Change—customers, digital markets and the building society of the future

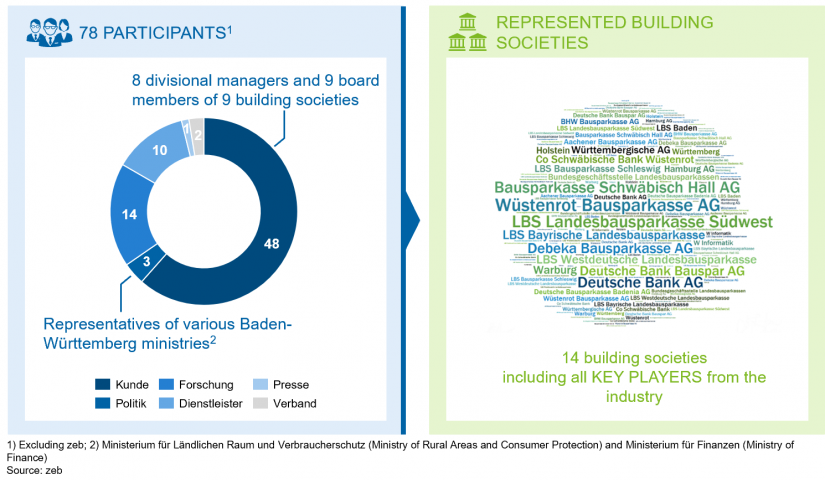

Once again, the event enjoyed great popularity among board members, top managers and decision makers of all building societies as well as renowned professors and well-known associations and ministry representatives (Figure 1). This proves that the symposium is very well received within the industry and has become a fixed date in the calendar.

This year’s program with the claim “Change—customers, digital markets and the building society of the future”, was divided into three sub-topics. First the academic field, followed by talks on IT at building societies. Finally, the program was completed by presentations from well-known building society directors with real-life reports.

Financial systems and building societies

Professor Dr. Burghof (University of Hohenheim), Prof. Dr. Stefan Kirmße (zeb) and Dr. Marc Mehlhorn (Stuttgart Financial) opened the event, followed by David Zimmermann from the University of Witten/Herdecke, who commenced the academic part. He lectured on Financial systems and building societies—a theory-driven empirical analysis.

Mr. Zimmermann advanced the argument that building society contracts counterbalance the credit volume in real estate markets as a result of anti-cyclical incentives[1] and therefore stabilize the bank-oriented financial system in Germany.

This chain of reasoning, however, is based on the assumption that unexpected periods of low and high interest rates alternate regularly, which no longer seems to be the case today. As a result, the building societies’ business model is expected to change: in the future, they are likely to increasingly offer classical standardized mortgages instead of their traditional building-society savings contracts.

Thus, the macroeconomic stability effects of the building societies on the financial system could be reduced. This change particularly affects the opportunities of lower and lowest income households to participate in society, as they are burdened with greater risks than before.[2] Against the background of the effects on wealth distribution in the sense of owner-occupied real estate among the population, this development should be kept in mind.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Platform and network economics

In his talk on Platform and network economics and the benefits of ecosystems for building societies, Prof. Dr. Stefan Kirmße (zeb) explained how established market participants can benefit from new business models and what opportunities may arise in this context.

The trend towards a platform and network economy is also evident in mortgages . In 2018, the five largest brokerage platforms accounted for 33% of new business. According to Prof. Kirmße, the customer interface shifts from the bank to the platforms. In the past, building societies focused solely on financing, but competition for customers was won outside this area.

Whoever manages to retain the customer in his digital ecosystem will permanently occupy the customer interface. Depending on their customer reach and competitive advantages, building societies can take different roles on platforms or in ecosystems. One option is to independently develop a platform and to establish a regional ecosystem through one or more institutions. Not only would this serve to defend the customer interface, but at the same time tap the earnings potential associated with real estate, which has so far not been addressed by traditional building society offers.

