Do decentralized financial applications serve as a testing ground for innovative concepts?

Decentralized financial applications (dApps) have steadily gained importance in recent years. While some innovations from the decentralized finance (DeFi) sector – such as the Metaverse and NFTs – still fall short of expectations, others have become firmly established in the DeFi space, including liquidity pools (LPs) and AMMs.

These tightly interwoven concepts allow digital assets to be traded without the need for centralized intermediaries such as traditional exchanges or brokers – a use case for the regulated crypto market?

Over the past decade, decentralized assets – including the cryptocurrency Bitcoin – have moved from a niche existence into the spotlight of the global financial industry, attracting billions in investment.

Decentralized finance enables the creation of services for decentralized assets, developed by both regulated financial institutions and decentralized organizations (DAOs). In recent years, the European market has seen successful DeFi concepts brought under regulatory frameworks by lawmakers, which has further accelerated the adoption of related services and assets.

Regulatory authorities and financial institutions continue to evaluate promising DeFi models to harness their potential for a comprehensive digital asset ecosystem. Examples include the tokenization of assets, the custody of digital assets and payments via stablecoins, all of which are now covered under the MiCA regulation. In addition, the DLT Pilot Regime is paving the way for trading on distributed ledger market infrastructures.

How do liquidity pools and AMMs work together to enable automated trading?

In traditional capital markets, liquidity on the stock exchanges is primarily provided by private investors, institutional investors and market makers – often banks or trading firms. Exchanges aim to maintain a well-populated order book with numerous buy and sell orders to ensure sufficient liquidity and execute trades with minimal spreads.

In the DeFi sector, liquidity is continuously provided through liquidity pools. Put simply, a liquidity pool is a programmable reserve of digital assets that, from an infrastructure perspective, enables automated and decentralized trading.

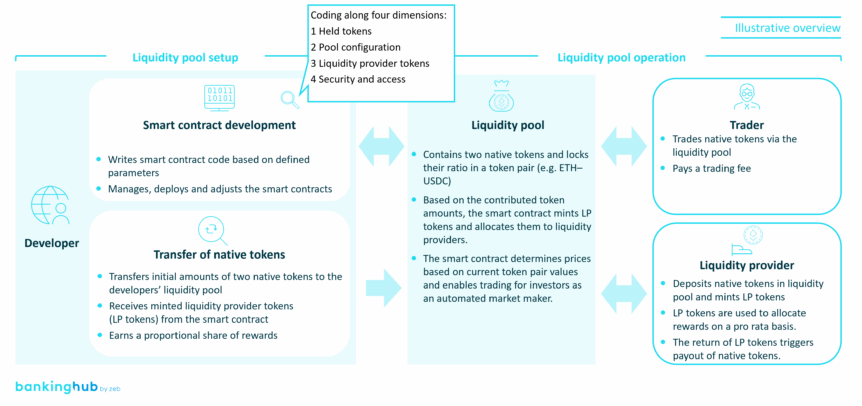

Technically speaking, liquidity pools are implemented as smart contracts that define a set of rules: they determine the conditions under which market participants can provide liquidity and how they are compensated for doing so. Any investor who holds digital assets and has access to distributed ledger technology (DLT), such as a blockchain like Ethereum, can act as a liquidity provider and participate in what is known as liquidity mining.

Decentralized trading – including price determination and trade settlement – is carried out by an algorithm known as an automated market maker. The AMM determines prices based on the available liquidity in the pool and automatically executes transactions against that liquidity. Trading fees paid by buyers or sellers for using the AMM are distributed to the liquidity providers via the smart contract. This illustrates a key point: liquidity pools and automated market makers are directly interconnected. Together, they form new trading structures in capital markets that operate without centralized intermediaries while efficiently providing liquidity.

Providers of liquidity pools and decentralized AMM trading platforms in the DeFi sector include Uniswap, PancakeSwap and Curve. Their smart contract frameworks are typically available as open-source software. As a result, there are few barriers to setting up a liquidity pool with an AMM. However, this openness also introduces potential risks – such as the possibility of misuse for illegal activities.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

What are the opportunities and risks of liquidity pools and AMMs?

