Overview Liquidity Study 2020

To provide a comprehensive overview of the latest developments in liquidity risk management, zeb conducted the 2020 liquidity study and surveyed a total of 27 institutions of different sizes and business models in Germany, Austria and Switzerland on the following topics:

Within the liquidity reporting topic block, we examined challenges as well as target levels and fluctuation margins of the liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR).

The ILAAP topic block analyzed the participating institutions’ self-assessment of their degree of compliance with ILAAP requirements and current need for action based on the ILAAP framework. We also focused on the target funding mix and an expansion of funding products as well as the design of funds transfer pricing.

In addition, we queried the level of satisfaction with the respondents’ current system landscapes, the use of “new” technologies, and specific use cases for digitalization technologies.

The key findings of the study are presented and explained below, differentiated according to the following topics: liquidity reporting (Pillar 1), ILAAP (Pillar 2), and IT organization.

Liquidity reporting (Pillar 1) | Key study finding

Around three quarters of the institutions surveyed stated that their predominant challenge in liquidity reporting at the time of the survey was the implementation of the NSFR in accordance with CRR II, whose first mandatory reporting date was June 30, 2021.

Further liquidity reporting requirements, such as the LCR, AMM, asset encumbrance, and funding plans, were cited as further challenges. In this context, the institutions generally work on functional enhancements and the further automation of reporting processes.

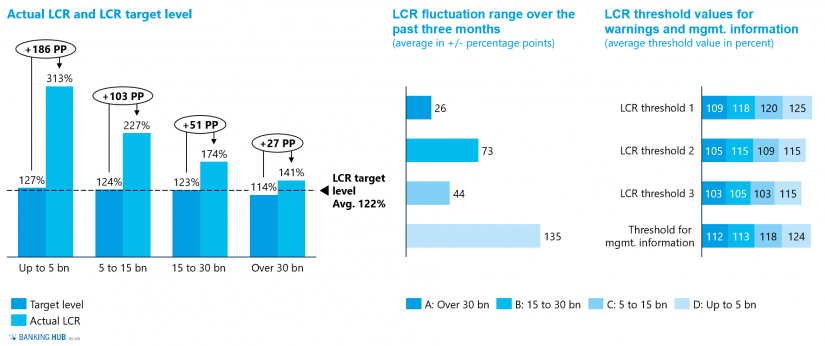

Many institutions still need to establish or strengthen their proactive KPI management with regard to the LCR and NSFR and integrate it into their integrated performance and risk management. For instance, the institutions surveyed significantly missed of their self-imposed LCR target level. Particularly in the case of smaller institutions – measured in terms of total assets – we have observed a large discrepancy between the LCR target level and the actual LCR.

Some of the small to medium-sized institutions in particular have extreme fluctuations in the LCR. Almost all institutions have implemented early warning thresholds. Furthermore, 80% of the institutions surveyed have integrated a warning threshold into their processes for management information purposes.

It is evident that active LCR management geared to a target level still poses a major challenge for many institutions. Extremely high LCR ratios imply significant opportunity costs and negative P&L effects that could be avoided by actively orienting LCR management toward a target level.

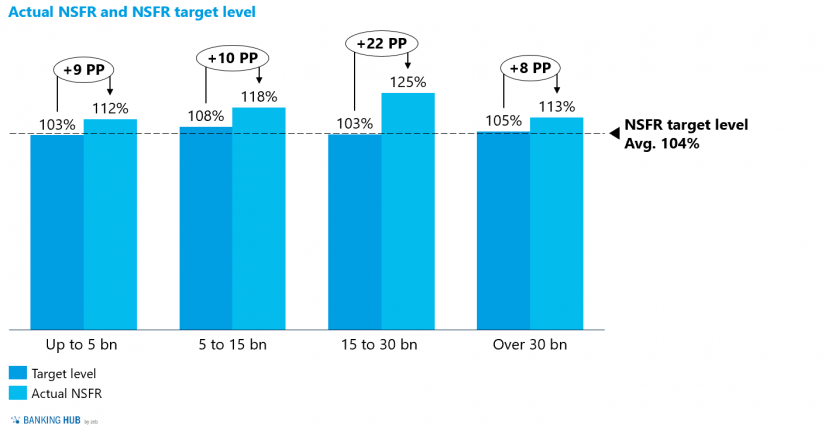

Compared with the LCR situation, the institutions only significantly missed of their self-imposed NSFR target level. Around 85% of the institutions surveyed state that in addition to current NSFR reporting they also perform corresponding calculations.