Discourse on the subject of building society saving

The panel discussion between Prof. Dr. Hans-Peter Burghof and Prof. Dr. Monika Gehde-Trapp (both University of Hohenheim)—moderated by Dr. Bernd Neubacher (Börsen-Zeitung)—developed into an exciting Discourse on the subject of building society saving.

Prof. Burghof countered the capital market theory’s thesis by Prof. Gehde-Trapp that the cash flows of a building society contract could be replicated with a forward loan and a fund savings plan. According to Prof. Burghof, building society contracts are useful institutional contracts from an information economy point of view because they generate additional information about the building society customers based on their savings behavior.

The two professors, however, agreed on the future prospects of the industry: building societies will only be able to meet the challenges of the low-interest environment by taking a bundle of varied but consistent measures. The supply side will require qualitative expertise in consulting and support in order to become contact partners beyond financing.

At the same time, however, they also identified earnings opportunities in optimizing the investment portfolio on the assets side. Targeted measures to keep costs under control are, however, inevitable.

Housing prices in Germany—when will the turning point come?

Housing prices in Germany—when will the turning point come? was the title of the talk by Prof. Dr. Michael Voigtländer from the Bonn-Rhein-Sieg University of Applied Sciences. Using empirical analyses, he demonstrated that there is currently no speculative bubble on the German real estate market.

A comparison of the development of rents and owner-occupier costs in the German metropolises shows that residential property remains attractive—even in cities such as Frankfurt/Main or Munich. The main drivers for this are low interest rates, and yet the home ownership rate stagnates.

According to Prof. Voigtländer, politicians are required to facilitate access to home ownership. Only a few tenants have sufficient funds to buy their first property. As measures to overcome the lack of capital, he proposes a number of measures, including a reform of the land transfer tax, the introduction of a credit default guarantee for lower-income households, a reduction in transaction costs and the introduction of the “Swiss model” for company pension schemes.

Agility in building societies

Prof. Dr. Joachim Hasebrook from Steinbeis University Berlin gave a talk on Agility in building societies. The following key statement summarizes it best: organizations are not rigid, but fluid and constantly changing.

What was previously seen as a disturbing factor needs to be systematically used as a strength now. According to Professor Hasebrook, agility does not mean acting aimlessly and without planning, but—if implemented correctly—improved risk management and the ability to adapt quickly to a changing environment in complex situations.

However, agility alone is not enough: rather, it is important to find the right individual organizational form for each company. In this context, banks could, for example, learn a lot from industrial companies. In any case, it is important to not impose agility, but to introduce it gradually during a period of at least one year according to project experience with the senior management preceding as a role model.

AI applications and process automation in the building society sector

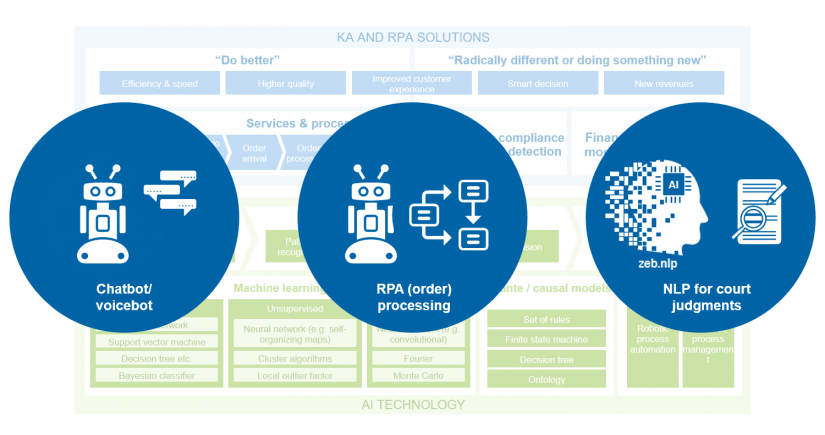

Marco Zimmer and Christian Nusser (both zeb) presented the possibilities of AI applications and process automation in the building society sector with selected use cases. Artificial intelligence and robotic process automation (RPA) are instruments for achieving significant process and cost optimization at building societies.

