatory factors.

It seems that the regulator will eventually replace the delivery of predefined and often aggregated reports with a granular, consistent and non-redundant data delivery of relevant business objects (customers, contracts, transactions, etc.).

Ambition

Benefits from the regulator’s point of view

From the regulator’s point of view, this long-term transition towards delivery of granular data leads to a number of benefits:

- In general, it is expected that the process to lead to an improvement of data quality, especially the data consistency, a more efficient and cheaper preparation of data (for the institutions and supervisory authorities) as well as a simpler comprehensibility, quality assurance and data control.

- Furthermore, there would also be the possibility to prepare own reports or assessment options more simply, without requiring new or additional reports from the institutions. With the help of specific figures and indicators, the comparability of institutions can be enhanced. Beyond this, based on the individual data, a link to macroeconomic indicators could be made easier (e.g. to facilitate predictions for actual implications of economic crises in certain industries or regions on European banks).

Benefits from the institutions’ point of view

In general Banks will continue to face the challenge of collecting all relevant data consistently in planning systems in the future.

- With BIRD, a consolidated, finely granulated description of the necessary reporting data will be available and can be understood as part of a bank-wide data model. This should lead to a better understanding of the interpretation and communication within the participating institutions and the interaction between institutions and the regulator.

- If in future relevant and detailed data is only delivered to the regulator once, and if the further processing (filtering, aggregation, etc.) is only conducted there for specific purposes, the vertical integration in reporting by the banks can be significantly reduced, which should lead to reduced cost and effort.

- The implicit demand that data for individual business objects have to be be consistently prepared offers potential for the bank to increase the consistency of its own reporting system, thereby reducing the currently necessary transformations and reconciliations.

Own reporting systems will become indispensable in the future, especially for fulfilling the requirements of internal reporting, risk management, accounting and ad hoc requests from the regulator. This raises the question to which degree institutions can provide qualified responses to the interpretation of their data done by the regulator if they have no comprehensive insight into the reports generated by the regulator. From the institutions’ points of view, it is thus important that the regulator does not only provide the institution-specific reports, but also discloses the applied plausibility checks, used indicators and applied transformation rules. It is currently open to which degree the banks will be provided technical solutions or just the methodology.

The advantages that have been identified are up against risks and investment costs associated with the implementation, which however cannot be quantified with certainty in the current level of discussion.

Outlook and Schedule

The implementation of the AnaCredit requirements can be understood as a first step in the outlined direction. The current draft of the requirement focuses mainly on the granular delivery of individual business objects. Initial analyses and piloting phases have shown that AnaCredit does not only require existing reporting data, but it also uses data from other sectors.

In autumn 2015, the first workshops between ECB and a series of institution representatives began. In a next step, further workshops will be held with the industry aiming at creating a stable glossary by the end of 2016, at least for AnaCredit as a first module.

The progress of this ambitious project will depend on various success factors, which are to be addressed as part of the workshop, e.g.:

- specification of a method for business data modelling

- development of a methodology for describing plausibility rules

- further standardisation of the Europe-wide understanding of products, collaterals etc.

- the national central banks and ECB should develop a common Business- and IT- target picture to be able to manage data efficiently and facilitate an exchange of data

Several institutions have also started to sort their data warehouse(s) from a business point of view and to describe the data content in the form of a business data model[1]. This is also supported by the required harmonized taxonomy of BCBS # 239 (Risk Data Aggregation). It also appears sensible in light of a glossary that will be provided by the regulator in future (BIRD), because it will surely take a long time for such a large group of users to fully define and introduce BIRD.

It has to be emphazised, that BIRD will only contain the part of data administered by banks that is required for external, regulatory reporting. Data for internal management, marketing, customer relation management, etc. will presumably not be described through BIRD at any time soon. Banks that have their own business data model can already use them with all advantages in their change and run processes. After the regulator has introduced BIRD, the regulatory requirements can then be mapped relatively simply for the own business data model. The use of BIRD will not be obligatory according to current discussions; instead, the institutions will be able to decide for themselves.