Across all institution size classes, we observe that the NSFR target level is achieved much better than the LCR target level. At the time of the survey, none of the surveyed institutions fell below their self-imposed NSFR target level. We found the highest deviations among medium-sized institutions. On average, the NSFR is 15% above the target level. Compared to the LCR, the current NSFR ratios thus do not deviate significantly from the targets.

On the one hand, institutions must continue to address the implementation of regulatory requirements, with the main focus being on the NSFR. On the other hand, they must drive forward the integration and optimization of both Pillar 1 liquidity ratios – LCR and NSFR. The LCR in particular reveals optimization potential due to the very high ratios on average.

We’d be happy to present the results of our study to you in person.

ILAAP (Pillar 2) | Key study findings

Around 80% of institutions with total assets of more than EUR 30 billion have been subject to a liquidity audit by the supervisory authority in the past two years. By contrast, the supervisory audit rate across all other size classes is still low at 20%. We therefore expect an intensification of regulatory audit activities, with a slight delay, also for small and medium-sized institutions, especially in Germany.

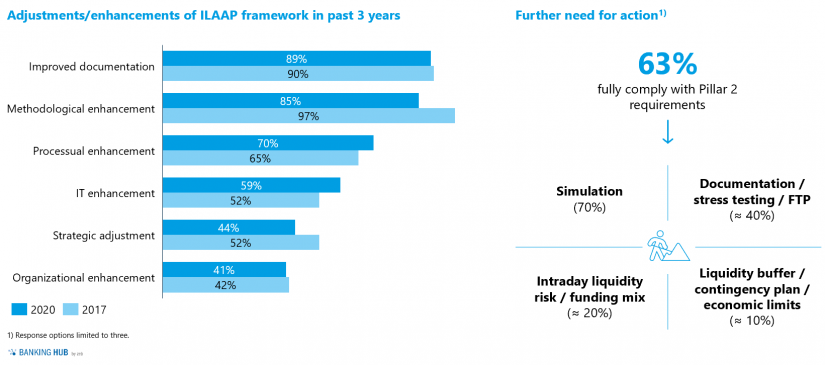

Without exception, all institutions surveyed have continuously developed their ILAAP frameworks over the past three years. Especially the improvement of the documentation as well as methodological extensions were driven forward. The current study result regarding ILAAP adjustments and enhancements hardly differs from the results of the 2017 zeb.liquidity study.

While 63% of the institutions surveyed consider the ILAAP requirements to be fully met, all of the institutions surveyed see a need for concrete action, 70% of which in the area of simulation capability and 40% in the areas of documentation, stress testing and FTP. Other areas requiring action, such as intraday liquidity, funding mix, liquidity buffer, contingency plan and economic limits, were only mentioned in isolated cases.

Furthermore, the participating institutions were asked about the ILAAP focus topics of simulation capability, funding mix and FTP. The key findings for each of these three topics are presented below.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Simulation capability

Against the backdrop of adequate and optimized liquidity risk management, all institutions regard the issue of simulation capability as particularly important. The majority of the institutions surveyed are aiming for an automated solution that is able to simulate key liquidity ratios, such as the LCR, NSFR and the survival period. The coronavirus pandemic also highlights the importance of simulation tools to rapidly conduct impact analyses.

The widespread use of Excel solutions for simulation and forecasting supports the assumption that, at present, manual processes still largely prevail in the context of simulations. zeb’s experience confirms that an integrated view is particularly important when implementing an automated simulation solution. It therefore doesn’t suffice to purely focus on liquidity ratios; all major KPIs of the bank as a whole and their influencing factors require equal consideration. Only then it is possible to sufficiently include interdependencies in the simulation, taking into account business, customer and market developments.

