Key takeaways of zeb’s current European Banking Study

The European Banking study illustrates the partly precarious situation in which European banks find themselves.

These are the key takeaways:

- Even a decade after the financial crisis, the top European banks’ profitability is still below capital market requirements

- Only a few banks rank digitalization at the top of their agenda—yet institutions with this focus tend to outperform the market average

- Business models must be future-proofed to meet current and upcoming challenges

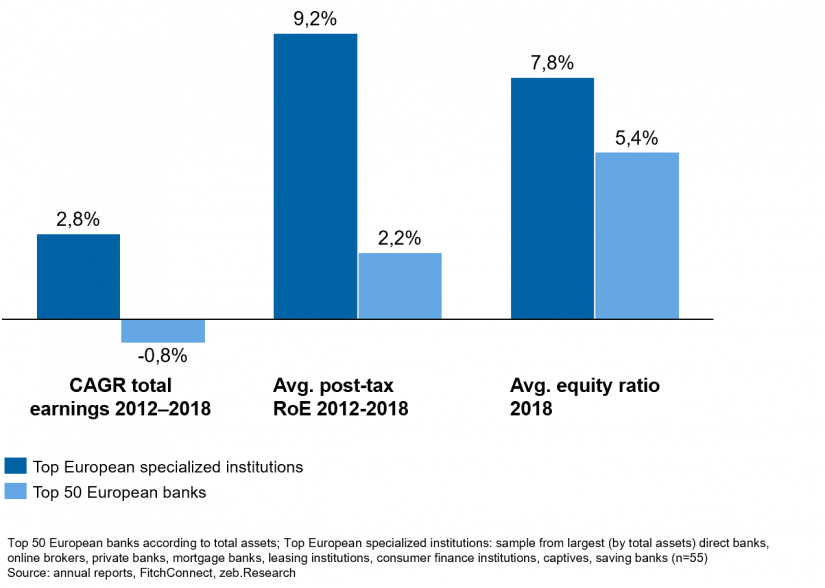

Specialized and mostly more innovative business models have achieved better profitability and equity ratios in the past year, as illustrated by last year’s European Banking Study as well as in figure 1. zeb believes this trend to be one of the key drivers of change in the retail banking sector over the next decade.

Irrespective of the current financial situation, digitalization requires all companies to invest heavily and to develop new competencies to make intelligent use of it:

Automation will lead to the introduction of end-to-end digital processes in all parts of the economy (e.g. automated household controls or large industrial control systems)—access anywhere & anytime will lead to a demand for simplicity—transparency will exert further pressure on competition—connectivity will lead to ubiquitous access to computing power (e.g. IoT connectivity, enabling new services)—advanced algorithms will predict customers’ behavior/needs—bionics will combine digital and personal interactions to leverage the advantages of both.

Unsurprisingly, global tech giants are equipped to incorporate all these digital drivers. Based on this strength, they are now striving towards specialized sub-areas of the banking business models. Mostof the global tech giants – Amazon, Google, Facebook, Apple, Tencent, Ant Financial – offer payment services, for example. As this mainly happens in the USA and China, European banks may yet feel safe. Once, however, technologies and customer behavior are fully advanced and applied throughout Europe, the need for change could hit them all the harder.

While big tech companies start out with very focused and simple elements of banking, many banks do the opposite. Hoping to transform themselves into tech companies by trying to incorporate all digital drivers within various digitalization initiatives, without, however, having a suitable business model strategy. The business models of full-scale tech companies, on the other hand, are predominantly capable of incorporating most digital drivers. Amazon, for example, is highly automated (e.g. capable of same-day delivery) and easily accessible with a transparent service offering and advanced algorithms that contribute to improvement throughout their business.

It will be difficult for banks to create something comparable to Amazon’s high-end platform. However, being the owner of a platform is only one way to participate. Producers offering services on a platform or consumers demanding services can benefit as well. Therefore, not only a comprehensive approach, but specialized business models can help reap the advantages of digital drivers.

In summary, retail banking business models are under severe pressure to proactively change to face the challenges of the decades to come.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Sustainable retail business models of the future

