Banks’ CSR impact on the environment becomes top management concern

More than ever, customers aim to procure services from companies that can demonstrate the lowest possible carbon footprint and operate sustainably in the interest of society. Equally, employees and investors are becoming increasingly interested in companies launching initiatives on topics such as CO2 emissions, recycling, fighting poverty, etc. as part of their social responsibility (so-called “Corporate Social Responsibility”, CSR).

Corporate Social Responsibility (CSR) is thus gaining more and more importance along the entire value chain. This is particularly true for the banking sector given its tainted image in recent years due to tax scandals, accusations of money laundering and not least due to the financial crises.

Numerous initiatives were launched at top levels to improve transparency for customers, employees and investors regarding companies’ (not just banks’) contributions to the community’s welfare. For instance, in Germany high-profile representatives of 30 companies have formed an association named “Value Balancing Alliance” aimed to measure “value” added to society.

A particular challenge that the initiative, which included numerous international corporations, has set itself is to measure and represent the value created by companies for the environment, society and the economy in a standardized and comparable manner. The goal to be achieved within three years is the definition of accounting standards that can be applied across the board.

Similar initiatives despite being less mature, have recently been launched on Wall Street where 181 leading US executives and CEOs agreed on a new objective of their “Business Roundtable” association. The prioritization of (short-term) shareholder value, which has long been the only mantra on Wall Street, is relativized in the revised “Statement on the Purpose of a Corporation” in favor of the value generated for other stakeholders such as customers, employees, suppliers and members of the community.

Additionally, several internationally operating banks have only recently signed the United Nations Environment Program Finance initiative’s (UNEP FI) “Principles for Responsible Banking” and the German BaFin is also focusing on the issue, albeit more from a risk perspective.

Decision makers are facing the following pressing questions: Which CSR impacts are relevant and to be taken into account? What particularities do banks need to consider as opposed to other companies? What methods for measuring and adding value are available?

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Creating a common definition and goal for CSR

In the heat of the moment it is easy to forget that the term “Corporate Social Responsibility” is down to interpretation. Differentiation and definition are therefore key in order to achieve a clear focus.

The decision on a definition[1] should not be done independent from the objective. Potential objectives could include boosting the financial performance as expressed by the total shareholder return and a higher market valuation, but also the realignment of the business model to improve sustainability—one does not necessarily exclude the other.

In this context it is crucial to agree on a common, company-wide definition of terms and objectives at the highest level in order to achieve a clear alignment of efforts and a consistent target vision.

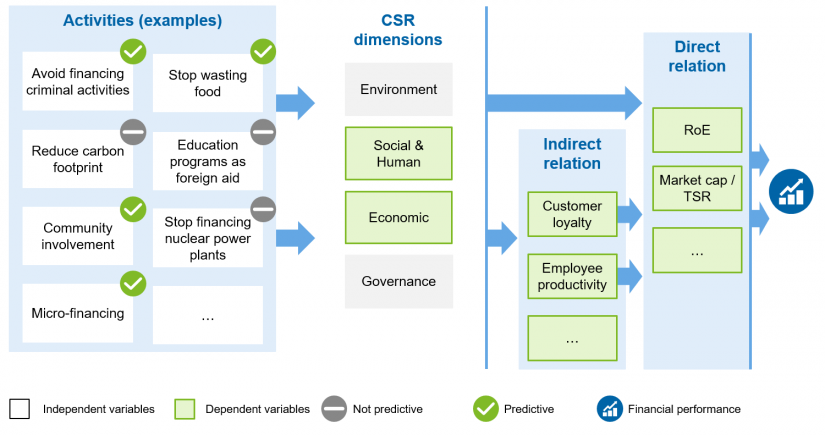

Based on a clear objective, the next question to be answered is which dimensions out of Environment, Social & Human, Economic and Governance and which activities in the respective dimensions support the defined goal.

Numerous analysis methods, such as value driver trees, can help to answer this (see Figure 1). For instance initiatives to reduce the financing of criminal activities could have a positive impact on the bank’s image in society (CSR dimension “Social & Human”), which in turn can improve customer loyalty and thus stabilize the return on equity (RoE) over time.

By contrast, however, reducing the carbon footprint could have a positive impact on the environment yet may not necessarily result in an increase in RoE as these initiatives may lead to higher operating costs. In-depth knowledge of the business model combined with statistical analyses serve as the foundation in defining these value driver trees.

Using these cause-and-effect analysis and based on the defined goal, it is important to identify those activities that result in the generation or the destruction of value or which are otherwise relevant.