Funding mix

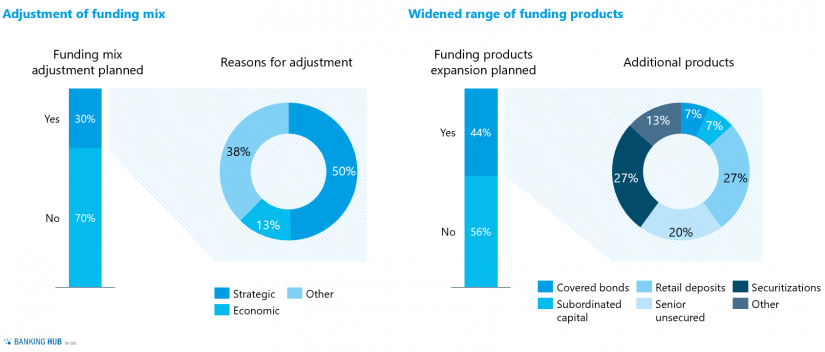

Around one third of the institutions surveyed are planning to adjust their funding mix. The main reasons for the planned adjustments are strategic considerations in terms of greater diversification of funding and higher flexibility. Almost half of the institutions surveyed are striving to expand their funding products. The focus of the planned expansions is on securitizations and retail deposits in particular – followed by senior unsecured funding.

During the personal presentation of the study results at the participating institutions, the topic of “green funding” received increased attention. A large number of banks already actively address this topic and are either planning to issue ESG bonds or to refinance through “green deposits”, i.e. deposits used to support the ecological and sustainable development of the economy and to combat climate change. Against the backdrop of the current sustainability drive, we believe that every bank will also have to actively position itself on the “green funding” topic in order to do justice to this game changer.

Funds transfer pricing

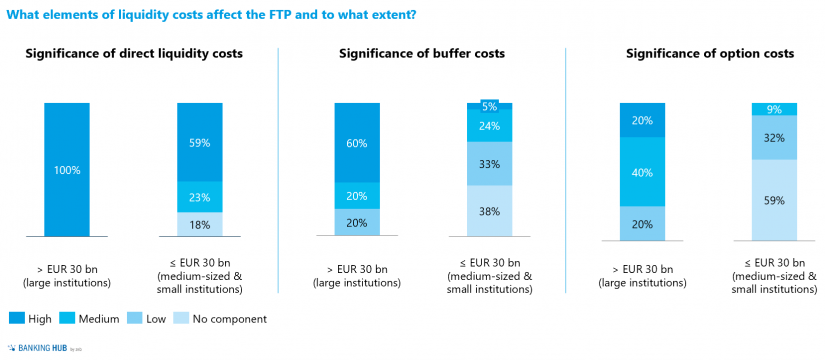

Large institutions with total assets of EUR 30 billion or more (100%) and small and medium-sized institutions with total assets of less than EUR 30 billion (around 59%) consider direct liquidity costs to be a key component of FTP. As expected, the consideration of indirect liquidity costs in FTP has a considerably higher significance for large institutions than for small and medium-sized ones. Buffer and option costs are only of major relevance for large institutions, while they are of medium or low importance, if at all, for small and medium-sized institutions. 59% of the institutions surveyed do not consider option costs to be a significant component of their FTP.

We could not identify a uniform approach to the use of the funding curve. Around one third of the large institutions use a mixture of secured and unsecured funding curves. Small and medium-sized institutions show a tendency toward unsecured funding curves. All large institutions (100%) but only a few small and medium-sized ones (around 11%) explicitly include “flooring costs” from negative interest rates in their FTP.

A majority of institutions (63%) do not consider the impact of regulatory ratios (LCR, NSFR, MREL) in the context of the FTP; instead, they view the FTP purely in economic terms. Of all regulatory ratios included, the LCR accounts for the largest share of the FTP (89% in total). The Interest Rate Benchmark Reform (e.g. Ester) only leads to significant adjustment needs for a small share of large banks (20%). At the time of the survey, the majority of small and medium-sized banks (around 64%) were still analyzing their need for adjustments.