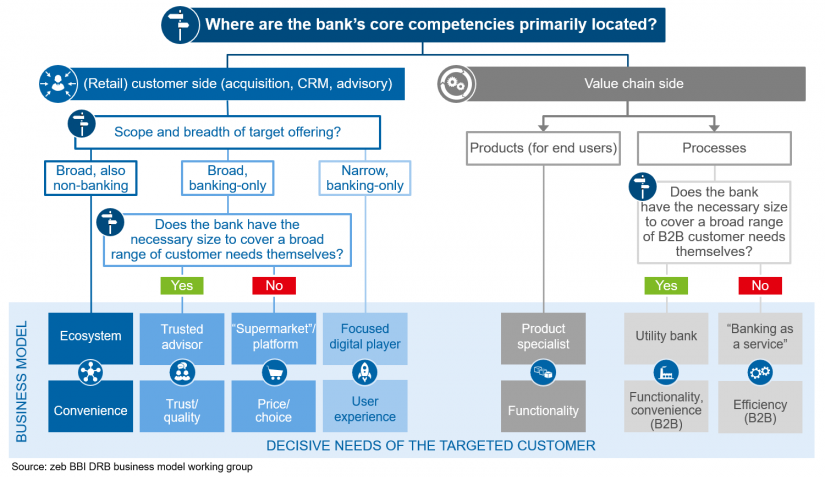

In light of the current challenges, retail banks need to focus on their strengths. There are two core strengths that define a bank’s business model: first, a clear customer centricity and second, a strong value chain focus.

Customer-centric banks have the ability to differentiate themselves through effective customer access across the buying process and to meet requirements along the customer journey.

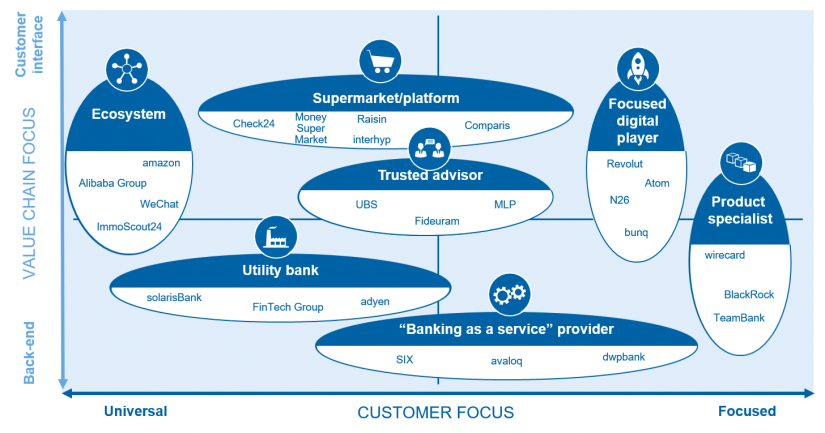

These business models include ecosystems with a broad (potentially non-banking) offering on the one end and focused digital players with a narrow banking-only offering on the other end. In between, there are trusted advisors with a broad customer range, who particularly target service-oriented individuals, as well as supermarkets serving self-directed customers in a narrower setting.

Value chain-focused banks, on the other hand, maintain their competitive advantage by differentiating themselves with effective resources and competences along the banking value chain.

Value chain-oriented companies operate as one of three business model archetypes: one concentrates on products for end customers; these companies are leaders in specific categories and therefore product specialists. The other two focus on processes and are further differentiated by their ability to cover a broad range of B2B customer needs themselves. Where possible, they position themselves as a utility bank, or else offer banking as a service.

Customer-centric retail banking business models of the future

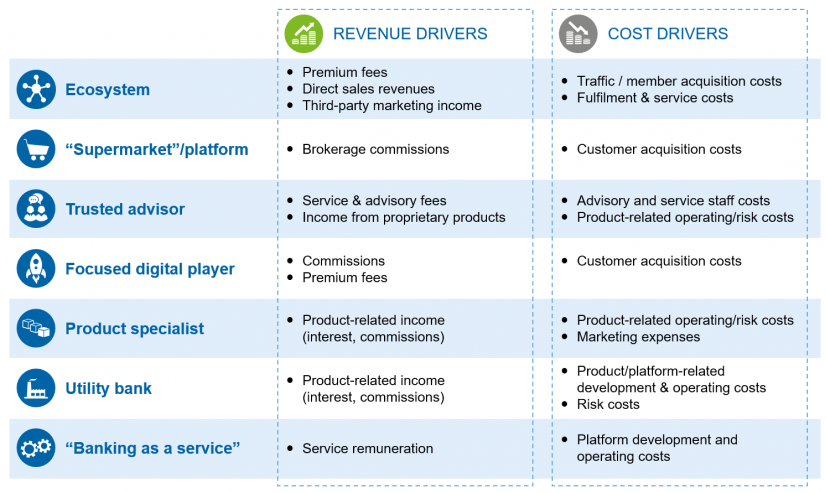

Ecosystems are (digital) gateways that aggregate suppliers to comprehensively fulfill different customer needs, often by combining complementary services. For customers, ecosystems are convenient one-stop shops that offer personalized solutions tailored to the customer’s profile, history and current situation. Network effects enhance the attractiveness by significantly reducing transaction costs.

To service such a broad offering, ecosystems rely on many partnerships, among which are traditional financial product specialists (asset managers, credit institutions, payment service providers,

insurers, …), fintech companies (alternative credit/payment providers, …) and consumer goods companies.

