There is no way around diversity

Almost all industries are complaining about the ongoing shortage of (skilled) workers. In another article, we did the math and showed that by 2030, banks and insurance companies in particular will lose over 30% of their employees due to retirement alone.[1] Even today, almost all institutions are already reporting long vacancy periods and declining application numbers. It’s getting ever more difficult for them to ensure the staffing levels necessary to remain fully operational. However, their current problems are merely a foretaste of what will follow in the coming years.

As a consequence, companies in the financial services industry will be virtually forced to fully tap the potential of the labor market in order to meet their existing and emerging needs. In other words: banks and insurance companies must be attractive employers for all people and can no longer afford to ignore or even exclude entire groups.

In addition, successful employee retention is becoming ever more relevant – good employees have almost free choice on the labor market so that remuneration is often becoming a mere hygiene factor. More importantly, employers should strive to offer an attractive overall package including a pleasant working environment. To this end, they ought to not only ensure personal development opportunities, but also create a professional home that invites all employees to stay by meeting their expectations in terms of culture and atmosphere.

Customers, too, are becoming increasingly aware of diversity. In a 2023 study, the majority of respondents stated that they attach great importance to companies promoting diversity and inclusion. A third would even consider boycotting companies that they find to come short in that regard.[2] These factors have a considerable impact on purchasing decisions and shouldn’t be ignored, especially at a time when regional banks in particular are faced with the question of how to attract and retain young customers. Moreover, regional banks find themselves in another area of conflict. A key way for them to stand out against their competition is to assume regional and social responsibility, e.g. through sponsoring activities. However, the question arises as to how credible such measures are if the institutions implementing them do not also take account of social developments in their own internal structures.

All of this would be reason enough to attach greater importance to the topic of diversity. However, legislators are even adding to this with ever stricter sustainability (i.e. ESG) requirements. The EU’s new Corporate Sustainability Reporting Directive (CSRD) requires companies to disclose, among other things, their activities and positioning in terms of diversity.

Moreover, the German General Act on Equal Treatment (Allgemeines Gleichbehandlungsgesetz, AGG), which, among other things, prohibits discrimination in the workplace and holds companies accountable for any violations, has turned 18 this year. In particular due to the prevailing reversal of the burden of proof in specific cases of suspicion, companies are well advised to do everything in their power to effectively counteract discrimination. In practice, however, many companies do not even fulfill the training duty stipulated in Section 12 (2) AGG at all, or only to a rudimentary extent.

It can be assumed that the additional requirements set out in the currently pending amendment to the AGG, which the German federal government agreed on in its coalition agreement, will close existing gaps in protection against discrimination.

All of this should be sufficient reason for companies to seriously revisit the topic of diversity. A study by the Allbright Foundation from 2023 gives us a good impression of the status quo. It shows that although the proportion of women in board positions at listed companies in Germany has increased in recent years, 82.6% of board positions are still held by men. It can be assumed that a dedicated analysis of regional banks would paint a comparable picture.

But even more alarmingly, at the current rate it would take over 200 years to achieve gender parity.[3] In this context, diverse management boards appear to be nothing but a pipe dream, even more so considering that diversity encompasses much more than gender equality. However, if one thing is clear, it is that banks and insurance companies can no longer afford to ignore the topic of diversity. The interplay of the labor market situation and employee, customer as well as regulatory requirements makes the active promotion of diversity an economic necessity.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Diversity has more to it than promoting women and colorful logos

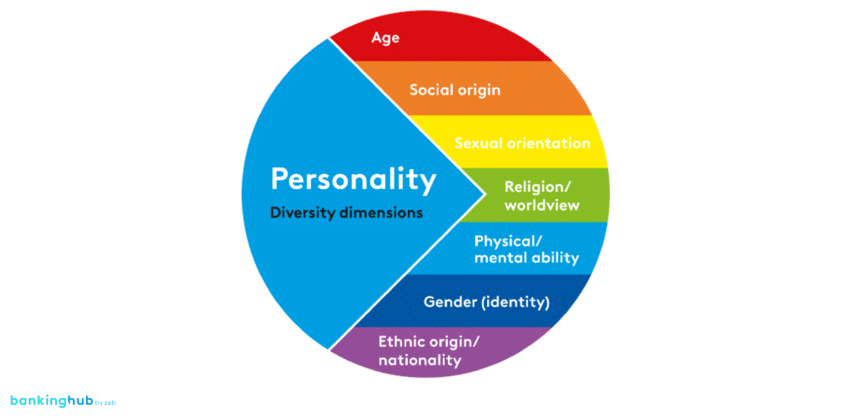

When we say that there’s more to diversity than promoting gender equality, you may ask yourselves what else it entails. The Diversity Charter, an initiative to promote an appreciative working environment free of prejudice, defines seven core dimensions of diversity that reflect the individual personalities of different people (see the illustration below).[4]

Even if, against the backdrop of generational shift, financial services companies put ever more focus on the diversity dimension of age, there are still glaring gaps when it comes to the other dimensions.

In this multi-dimensional context, the controlled and targeted promotion of diversity is often referred to as “diversity management”. This term reflects a holistic perspective on diversity that encompasses the entirety of a company’s strategic and operational activities aimed at creating a working environment that ensures the participation and inclusion of all of its employees.

In order to achieve a successful diversity management, companies need to analyze their own corporate culture, scrutinize their internal and external processes, focus on the individuality of their employees and understand it as an asset, especially when it comes to HR matters. Seriously promoting diversity therefore involves a considerable amount of effort.

However, mere lip service and “pinkwashing” do more harm than good. In the worst case, such practices can result in a significant loss of credibility and authenticity, which may not only weaken a company’s position in the war for talent, but also undermine the loyalty and trust of its existing workforce.

Promoting diversity is more of a marathon than a sprint

The impression could arise that companies can overcome all these challenges by simply allocating some of their capacities to diversity management in order to deal with any issues that might come up. However, such an isolated approach has proven to be less effective in practice.

The strategic relevance of promoting diversity must be recognized and anchored in the overall corporate strategy or even a designated diversity strategy. This is the first step towards drawing the necessary attention of board members and executives to the topic. It is also important for companies to define concrete goals and carry out status quo analyses in order to derive measures that help them achieve their goals. By defining suitable key figures and analyzing them on a regular basis, they can keep track of their own progress.

Ultimately, they should aim to educate and empower the entire organization at all levels in order to bring about lasting change. Top management should assume responsibility for the success or failure of the corresponding activities. Other success factors include a holistic approach, a serious commitment to tackling the issue and an overall openness. The latter can only be achieved by reflecting on one’s own internalized biases and stereotypes.

Although the promotion of diversity appears to be a highly complex issue, there is no single right or wrong answer to many questions. Instead, one has to keep in mind that the comprehensive promotion of diversity is a long road on which mistakes can – and probably will – happen. Nonetheless, the best approach is to simply get going and start shaping the path together with the entire organization.

![Thede Küntzel, Manager Projects & Innovation at Sparkasse Bremen and Managing Director of ÜberseeHub GmbH.]](https://www.bankinghub.eu/wp-content/uploads/2023/04/thede-kuentzel-bankinghub-768x549.jpg)