What is the Metaverse?

- Metaverse platforms are continuously gaining popularity, and as virtual ecosystems are changing the way we interact with other people and corportations. There are several examples from the financial services world, but especially from the non-FS world, where companies are actively engaging the Metaverse.

- Within the Metaverse, distributed ledger technology acts as a catalyst, enables additional use cases and changes the understanding of virtual ecosystems. However, DLT-based platforms are just one form, which still has to prove itself.

- The most likely use cases for banks are currently in marketing & education as well as client support – additional use cases depend on further technological development and require, for example, advanced authentication features and corresponding regulatory frameworks.

- Timely engagement with the Metaverse is recommended and allows banks to seize the client interface in virtual worlds at an early stage – thus despite the many challenges ahead, banks should seize the opportunity and start their learning curve now by establishing an initial presence in the Metaverse, acquiring talent and building appropriate technological capabilities.

Relevance and main drivers

Under the umbrella “Metaverse”, virtual worlds are rapidly gaining popularity. Notable signs of this development include Ariana Grande, who gave a live concert in the online video game Fortnite, and footballer Kevin Prince Boateng, who co-hosted his wedding ceremony on a Metaverse platform. Microsoft’s purchase of computer and video game company Activision Blizzard and Nike’s acquisition of Metaverse fashion company RTFKT underline the trend.

Looking at the financial industry, banks such as J.P. Morgan and HSBC have established virtual presences in Decentraland or the Sandbox, respectively. Therefore, for financial institutions that have not engaged it yet, the question arises as to what the Metaverse promises and what impact it will have on interactions between clients and banks as well as subsequent service delivery. In short: when and how should a bank position itself in the Metaverse?

The Metaverse is not yet subject to a narrow definition. Broadly speaking, it stands for an evolved, immersive internet, in which the boundaries between the physical and digital worlds become increasingly blurred as a result of various software and hardware innovations. Consequently, Metaverse platforms are virtual ecosystems for social interaction as well as commercial and leisure activities.

On these platforms, individuals can own digital identities, pay in digital currencies, educate themselves, play online games, trade goods and create their own artifacts or even worlds. As a somewhat simplified but catchy description, Mark Zuckerberg called the Metaverse “the embodied Internet”.

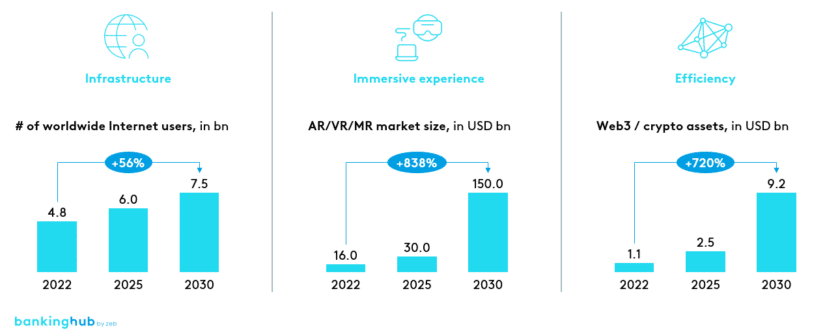

The increasing popularity of Metaverse platforms is based on the global adoption of key technologies that improve both the basic infrastructure and the experience made in such worlds (see Fig. 1). Firstly, with regards to connectivity, the number of Internet users worldwide is increasing. It is estimated to grow by 56% to approximately 7.5 billion by 2030[1].

Secondly, augmented/virtual/mixed reality (AR/VR/MR) technologies are driving immersive experiences for users. This AR/VR/MR market is forecast to grow by over 800% to approximately USD 150 billion by 2030[2], which will simplify entry into virtual worlds.

Finally, supporting technologies such as DLT (distributed ledger technology) and digital assets also increase the efficiency of transactions of capital and data in virtual ecosystems. Web3 / crypto assets are expected to grow by more than 700% to approximately USD 9.2 trillion by 2030[3]. While this growth of DLT and digital assets is not a prerequisite for designing virtual ecosystems, there are a variety of reasons why the future should belong to DLT-based platforms.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Relevance of DLT in the context of Metaverse platforms

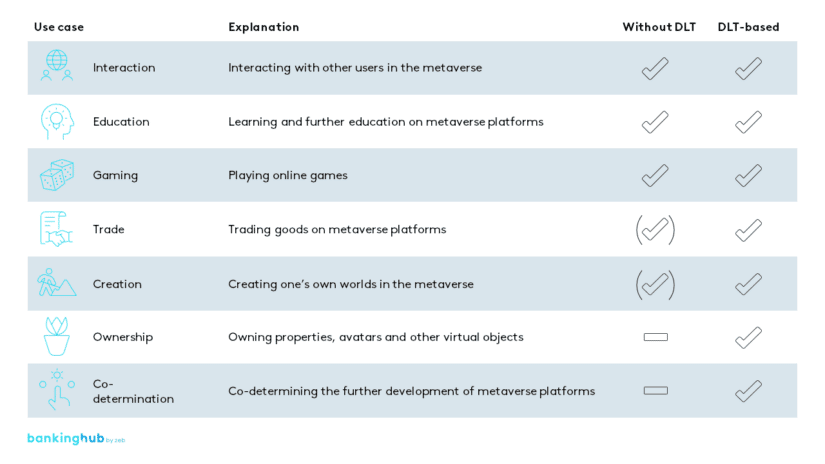

To assess this, it makes sense to look at distributed ledger technology as a distinguishing criterion between platform types. The fundamental decision as to whether to use DLT or not has a massive impact on the way a platform works as well as its possible use cases.

Non-DLT-based, platforms with centralized governance lack the user’s ability to control and enforce ownership in virtual space, as well as the ability for smart contract-driven co-determination of the way ecosystems should evolve.

By contrast, DLT-based ecosystems have the following essential characteristics:

- Governance: Virtual ecosystems based on DLT may be set up as decentralized autonomous organizations (DAOs) and managed by means of governance tokens. Instead of a centralized organization, they can then be controlled by all users according to specified rules. This enables “community-based decisions” regarding the evolution of an ecosystem, which means that “single authorities”, as represented, for example, by Meta or TikTok, become obsolete.

- Ownership: By tokenizing assets and creating non-fungible tokens (NFTs), DLT enables the representation and enforcement of ownership in virtual spaces. As a representation of a virtual asset, NFTs include metadata about the origin, content and ownership of an asset in their smart contracts. This allows virtual land plots, for example, to be uniquely assigned to someone’s wallet address.

- Transaction processing: While centralized ecosystems may also be connected to payment systems, DLT-based transaction processing (data and funds) promises to be more efficient and less expensive. This is especially true for commercial activities in virtual ecosystems.

From a user’s perspective, these benefits have a direct impact, as can be seen in the illustration below.

It is important to note that both platform types benefit from improvements in basic infrastructure technologies as well as technologies that optimize the immersive experience. Although the above-mentioned benefits of DLT-based platforms speak for themselves, non-DLT-based platforms with centralized governance currently are still enjoying a higher adoption rate.

Users of the largest DLT-based platforms such as the Sandbox or Decentraland[4] are currently only in the thousands. In comparison, tens of millions of people use non-DLT-based, centralized platforms such as Fortnite or Minecraft on a daily basis[5].

Nevertheless, for innovative, technology-savvy companies, the promised learning curve still makes it worthwhile to better understand DLT-based platforms and to take initial steps in connection with DLT, digital assets and NFTs.

Initial Metaverse use cases for banks

Growing client interest is forcing companies worldwide to address the Metaverse topic. This is especially true since the Metaverse offers the possibility of positioning oneself very directly with younger client target groups and banks are willing to spend large sums of money to attract precisely these client groups.

While some banks have already taken a pioneering role and established a presence in the Metaverse, many other institutions are still facing four key questions: What is to be achieved with the Metaverse presence? What target clients are to be addressed? Where / on which platforms should a presence be established? How can this be implemented?