Trusted advisors focus less on self-service than on service and advice. They serve sophisticated customers looking for expert advice on commonly non-standardized needs. Therefore, individuals who are insecure, time-restricted or assistance-seeking will most likely turn to trusted advisors.

The appeal of a trusted advisor is in large part derived from the fact that they are part of a well-trained, highly qualified staff. They facilitate access to extended services along the typical household finance customer journey. This leads to an outstanding quality of advice and truly personalized solutions, securing mutual long-term interests (potentially life-long and even spanning generations).

Supermarkets provide a wide transparency and access to goods in complex markets by aggregating products and services on one platform. Their target customers are financially savvy and price-sensitive individuals who strive to manage their personal finances themselves. Thus summarized, the service offering should include an easy-to-use marketplace with high-quality products and services at competitive prices. To create an outstanding offer with the right products and services, successful partnerships are essential. This may include collaborating with asset managers, credit institutions, payment service providers, insurance companies, fintech companies, search engines and many more.

Focused digital players are among the more recently established business models. They offer convenient, lean, digital banking solutions in a state-of-the art design. In this context, customer centricity is of fundamental importance, as the targeted customers value convenience. One means to achieve this is to offer nearly everything their target customers would ever want, but not all of which can be reflected in a standardized approach. This approach ensures high delivery capabilities for target customers who value attractive prices but also accept that cornucopia doesn’t come cheap.

Back-end-focused retail banking business models of the future

Product specialists focus on succeeding in (at least) one category through mostly back-end skills, i.e. leadership in innovation, performance or cost. Products can be placed in two ways: First, product placement with B2B distribution partners such as financial supermarkets or trusted advisors with an open platform. Second, direct B2C placement with self-directed individuals who share an appreciation for price and performance leadership. Fintech companies acting as product specialists for payment solutions, for example, have established a basis for seamless payment transactions (such as instant payments).

Utility banks provide plug-and-play solutions for non-banks, which can henceforth integrate financial services into their customer journey without having to create their own products. These solutions can either be a finished financial product or enable the cooperating company to offer financial products themselves without having a full back-end or even a banking license. A utility bank could, for example, support an e-commerce retailer in offering credit products directly to customers who wish to make a purchase but lack sufficient funds to do so.

Banking-as-a-service providers offer banking solutions to other financial service providers. They either possess outstanding expertise in a specific business area, resulting in a leading-edge performance, or, as B2B partners, use their size advantages to offer low-cost solutions. With their offering, they can help heavily front-end-based financial services providers to source back-end products. Banking as a service, for example, could provide portfolio and asset managers with modeling tools that enable them to develop and maintain investment strategies.

Retail banking business models—so what?

Altogether, the seven business models show that a market with more focused banking business models will be a tough environment to compete in.

Holding up a universal banking approach will be impossible for most banks, as the vast majority lack the critical size and the required capabilities to operate as such, especially when challenged with focused competition.

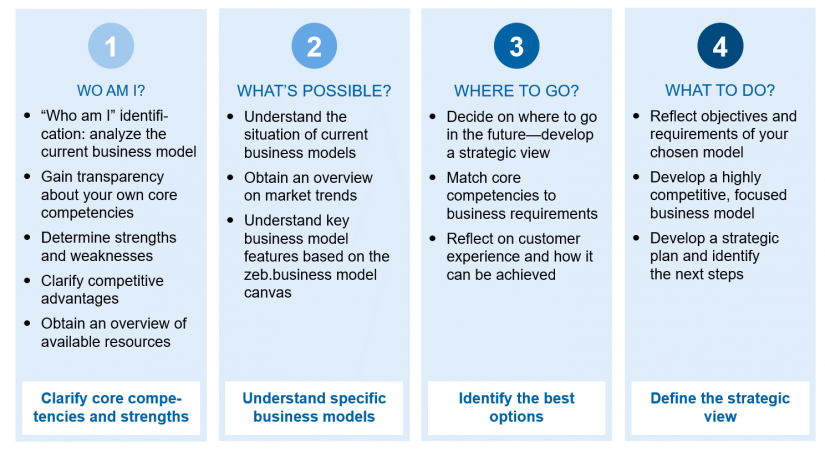

We believe that banks need to ask themselves the “who-am-I” question of their identity. Once this is resolved, banks need to decide on where to go. The options are described in the zeb.business model canvas (see figure above).

zeb has both the experience and capabilities to support the analysis of current business models as well as the development of a highly competitive focused business model. We help CEOs make changes and set up business models that deliver the type of services and customer experience that allow banks to emerge as winners in the digital economy.

Sources: Bloomberg, FitchConnect, Federal Ministry of FinanceGermany, ECB, zeb.research