Intelligent automation using the example of real estate finance

State-of-the-art technologies for process automation can be adopted almost independently of the systems in use. Be it a large-scale automation of (lending) processes by means of RPA or the use of artificial intelligence for processing unstructured data. While these technologies can already be applied independently to automate a wide range of tasks, combining them, and using them together holds far greater potential on the road to full automation – also with a view to the real estate financing process.

Banking processes often involve document-based input information. Automated document processing can significantly increase efficiency in terms of turnaround time and quality. This leads to faster processing of requests and thus a near real-time response to the submitted application, which increases customer satisfaction at best. Optimized document review can thus eliminate inefficiencies, seamlessly transfer data to follow-up processes and generate valuable net market time.

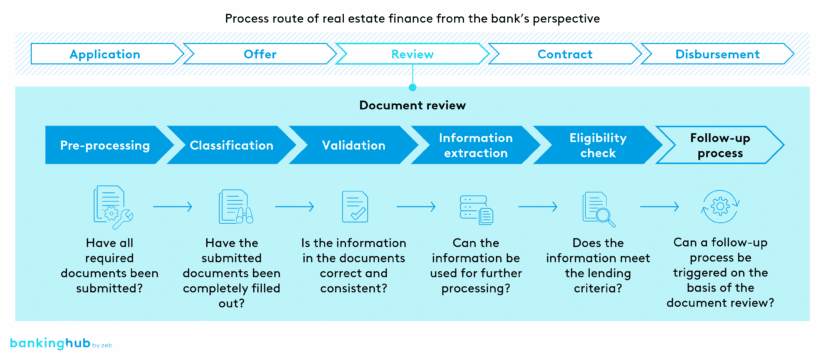

With regard to the real estate financing process, which is subsequently divided into the five stages Application, Offer, Review, Contract and Disbursement, the Review stage, for example, with the corresponding check of documents and information, offers many opportunities to combine RPA and AI-based software and tools for automation in order to leverage existing optimization potential.

Traditional paper-based document reviews come with some disadvantages when processed manually. Starting with the time-consuming pre-processing of submitted applications and the check for completeness, followed by the numerous resubmissions of incoming applications, which result, for example, from incorrectly submitted property and creditworthiness documents, experience has shown that the significantly higher error rate in document reviews can be attributed to the predominantly analog formats.

The respective manual conversion of analog formats into digital data and the consequent specific extraction and transmission of information are just as much weak points as the validation and verification of information and the subsequent rule-based eligibility check. Since a large number of processes will remain document- and paper-based in the future, banks should address the issue of automated document processing.

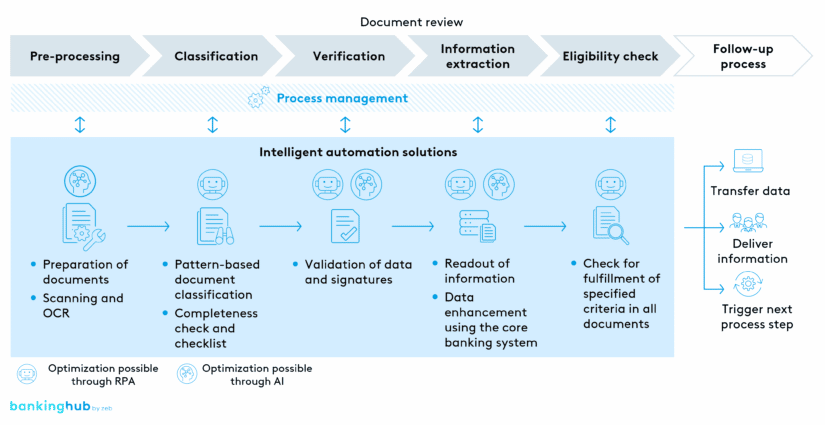

Here, both RPA and AI can be applied either individually or in combination to deliver significant benefits and optimize processes. The pre-processing of documents, for instance, can be digitalized using AI and OCR (Optical Character Recognition) technology and is thus significantly accelerated. This allows for rapid preparation of records and documents as well as prompt processing in subsequent process steps.

