Chatbots and Voicebots

Chatbots and voicebots play a crucial role in digital customer interaction. Digital customer interaction is desirable not only in terms of strategy, but also essential from the customer’s point of view: customer expectations – concerning accessibility and speed in responding to service requests – have changed radically in recent years. For a while now, customers have come to appreciate the convenience of 24/7 accessibility and instant solutions offered by leading providers in other business areas.

So far, in banking, the very first customer experience with a similar degree of convenience is offered mainly by neobanks – and they are seriously threatening access to the customer interface for the established players in the market. In short, it is increasingly evident that chatbot and voicebot technologies are valuable strategic assets. They can contribute not only to a modern image, but also to significant income growth and cost savings.

Value-irritant matrix as the starting point for setting the targets for customer interaction

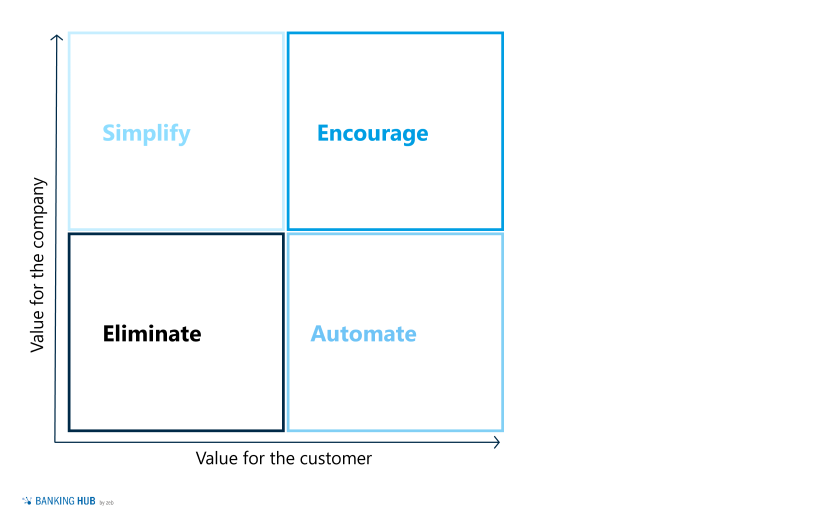

A holistic view of the company’s own customer interactions and a corresponding strategic classification of relevant use cases are important success factors for leveraging potential. This is because every customer interaction consciously or unconsciously influences customer satisfaction. It therefore effectively has an impact on the bank’s business success. The value-irritant matrix, developed by Bill Price, former Global VP of Customer Service at Amazon, is a suitable tool.[1]

It allows for a systematic classification of use cases along two important dimensions:

- Value for the company

- Value for the customer

The combination of both dimensions enables strategic deductions as to how the various service areas should essentially be dealt with.

Services with little value for the customer but great value for the company should be simplified to make them as “convenient” as possible for the customer. One relevant example in this respect are the current activities prompted by the Bundesgerichtshof (Germany’s Federal Court of Justice) ruling on the adjustment of account management fees. Immediate implementation is of enormous importance to the bank, whereas for the customer it primarily presents an administrative burden.

Tasks with great value for the customer and great value for the bank should be leveraged. These are usually activities with a direct positive impact on the bank’s income and which are very useful for the individual customer. For example, advisory services for various long-term products, such as occupational disability insurance, often fall in this category.

Processes which neither have a value for the bank nor for the customer should be eliminated, if possible. However, during almost every analysis, isolated processes of this kind are still identified. They are usually legacy burdens related to previous regulatory requirements or to process changes from recent years, for example following mergers, and must be reduced accordingly.

Most processes from inbound day-to-day business fall into the “high value for the customer and low value for the bank” category. They are consequently well-suited for the “automate” solution. Numerous use cases can be identified in this context, ranging from bank transfers to the activation or unblocking of various functions and limits. These have a high value for the customer, as they are linked to the basic banking business and represent the core of the business relationship from the customer’s point of view. For the bank, on the other hand, these are activities that have no direct impact on income. Above all, they entail costs that need to be reduced.

Setting the targets for future customer interaction and deriving a roadmap

Use cases from the “simplify” and “automate” categories generally aim to reduce administrative effort. With the introduction and continuous expansion of online banking, banks have already made great progress in recent years. Nevertheless, the remaining potential is still large. Chatbots and voicebots in customer service centers are a common example. They carry out tasks for the agents from the customer service centers, thus reducing the pressure on resources and personnel costs.

Depending on the level of digitalization, the bots can even resolve some customer requests from start to finish themselves – without any human intervention at all. As you can see in our example below, a calculation for a business case, the potential savings are enormous – partly because the customer service center is becoming more and more important for most banks.

Typically, use cases from the “leverage” category aim to increase income from interest and commissions. For instance, the traditional lead generation via outbound campaigns is resource-intensive and accordingly not easily scalable. Modern customer communication offers great potential in this context: lead generation, for example, can be accomplished in a more scalable way via chatbots that use micro-segmentation to generate leads. Frequently, they even improve the leads through targeted addressing – at comparatively lower costs. This allows banks to place highly targeted offers with the right customers and accordingly generate high interest and commission income. First implementations have proven the success of this model, for example by staging campaigns via chatbots on social media platforms such as Instagram.

Analyzing and discussing potential optimization candidates via the value-irritant matrix is the starting point and examines processes from a value perspective. In order to derive a target vision for future customer interaction, other dimensions must also be considered, including regulatory complexity. This is because regulatory standards, for example from PSD2 or the German Securities Trading Act (WpHG), specify certain requirements and framework conditions that must be taken into account and should be integrated directly into the targets.

The target vision for future customer interaction is always based on an assessment of one’s own bank with its individual environment, business model and customer base. A holistic, strategic approach is necessary and valuable. By prioritizing and focusing on different areas, the roadmap for the implementation process is derived. An essential part of this is the implementation of digital assistants, i.e. chatbots and voicebots, as illustrated in the following example of the case study.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Case study: implementation of chatbots and voicebots in the customer service center

In determining the status quo, the frequency of individual customer interaction and the effort that is involved in each case is analyzed and quantified. All inbound but also outbound activities should be taken into account. In addition to “traditional” points of contact, such as bank transfers or product orders, service inquiries about accounts and cards or the arrangement of appointments with customer service representatives, for example, are also relevant points of interaction. For this purpose, current customer interactions are differentiated and quantified into central process areas in the first step.

The bank then classifies all identified process areas using the four fields of the value-irritant matrix. This reveals that most processes are of medium to high value to the customer. Accordingly, these processes either fall into the “leverage” category to increase income or the “automate” category to reduce costs. Unlocking online banking functions, for example, is mainly valuable to the customer and of no direct benefit to the bank. This process therefore falls in the “automate” category.

A corresponding business case should be attached to each measure on the roadmap towards achieving the target vision for digital customer interaction. This should be done as part of the roadmap’s creation process.

Customers regularly block their online banking account or their TAN device, such as the app, and then go through a lengthy manual process supported by the customer service center. Unlocking online banking functions is so time-consuming that each process takes 5 to 10 minutes. This is how long it takes to talk to the customer and adjust the necessary settings in the system. If the process is performed from start to finish at a small bank over 5,000 times per year, this one process relating to the unblocking of an online banking account already represents a full staff capacity.

It is one of many processes that can easily be automated with current technology. This reduces both the workload on the staff of the bank’s customer service center and the administrative burden. In addition, it increases the amount of time that can be devoted to sales activities. Accordingly, the potential of chatbot and voicebot solutions is high.

Read more about digital assistants

Our digital assistants series will be expanded regularly. An overview of the topic and all articles in the series can be found here: