Climate pathways – requirements for financial institutions

Under the Paris Climate Agreement, nearly 200 countries have committed to limiting the global average temperature increase to well below 2°C – preferably even to 1.5°C – compared to pre-industrial levels. In line with this, the EU aims to achieve climate neutrality by 2050, while Germany has even set the target year to 2045.

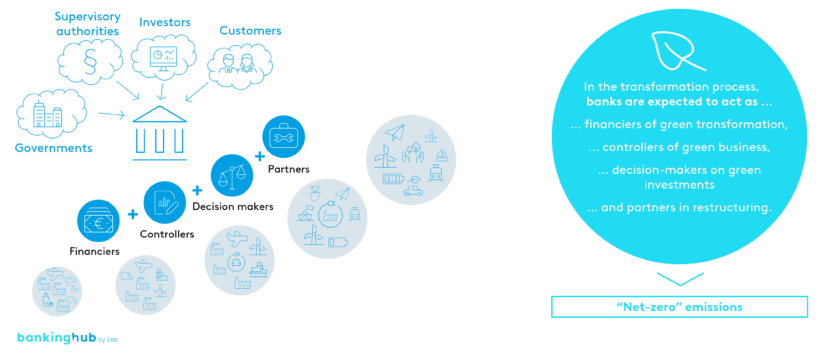

The adoption of these targets marks the first step, but their implementation requires a significant effort involving multiple stakeholders. Recognizing the crucial role of financial institutions as capital allocators, policymakers have acknowledged their key role in ESG transformation and achieving the climate neutrality targets.

One way to guide the banks in their ESG transformation function is to require or expect the formulation of a GHG reduction pathway for existing financed GHG emissions towards “net zero”. Several factors are now driving the development of targets and measures for the consistent reduction of emissions in the customer loan and securities portfolios, including:

- Non-financial reporting: The European Sustainability Reporting Standards (ESRS), which specify the reporting requirements of the CSRD that will apply in the future, mandate reporting on GHG emissions (Scope 1 to Scope 3, including financed emissions in Scope 3 category 15 according to the GHG Protocol) as well as the presentation of specific target pathways and implementation plans for reducing these emissions.

- IFRS – sustainability-related reporting: The new IFRS sustainability standards demand quantitative and qualitative descriptions of climate-related targets. In particular, institutions reporting under IFRS S2 are mandated to accurately document the methods and processes for defining and managing decarbonization targets.

- CRR – Pillar III disclosures: Currently, pursuant to Art. 449a CRR, significant and capital market-oriented institutions must disclose information on ESG risks in the disclosure report. As part of this, they need to disclose metrics that describe the target emission intensities of key sectors compared to the science-based targets of the International Energy Agency (IEA) for each reporting year. In the future, CRR III should also include smaller institutions in similar disclosure requirements.

- Risk management: European expectations, reflected in the ECB’s Guide on climate-related and environmental risks[1] and Good Practices[2] aim to steer financed GHG emissions towards “net zero”. Implicitly mandated by the 7th MaRisk amendment, the reduction of financed GHG emissions serves as a risk management strategy to mitigate transition risks within the loan portfolio and the bank’s proprietary trading account. As part of CRD VI, banks are also obliged to develop transition plans for risk assessment.

- Supervisory authority: The recently published Sustainable Finance Strategy provides clarity on BaFin’s role and its intention to intensify its scrutiny of environmental risk disclosures. The supervisory authority focuses in particular on processes related to identifying, measuring and managing environmental risks, as well as reviewing transition plans such as decarbonization pathways.

- Rating agencies: ESG rating providers regularly assess the presence of a science-based Scope 3 target pathway towards “net zero” in order to take transition risk mitigation efforts into account.

- Other stakeholders: Customers, employees, NGOs and the public increasingly expect banks to actively contribute to achieving climate neutrality. This expectation extends not only to the bank’s own operations but also to the assets it finances. Consequently, a science-based climate pathway becomes a competitive advantage, while the absence of such a pathway poses reputational risks.

European banks are thus required to gradually establish decarbonization targets for the portfolios they finance. Specific measures pertaining to the portfolio and aimed at reducing financed emissions must be defined, monitored and reported, with responsibility for achieving these targets embedded in corporate governance.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

From goal to implementation: best-practice approaches for developing pathways to achieve climate targets

The market has seen the emergence of various approaches to formulating decarbonization targets. This heterogeneity is generally unproblematic, provided that the determination of a climate pathway is grounded in scientific principles, e.g. taking into account the research findings of reputable organizations such as the Intergovernmental Panel on Climate Change (IPCC[3]) or the International Energy Agency (IEA).

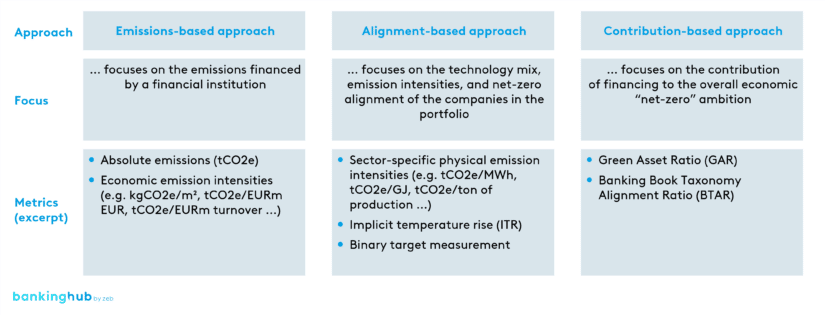

- A commonly employed strategy involves adopting an emissions-based approach, where institutions focus on the measurement and monitoring of absolute and relative emissions. The benefit of this approach is that it directly “processes” the emissions calculated in carbon accounting (including financed emissions according to the PCAF[4]).

- Another approach is the alignment-based approach. Basically, this involves assessing the degree to which the financed portfolio aligns with science-based targets. For instance, this includes evaluating whether the energy mix or emissions intensity of the financed portfolio corresponds to the requirements outlined in science-based scenarios. Additionally, it is possible to verify the projected temperature increase associated with the financed portfolio based on the net-zero commitments of individual customers (currently applicable to selected large customers rather than small/medium-sized ones).

- Furthermore, it is worth mentioning the emerging contribution-based approach, which focuses on evaluating a portfolio’s contribution to global targets using key sustainability metrics such as the Green Asset Ratio (GAR) or the Banking Book Taxonomy Alignment Ratio (BTAR).

Typical challenges in formulating climate paths

The following selection of questions addresses key challenges observed in current implementation practice and highlights important considerations when planning and implementing GHG reduction pathways.

What is the relationship between “net-zero” planning and strategy?

The planning of reduction targets for financed emissions and the overall strategy of an institution are closely intertwined. It is crucial for an institution to determine its commitment to being a consistent financier of environmental transition or whether it may even choose to refrain from particularly GHG-intensive business activities. Committing to net zero is primarily a strategic decision derived from the institution’s business and sustainability goals. The concrete planning of measures to achieve this goal necessitates specifying strategic objectives, which must be defined in collaboration with the strategic and market units and consistently integrated into the business and sustainability strategy.

Financial institutions can adopt varying levels of ambition when it comes to defining targets and strategic positioning, ranging from positioning themselves as particularly ambitious sustainable institutions (pioneer role) to passively financing the economy without specific ambition (representing the economic situation).

Which climate scenario should be chosen for setting emission reduction targets?

Selecting the appropriate climate scenario is essential for determining the reduction pathway. Current banking practice commonly utilizes data from the Intergovernmental Panel on Climate Change (IPCC) or the International Energy Agency (IEA). Both organizations provide science-based emission reduction pathways to limit global warming to 1.5°C. However, the IEA’s ambition for emission reduction is higher than that of the IPCC, resulting in a more ambitious and steeper emission reduction curve.

Ensuring the transferability of science-based scenarios is crucial: deviations of emission intensities of key sectors from the IEA scenario must be reported in the Pillar III disclosure report. Therefore, if an institution has set targets based on the IPCC scenario and operates accordingly, the deltas between the two targets need to be measured and explained.

What granularity and time ambition are relevant for defining target paths?

Financial institutions face a crucial decision regarding the level and time frame for achieving emission reductions. Planning can be carried out at the overall level of the customer loan and securities portfolio, or it can be more specific, focusing on certain sub-portfolios, customer groups or asset classes. In general, pathway planning should be performed at various levels of aggregation, considering relevant sub-portfolios individually in addition to the bank as a whole. Sub-portfolios with the greatest potential to reduce emissions can be identified as significant.

Reduction targets should be planned for both the medium term (up to 2030) and the long term (up to 2045/2050).

What role do negative emissions play in pathway planning?

Achieving climate neutrality requires a combination of two levers: significant reductions in GHG emissions and the utilization of negative emissions. Negative emissions encompass both natural and technological solutions. Natural sinks like peatlands or forests have the capacity to absorb GHG emissions and store them in the soil. Technologies such as CO2 separation systems that utilize the separated CO2 in the production of fuels or other products (known as CCU technology[5]) also contribute to negative emissions.

When making decisions regarding (future) investments in negative emissions and their incorporation into the climate pathway, it is important to note that negative emissions are not well-suited for achieving short- and medium-term targets due to the current lack of mature technologies and clear methodological specifications for measuring negative emissions[6].

Furthermore, financial institutions face operational challenges related to data quality in emissions calculations, the coverage of Scope 1 and 2, or Scope 1 to 3 emissions, and the selection of the “right” methodologies and tools for implementing a science-based climate pathway.

On the way to climate neutrality: conclusion and outlook

In summary, financial institutions are facing increasing public and regulatory pressure to define compliant decarbonization targets, implement appropriate reduction measures and consistently monitor and manage them. When formulating a suitable reduction pathway for financed GHG emissions, it is advisable to consider various methodological specifics, strategic considerations and implementation challenges and to take a holistic approach to their implementation.

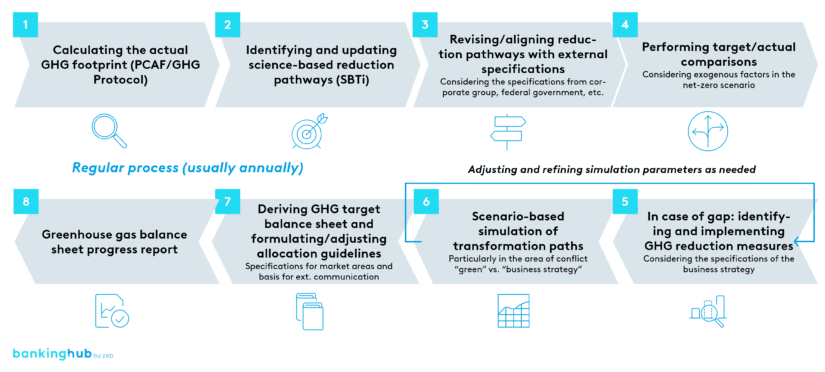

It is generally recommended to systematize the measurement of emissions and GHG reduction paths, develop reduction measures and consistently monitor emission reductions as part of a regular process. The individual steps should then be recorded in process model, tailored to the respective business model. It should also include a continuous analysis of actual emissions against targets, preferably on an annual basis, to ensure effective control and performance measurement.