The steps to be completed include, among others, the classification of the various documents submitted based on document-specific structures and patterns. The initial classification then serves as the basis for matching against application-specific checklists using RPA to enable an early check for completeness and verification. This way, missing documents can be requested directly from the customer without delay in order to continue the application process. Furthermore, the documents can be archived automatically afterwards.

Once all documents have been reviewed and are complete, information from the application can finally be extracted and customer- or application-specific data seamlessly transferred to the bank’s internal systems. In the process, RPA can help appropriately match or enhance data with information that may be available in the core banking system, while AI can verify signatures.

Afterwards, the technical focus of the document review is on comparing the information provided in the application against defined technical rules. RPA can optimize this comparison process with quite complex technical criteria to ensure an error-free and target-oriented processing of solvent applicants.

The possible target image, consisting of various interacting RPA and AI services, thus allows for automation of document processing while eliminating typical vulnerabilities. Appropriately implemented, effective application review makes it possible to efficiently process fully verified and high-quality data from the application documents in the follow-up processes.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Implementing intelligent automation

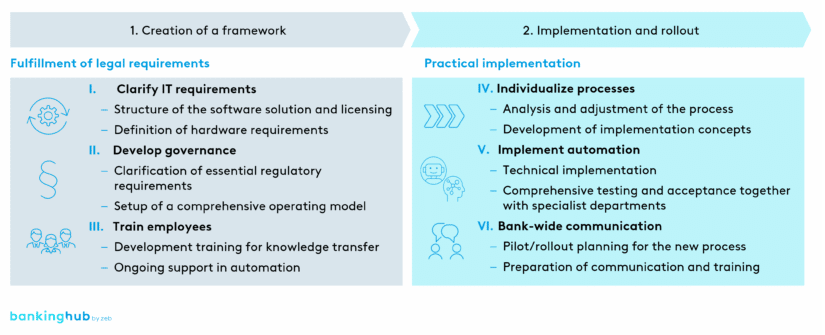

When implementing intelligent automation solutions, zeb applies a two-stage model.

The first stage, “Creation of a framework”, aims to embed the newly introduced technologies in the institution. This includes, first of all, the IT infrastructure’s audit-proof setup. In addition to the technical requirements, the focus is on embedding it in banking operations. To this end, zeb has developed an approach that defines the four dimensions Guidelines, Organization, Processes and Control in an operating model and the associated governance. This ensures that all regulatory requirements are met and that ongoing operations and the automation of new processes are organized. Finally, employees are trained to use the new automation technologies.

In the second stage, “Implementation and rollout”, we take a look at the process level. First, existing processes are analyzed in terms of their possible standardization and automation potential. Subsequently, a corresponding solution and implementation concept for process optimization needs to be developed, technically implemented and checked with regard to functionality. Finally, it is time for rollout and bank-wide communication, which also includes achieving acceptance throughout the institution and consolidating the new solution.

Conclusion on intelligent automation with RPA and AI

The combination of RPA and AI-based automation, such as document recognition, continues to push financial services providers on their path to full automation of various processes. By processing longer process routes via RPA and selectively supplementing AI to process steps that could not be automated so far, it will be possible to optimize even more complex processes in the future. This leads not only to a sheer reduction in manual effort and the associated cost efficiency, but also to less susceptibility to errors and shorter processing times. In addition to increasing the employees’ satisfaction by enabling them to focus on more complex (advisory) activities, this has a positive impact on customer satisfaction and the bank’s reputation with regard to its digital expertise.

The above field of application of these combined technologies in the real estate financing process provides only a glimpse of the far-reaching potential that can be unlocked by the combination of RPA and AI. Due to the versatility of AI-based approaches, numerous other application areas and processes can be digitalized and automated, such as lending decisions, processing of customer requests or even sales support.

As partners for change, we would be happy to assist you if you are interested in learning more about the possibilities of RPA and AI for your financial institution.