The interaction between liquidity pools and automated market makers offers a wide range of opportunities for various market participants. However, as previously mentioned, it also entails shared risks.

Opportunities

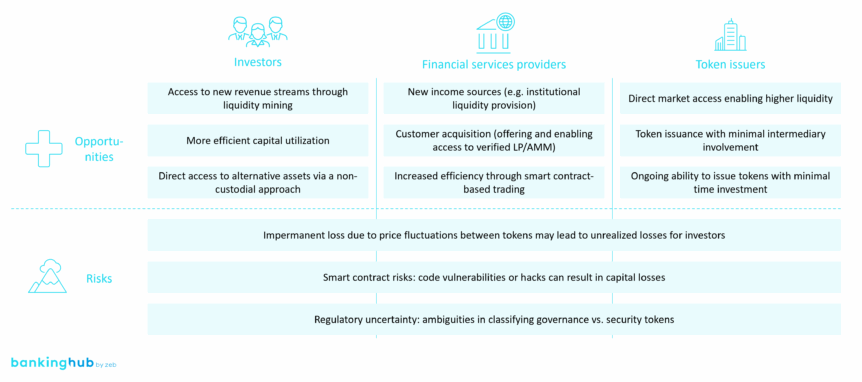

In the context of liquidity pools and AMMs, the following opportunities arise for investors, financial services providers and issuers:

- Investors can unlock additional sources of income by allocating their existing digital assets to liquidity pools or by contributing new capital. In return, they earn yields from trading fees or incentives distributed through the pool. This leads to more efficient capital utilization within their portfolios.

- Financial services providers and banks can take on various roles:

- Technical liquidity pool providers: They can enable their clients to contribute digital assets to liquidity pools – for example, as part of a technical service offering. This may be particularly relevant for institutions already offering crypto custody solutions for investors.

- Liquidity pool operators: They can establish and manage their own liquidity pools in compliance with regulatory and anti-money laundering (AML) requirements. This creates a secure environment for investors and allows institutions to generate additional revenue through fee-based pool management.

- Liquidity providers: In a mature and regulated environment, institutions can act as liquidity providers themselves, earning returns on their digital asset holdings. This requires the institution to invest directly in digital assets.

- Issuers can use liquidity pools to bring their tokens to market more quickly and gain greater visibility among potential investors through direct listings. This can enhance liquidity, increase the attractiveness of the assets and attract additional investors. Moreover, the process involves minimal reliance on intermediaries – or in some cases, none at all.

Risks

Liquidity pools and AMMs present several risks that affect all market participants:

- Impermanent loss: This term refers to potential unrealized losses that occur when the prices of tokens in a liquidity pool fluctuate significantly. As a result, liquidity providers may withdraw their funds at a lower value than if they had simply held the tokens. This risk increases as market volatility rises.

- Cyberattacks: Liquidity pools operate through smart contracts, which may be vulnerable to hacks or technical flaws. Exploits, phishing attacks or other forms of manipulation can result in the theft or diversion of capital from liquidity pools.

- Regulatory ambiguity: As outlined in our detailed glossary entries on liquidity pools and AMMs, current regulations in this area lack clarity. Liquidity pools and AMMs are not yet subject to explicit regulatory frameworks, which leads to uncertainty among investors, financial institutions and issuers. Future legislation may either support the use of these technologies or impose significant restrictions.

What disruptive potentials does DeFi hold for traditional capital markets?

Recent market trends suggest that liquidity pools and AMMs have not yet gained traction in the traditional financial sector. Only a small number of regulated financial institutions currently offer innovative services related to these technologies.