A live presentation showed a possible use of an intelligent chatbot/voicebot solution in building societies’ customer service aiming at exploiting potential savings in personnel costs and offering 24/7 customer service.

Courage to master major IT changes collectively

Henning Abmeyer (iBS), representing a major software manufacturer in the building society sector, spoke about the Courage to master major IT changes collectively, the goal of creating a modern building society platform based on SAP Banking and the benefits of standard software for the building societies Schwäbisch Hall, Wüstenrot and BHW.

The future standard should enable more efficient (through intuitive user guidance) and automated processes. In addition, its layer architecture should be flexible, its structure modular, and it should offer comprehensive adaptation and expansion options. After go-live in all three building societies, every seventh person living in Germany would then save on their building society savings contract via iBS-BASS (Building Association Software Suite).

Opportunities offered by the cloud

Lars Meinecke from Microsoft spoke on the topic of Opportunities offered by the cloud for building societies. In particular, new market entrants and fintech companies are highly agile and already use the cloud as a competitive advantage. The cloud offers very flexible, highly scalable hardware, software and services to develop a new digital business model for lower total costs of ownership.

The presentation was rounded off by illustrating a cloud-based AI meeting assistant that handles the minutes of a meeting and creates personal to-do lists.

Current challenges, solutions and positive contributions of building saving in the current market environment

Stefan Siebert (CEO of LBS Südwest) was the first to give his speech as part of a series of practice-oriented presentations. In his talk on Current challenges, solutions and positive contributions of building saving in the current market environment, he addressed, among other topics, the cutting-edge issue of climate change.

Social interest in this phenomenon is growing continuously, and building societies could contribute their share, considering that approximately 20% of greenhouse gas emissions per inhabitant can be attributed to electricity and gas consumption. Energy-efficient refurbishments could reduce these emissions by a factor of 24. This would enable building societies, whose core competencies undoubtedly include modernization and granting the corresponding loans, to consolidate their market position and continue to grow as a brand.

Adaptation of business models and regulatory requirements

As part of his talk on the Preparation and implementation of a merger—adaptation of business models and regulatory requirements, Henning Göbel (CEO of BHW Bausparkasse AG) presented the merger project CASA of BHW Bausparkasse AG and DB Bauspar AG.

The project consolidates the collectives of the two building societies and is expected to generate synergies of EUR 25 million from 2022 onwards. Mr. Göbel emphasized three essential aspects for a successful merger.

The first aspect is to leverage (product) efficiencies and economies of scale. Its objective is to harmonize the product variants in order to create uniform distribution channels for both companies. The second aspect aims at creating a uniform, lean organization with regard to management and KPIs. This standardization finally leads to adapting internal standards with a clear focus on retail business.

Strategic transformation, using Bausparkasse Schwäbisch Hall as an example

Mike Kammann (General Manager and Head of Corporate Strategy of Bausparkasse Schwäbisch Hall AG) reported on Strategic transformation, using Bausparkasse Schwäbisch Hall as an example.

In the context of this talk he outlined Bausparkasse Schwäbisch Hall’s vision of becoming a profitable market leader in Building and living topics. To this end, it is necessary to stabilize the building-society saving segment and make it profitable, while at the same time ensuring that the mortgage segment also grows profitably.

Both building blocks can be achieved within the cooperative network. For this purpose, a customer-focused digitalization campaign should focus on three main areas: firstly, the digitalization of the fundamentals, i.e. the use of new digital working methods and new technologies; in this context, data management plays an increasingly important role.

These fundamentals can be used to serve the second field, the transformation of the core. The primary objective is to optimize existing processes and promote the expansion of digital marketing. Finally, new business models, including the use of platforms and ecosystems, should complete the transformation.

The organizers Prof. Dr. Hans-Peter Burghof and Prof. Dr. Stefan Kirmße summarized the event by emphasizing once again that the building society sector has to expect turbulent times, which can be turned into a success when acting as a team. The participants took advantage of the following get-together to network extensively. Once again, the participants were unanimous in their opinion that the symposium for building societies provides significant added value for the industry.