High demand from private investors drives market development

According to CoinMarketCap, the global market for cryptocurrencies alone increased approximately fivefold from the beginning of 2020 to the beginning of 2022 (as of January 2022). This momentum is expected to continue during the coming years. The growing demand from private investors, who are strongly inclined towards cryptocurrencies, will probably be one of the key drivers of this development.

In a survey conducted by Bitkom, for example, 7% of the German private investors surveyed state that they have already bought cryptocurrencies. Another 18% say they are interested in cryptocurrencies. By comparison, only 19% of respondents take an interest in stock investments. This shows that there is a strong awareness of digital assets among private investors.[1]

Institutional investors are also showing an increasing demand for digital assets. In a zeb survey, around two-thirds of the institutional investors surveyed stated their interest in digital assets and thought it likely they would invest in digital assets in the next two years. The growing interest of institutional investors is driven by the potential of high returns in proprietary trading, rising investor demand for hybrid crypto funds as well as increased legal certainty and improved tradability of digital assets.

The rising inflow of funds from institutional investors provides stability to the digital asset market, which should be reflected in increasing professionalization, higher liquidity and, accordingly, falling market volatility in the medium to long term as well as faster expansion of the technical infrastructure. From a private investor perspective, these effects will also improve the general market conditions / investment conditions and trustworthiness of digital assets.

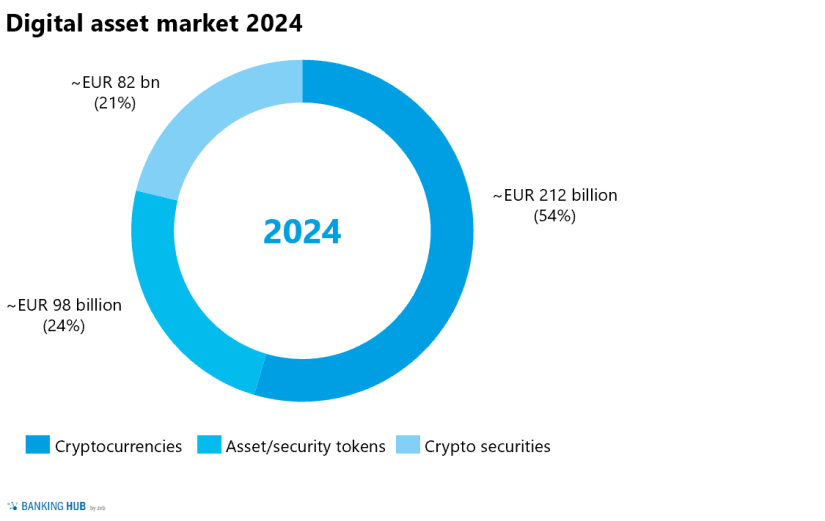

Given these trends, zeb is expecting the total market for digital assets in Germany to increase from currently around EUR 118 billion to approximately EUR 392 billion by 2024. Cryptocurrencies will likely continue to account for the majority of the market at around 54%. In the future, however, asset and security tokens[2] with approx. 24% and crypto securities[3] with approx. 21% will account for a proportionally larger share of the total market than today.

Digital assets are also becoming increasingly important for regional banks

The increasing importance of digital assets raises various challenges for regional banks. Among other issues/challenges, institutions are facing a new demand, which some players are currently unable to meet. As a result, fintech companies are gaining traction, especially in crypto trading, which is why some regional banks may face customer churn and outflows of funds.

In order to live up to their service commitment of offering their customers a comprehensive product portfolio and holistic advice, regional banks need to seriously tackle the topic of digital assets.

Of course, it takes time to acquire the necessary expertise and, if necessary, obtain the appropriate licenses for business operations. Therefore – at least in theory – regional banks run the risk of being left behind by start-ups and institutions with digital asset portfolios. If institutions then decided to introduce such offerings after all, the time-to-market would be long and their dependence on third-party providers high.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

First regional banks are positioning themselves with pilot projects

To overcome these challenges, it is essential that institutions deal with the topic of digital assets in an open and unbiased manner and consciously decide in favor of or against a digital asset strategy of their own.

Numerous regional banks have recognized this need for action and have already initiated their first digital asset projects in order to create their own product offering.

- VR-Bank Bayern Mitte, for instance, has expanded its product portfolio in response to numerous customer requests regarding cryptocurrencies. The bank will enable its customers to purchase and trade bitcoins and to hold them in cold wallets[4] for safekeeping. Customer advisors will receive extensive training to expand their investment advice expertise regarding financial instruments to include digital assets.

- A different strategy is pursued by Kreissparkasse Ostalb, which has decided to partner with Börse Stuttgart Digital Exchange. As part of this cooperation, Kreissparkasse Ostalb offers its customers the opportunity to open a wallet at the Börse Stuttgart stock exchange for trading cryptocurrencies. In return, Kreissparkasse Ostalb receives a commission from Börse Stuttgart.

In addition to cryptocurrency trading, the first regional banks are also experimenting with asset tokenization, which uses fractionalization to make asset classes such as art objects and real estate accessible to retail customers.

In addition to projects at bank level, digital asset initiatives are also currently being discussed by banking associations. In this context, some key players have already initiated pilot projects:

- Deka, for example, has created a digital asset settlement platform, which can be seen as a milestone in the development of the German digital asset ecosystem.

- Union Investment has also already positioned itself and offers hybrid cryptocurrency funds to provide customers with optimized portfolio diversification.

- And S-Payment is currently working on a wallet solution for the entire Sparkassen-Finanzgruppe association.

Limited window of opportunity to enter a highly profitable market

Although the changes that digital assets have triggered in the banking sector are raising challenges for many institutions, the current market environment also offers great opportunities. The German digital asset market, for example, still offers high income potential, since the lack of standardization and low price transparency allows companies to charge significantly higher fees than in traditional financial markets. At the same time, given the still manageable level of competition, the German digital asset market can be entered quite quickly and cost-effectively.

However, entering the digital asset market will become more difficult in the future as the market matures. On the one hand, institutions entering the market at the current stage can gain industry-leading experience and use their high income to finance competitive advantages such as technical platforms or build strong brands. Early movers can use their positioning to establish barriers to entry, which would significantly increase the cost of entry for followers or late adopters.

On the other hand, the current market environment is likely to attract numerous new players in the medium term, which will lead to price pressure. Furthermore, pricing will become more transparent as the market matures. This will have a negative impact on fees, while facilitating higher product quality and greater economies of scale.

Conclusion: regional banks should position themselves quickly

Given the currently attractive market environment and the barriers to entry that will appear in the medium term, regional banks are advised to strategically engage with the digital asset market as soon as possible. Market entry requires formulating a digital asset strategy, designing a viable business model and understanding the technical infrastructure.

Besides, it would be beneficial to carry out a comprehensive sourcing analysis of specialized service providers in order to develop tailored solutions that meet customer demand.

Expertise for your digital asset project

zeb combines comprehensive expertise in digital asset projects with a deep understanding of the organizational structure and business model of German regional banks. Therefore, zeb can support regional banks as a competent partner for change in the currently transforming market environment.

For more information, visit zeb-consulting.com.