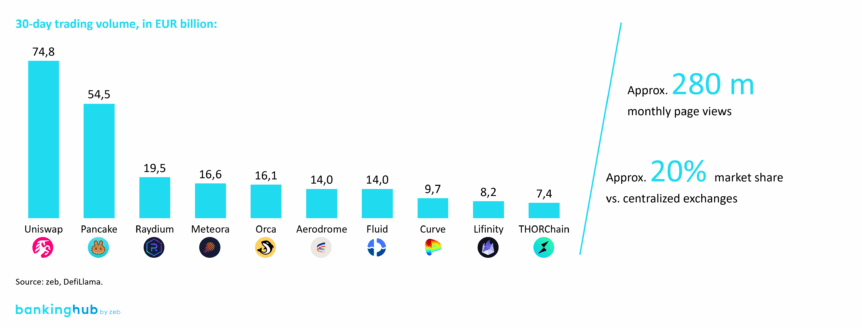

However, developments in the digital asset market show that unregulated, decentralized trading platforms already account for up to 25% of total crypto trading volume. This momentum highlights the need for traditional capital markets – and regulatory bodies – to engage more deeply with the opportunities and challenges presented by DeFi.

Figure 3: Top 10 decentralized exchanges ranked by 30-day trading volume February to March 2025, in EUR billion

Figure 3: Top 10 decentralized exchanges ranked by 30-day trading volume February to March 2025, in EUR billionIn particular, three major disruptive forces are emerging for the traditional capital market.

I) Growing competition from DeFi protocols and hybrid trading models

Technology firms and digital asset start-ups are using the smart contract logic behind liquidity pools and automated market maker algorithms to build compliant and cost-efficient trading platforms. These platforms often integrate centralized and decentralized components, forming hybrid trading structures that enable smart contract-driven market mechanisms.

Lower trading costs and improved efficiency are intensifying competitive pressure on traditional banks and brokers, who now face increasing challenges from new market entrants. Over time, established financial institutions offering digital assets may find themselves compelled to either develop their own hybrid solutions or engage with existing DeFi platforms – especially if these models prove viable for security tokens and crypto securities.

II) Disintermediation and real-time transaction processing

AMM protocols facilitate direct peer-to-peer transactions in real time, challenging the traditional role of banks and brokers as intermediaries and settlement agents. This shift has the potential to fundamentally reshape the business models of established financial institutions. As a result, their focus may increasingly move toward regulatory gatekeeping functions, including:

- Compliance and KYC/AML processes

- Transaction and tax reporting

- Risk management and market surveillance

In the long term, this shift may lead banks and brokers to derive most of their value from regulatory and infrastructure services, rather than traditional trading and brokerage fees.

III) Shifting capital into digital assets and DeFi products

The ability to earn attractive yields by providing liquidity in DeFi protocols is driving increased capital allocation toward digital assets. This trend poses a challenge for traditional banks and brokers, as conventional savings and investment products may lose appeal among certain investor segments.

Private investors, in particular, are showing growing interest in alternative DeFi investment opportunities, further intensifying competition for capital flows.

What measures should regulators and financial institutions take?

The growing relevance of DeFi concepts such as liquidity pools and automated market makers (AMMs) raises important strategic questions for both regulators and financial institutions. According to zeb, early engagement with the topic and the proactive development of expertise and partnerships are essential steps toward effective positioning.

Regulators should focus on establishing clear and consistent rules for liquidity pools and AMMs in close collaboration with financial institutions and tech companies to define a regulatory framework. Key priorities include determining whether existing regulations already apply or whether new frameworks are needed to appropriately govern the use of self-executing smart contracts in trading and settlement processes.

Financial institutions should consider the following steps to define their strategic approach:

- Monitor market developments and identify use cases: Institutions should continuously observe DeFi trends and assess how AMMs and liquidity mining can be applied within capital markets.

- Conduct a preliminary study: Carry out a strategic review, assess the regulatory environment and risks, evaluate sourcing options (make, buy or collaborate) and analyze economic potential, opportunities and technical feasibility.

- Pilot AMM and liquidity mining use cases: Launch pilot projects to test specific applications and prepare the organization – across operations, IT, compliance and governance – for potential implementation.

- Collaborate with DeFi project labs: Financial institutions should establish targeted partnerships with DeFi labs and leading centralized digital asset innovators to explore AMM and liquidity mining applications and build sustainable in-house expertise.

- Leverage white-label solutions with centralized digital asset thought leaders: Utilize technical solutions from centralized thought leaders in the field of digital assets to enhance liquidity and revenue potential through AMM and liquidity mining strategies.