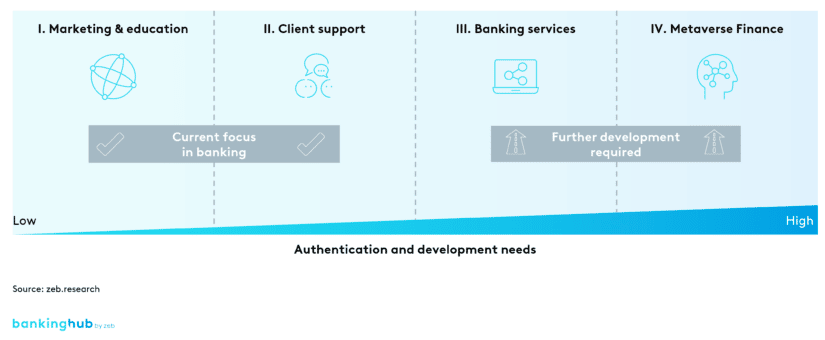

The possible use cases for financial institutions can be roughly divided into four categories:

- Marketing & education

- Client support

- Banking services

- Metaverse Finance (MetaFi)

Hereby, the technological requirements for their service delivery and the required authentication levels increase in that very order.

- Marketing & education: As lowest hanging fruit, financial institutions can pursue marketing-related or educational use cases. For example, events can be offered to activate employees or establish relationships with potential clients. Internal meetings can be held with AR/VR/MR support. Information such as exchange rates and stock prices can be presented. J.P. Morgan has followed this example by holding presentations on cryptocurrencies in their Onyx Lounge.

- Client support: In a second stage, standard queries that do not require client data, e.g. the location of the nearest ATM or branch, can be answered. BNP Paribas, for example, has rolled out a virtual world that allows clients to use VR to talk to bank employees on different continents.

- Banking services: Owing to the current technological possibilities, providing traditional banking services directly to clients is conceivable, but still rather a long way off. In addition to checking balances and transactions in a virtual branch, holding advisory meetings directly in the Metaverse could be an option – given sufficient authentication capabilities and appropriate AR/VR/MR technology. A key requirement here is to convert content from 2D format to 3D format so that clients experience added value in the immersive world.

- Metaverse Finance: Finally, the term Metaverse Finance opens up entirely new business models from which banks can profit. This involves the comprehensive provision of financial services for virtual worlds, including the financing of virtual real estate and other virtual assets as well as the transfer of funds between traditional bank accounts and the Metaverse.

Due to the lack of authentication methods and the aforementioned technological obstacles, it is mainly the use cases in marketing and education, as well as client support that seem realistic. This therefore should also be the current focus of the banking industry. In the long term, the added value offered to clients will be the key success factor for Metaverse presence and services.

So, while the JP Morgan Onyx Lounge in its current state is not sufficient as a Metaverse presence, early investments like this are crucial because it takes a lot of time to build up related knowledge.

Key factors for the adoption of Metaverse platforms

Further adoption of Metaverse platforms depends on user acceptance, technological development and infrastructure, regulatory frameworks and governance. The outlined application areas in the banking industry place clear demands on banks and their clients. Particularly in the context of user acceptance, the question arises as to whether people are even physically prepared at all to expose themselves constantly to the virtual world.

In the area of technology and infrastructure, the need for interoperability solutions between platforms, i.e. standardizations, as well as the further adoption of key technologies for the Metaverse is emerging. For example, faster connections are needed to increase data transfer rates. AR/VR/MR adoption also dictates immersive experiences in the Metaverse.

Moreover, the compatibility of banking platforms with digital assets and low-latency networks[6] are among the requirements on the banks’ side. In terms of processes, an adapted omnichannel strategy is just as important: to provide an attractive user experience and generate quality content, 3D designs, engines and artists are necessary. Bank output must be accessible as 3D-enabled immersive output. In addition to technical skills and platform expertise, banks and users also need the necessary transformation capital – both financially and in terms of personnel – to make the transition.

Last but not least, the legal framework for the Metaverse is still poorly developed. Since clients’ identities are linked to avatars, the key question here is how to regulate the use and monetization of user data. The challenges of Web2, e.g. moderation of content, freedom of expression and data protection, could become even greater in the Metaverse.

Outlook

Despite these key challenges, we see the development of Metaverse platforms moving forward steadily. The way people interact – and also how banks interact with their clients – is changing significantly. The pressure to gradually adapt to this new way of interacting is therefore increasing for financial institutions.

In the Metaverse, it’s important to take the first steps quickly in order to stay on track and address tomorrow’s clients where they want to be. This is true even if many of the factors for functioning Metaverse platforms are currently still in development. For example, while we see the potential benefits of DLT in the context of virtual ecosystems, DLT-based platforms are still at a very early development stage.

As said before, the scope for realistic use cases for banks at this stage are to be identified in the areas of marketing & education and client support.