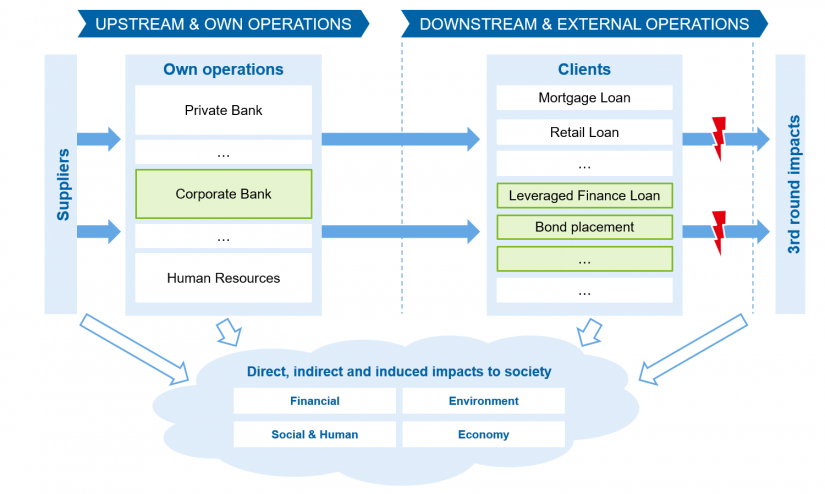

CSR activities and impacts are highly dependent on the sector in which the company operates. The value added by a chemical company differs strongly from the CSR impact of a bank. For banks, two paths of CSR impacts must be differentiated (see Figure 2):

- Upstream and own operations: these are the CSR impacts of inputs used by the bank and its suppliers, e.g.: employment impact due to wages, environmental impact due to the use of office premises, water and energy consumption, etc.

- Downstream and external operations: includes any impact at the customer level which is indirectly supported or financed by the products and services offered by the bank, e.g. environmental damage due to financing a new factory.

It is debatable to what degree the impact of operations should be included in determining the value generated: The further the distance from the core of own and customers’ operations, the higher the complexity of measuring. For banks at least at the development stage of value measurement, the range of effects should be kept fairly narrow and only direct suppliers should be taken into account, while more distanced effects should be neglected.

This would mean that for example, the environmental impact of products manufactured by a bank’s customers would not be included in the analysis. This decision has a huge impact on the complexity and the data requirements of measuring.

Over time and with increasing experience, the range of analysis can be expanded.

Measuring, monitoring and reporting CSR impact

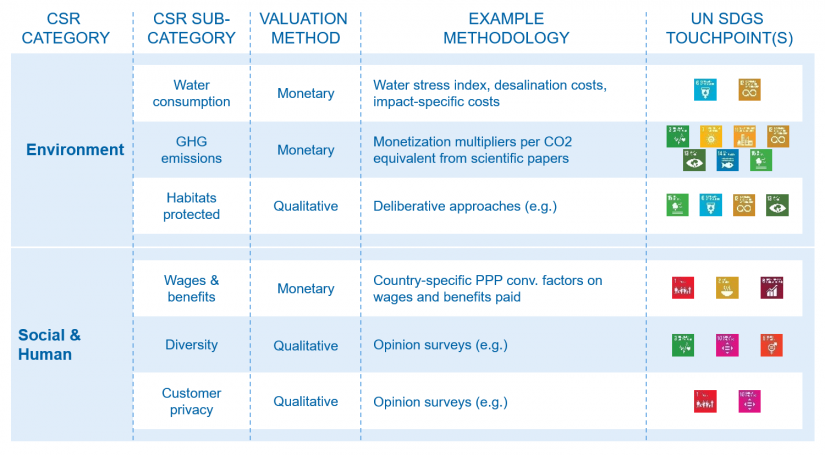

Once the goal, the relevant activities and the desired paths of impact have been defined, the various activities and their impact regarding the value generated for the environment can be measured. Figure 3 shows an example of the wide variety of methods that can be applied to measure activities and their impact. Not all activities can be directly translated into a monetary value and should instead be valued qualitatively, for example the protection of habitats.

It is also useful to map CSR activities to the United Nations Sustainable Development Goals (UN SDGs). More and more companies, increasingly also banks, use these UN SDGs as the primary way of communicating their goals and achievements regarding CSR.

As mentioned above, activities and their impact are usually not measured based on a central and common metric. Subsequently, the question is how to make the various operations and activities comparable and how to calculate the total contribution. There are two approaches:

- Monetizing all activities in the sense of a P&L contribution (also called “integrated P&L”): contributions that cannot be measured in monetary terms as such are converted into a “euro” sum using fictitious prices.

- Normalizing all activities using a scoring approach: contributions without a clear monetary value are converted into a normalized “score” in order to ensure comparability.

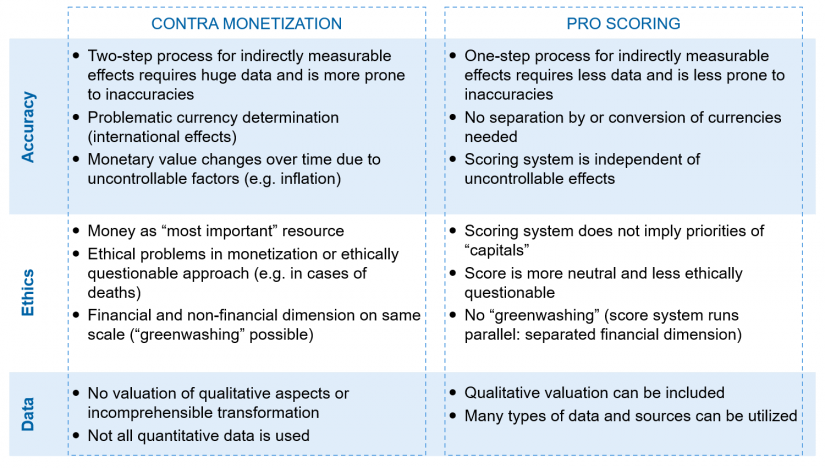

Both approaches are debatable and both offer valid lines of argument. Monetization allows adding and subtracting a key metric, which can be aggregated or distributed down to cost center level if desired. Various activities as well as various divisions/departments/cost centers can thus be compared in a supposedly standardized manner.