IT organization | key study findings

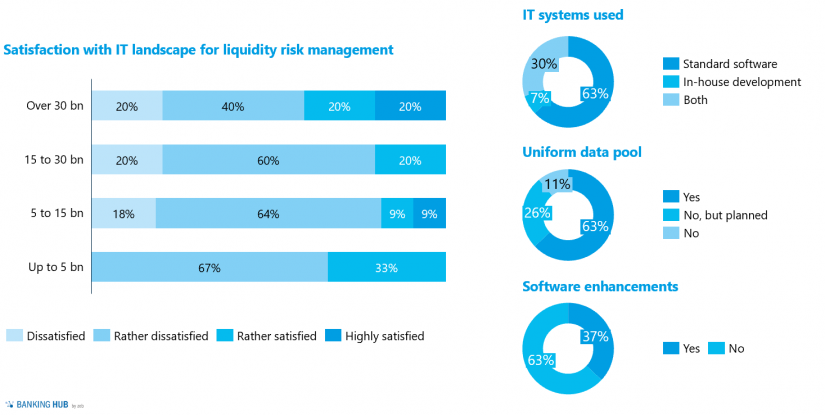

The majority of the institutions surveyed are dissatisfied or rather dissatisfied with their current IT landscape for liquidity risk management. Standard software clearly prevails over purely in-house developments. Around 63% of the institutions surveyed stated that they currently use standard software. A further 7%, on the other hand, have developed their own software, and 30% use a combination of standard software and in-house developments. 63% of the institutions participating in the study already have a uniform data pool for Pillar 1 and Pillar 2 requirements at their disposal. A further 26% of the institutions intend to implement a uniform data pool. Around one third of the institutions also plan to introduce a new standard software solution for liquidity risk management.

Although around 75% of banks have identified specific use cases for new digitalization technologies in the context of liquidity risk management, only 10% of the institutions surveyed currently use new technologies, such as advanced analytics, machine learning or robotic process automation. The institutions surveyed showed great interest and most have already launched initiatives, but are currently still at the early stages of their digitalization initiatives.

Their current focus is still on traditional IT topics and processes. For most institutions, concrete use cases are the automation of reporting and simulation or forecast calculation. In addition, around a third of the institutions surveyed anticipate further use cases in the context of data management, cash flow modeling and the automation of other processes. All institutions recognize and confirm the important competitive factor of building up expertise in digitalization topics at an early stage.

Conclusion on the overview of the latest developments in liquidity risk management

The zeb.liquidity study reveals that, in recent years, institutions have been able to continuously and successfully develop their liquidity risk management. Nonetheless, they still face challenges which, in our view, also offer opportunities – as outlined below.

ILAAP check-up

In order to achieve detailed transparency on the strengths and weaknesses of the liquidity framework, institutions should regularly conduct an ILAAP check-up. This is a useful self-assessment tool, which also supports the structured further development of the framework and the preparation for possible regulatory audits. We expect increasing ILAAP audit activities, especially at the smaller and medium-sized institutions in Germany, which underlines the urgency of an ILAAP check-up.

KPI management

LCR ratios with continued high deviations from the target levels imply significant optimization potential. In addition to analyzing and implementing optimization levers, the LCR and NSFR must be checked for “dormant” potential. The introduction of standardized forecast calculations can ensure short-term LCR and NSFR adjustments.

Simulation capability

An ever-tightening political, economic and regulatory environment requires all institutions to have comprehensive scenario/simulation capabilities. Rapid analysis capabilities and the coordinated adoption of appropriate measures are essential to remain competitive or even gain a competitive advantage. Cross-divisional implementation helps to leverage synergies and establish an integrated view of management KPIs (risk, balance sheet and P&L). Increasing the degree of automation positively influences the cost efficiency of the simulation capability.

Digitalization

The development of partially or highly automated liquidity risk management with a focus on fully automated data provision, validation and reporting is a decisive competitive factor for all institutions. In this context, it is advisable to use integrated and harmonized models as well as methods in order to avoid the need for manual interventions as far as possible. AI-supported modeling of cash flows, including prepayments and termination behavior, as well as AI-supported decision-making processes, can lead to lasting improvements in liquidity risk management and the institutions’ cost situation.

We’d be happy to present the results of our study to you in person. Contact us now here.