However, the aggregation of impacts can lead to a massive simplification. For instance, human rights violations could be compensated by a low carbon footprint. Monetization additionally feigns accuracy and can ignore potentially relevant dimensions due to their low relative value generation. Scoring of non-monetary items can eliminate these issues at least to a certain degree.

We therefore recommend a monetization of contributions where economically reasonable and scoring for contributions that are not in themselves of a monetary nature. Fundamentally, the individual scores in the respective category could be consolidated into an overall CSR score.

In this case, however, we do not recommend aggregating different activities into a total score as such an approach would hardly differ from monetizing and summing up all the effects. Effects should only compensate for each other within the same sub-category. In Figure 4 the pros and cons of monetization and scoring are listed and analyzed in terms of accuracy, ethics and data requirements.

Last but not least, appropriate reporting based on the defined goals is necessary to achieve the desired transparency and trigger the required actions.

As the majority of banks so far have little experience with measuring value generated for the environment, it is recommended to start with internal monitoring and reporting.

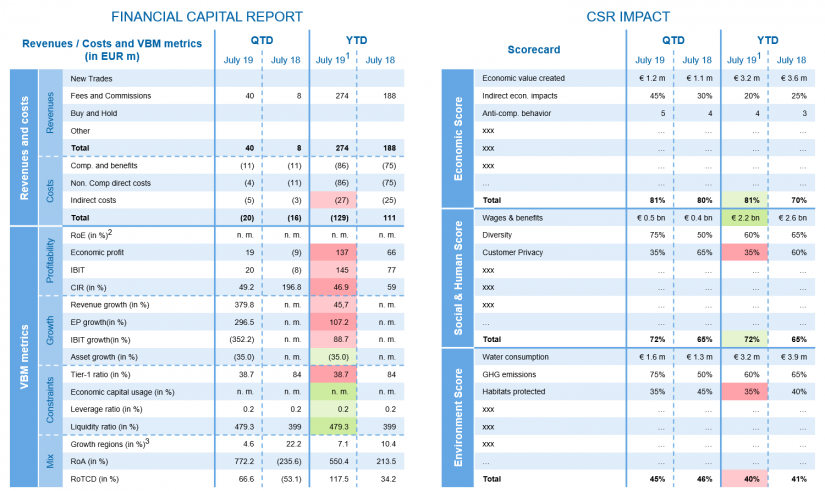

The use of scorecards has proved to be particularly efficient in this context. It involves a structured list of activities and the value they generate, separated according to CSR categories.

Effects are only aggregated vertically (i.e. in a hierarchical manner) and therefore in line with the above mentioned guidelines for valuation. The objective is to generate a report similar to the Balanced Scorecard which can be used as an additional management tool to complement the traditional financial reports (see example in Figure 5).

Once the required level of transparency and acceptance has been achieved internally, a management framework that defines required measures and responsibilities across the entire company should be defined. Actively managing the generated value is the only way to ensure a comprehensive view and shows whether the set targets have actually been attained.

Conclusion

It is important to remember that any statistically significant link between CSR activities and financial performance has not yet been entirely proven. Numerous studies (some of them by zeb) have returned ambivalent results. Based on the actual objective of measuring the value created by CSR, a suitable definition as well as the scope of measuring, i.e. what to measure in which categories, must be established.

We recommend starting with a narrow definition which can be gradually expanded over time and based on the necessary experience. In-depth knowledge of the bank’s business model and the interdependencies, from suppliers to customers, is fundamental. Only then can those activities that actually impact the desired goals as well as their implications in the CSR categories (Environment, Social & Human, Economic and Governance) be identified.

In measuring the value generated by these activities, simple monetization and aggregation are not to be recommended as they can lead to oversimplification and distortion. For activities that cannot be measured in a monetary value, a normalized score should be used instead and activities and their impact should be reported individually similar to a Balanced Scorecard.

Successful bank internal as well as external communication must be based on a consistent management framework that allows taking active measures and controlling added value long-term. Given this context, we recommend using well-established standards, such as the UN Sustainable Development Goals, for guidance.

[1] See for example the definition adopted by the European Commission: “CSR is defined as companies’ understanding of their positive and negative impacts on society and the environment. So companies prevent, manage and mitigate any negative impact that they may cause, including within their global supply chain.”

The authors of this article are available for questions and answers as well as discussions about this hot topic.

zeb can support you in a variety of ways, from consistently defining corporate and sustainability goals and establishing a valuation method to reporting and determining options for action.

Links to the initiatives mentioned above

Value Balancing Alliance, Business Roundtable US, UNEP FI, BaFin