Analysis of current market trends

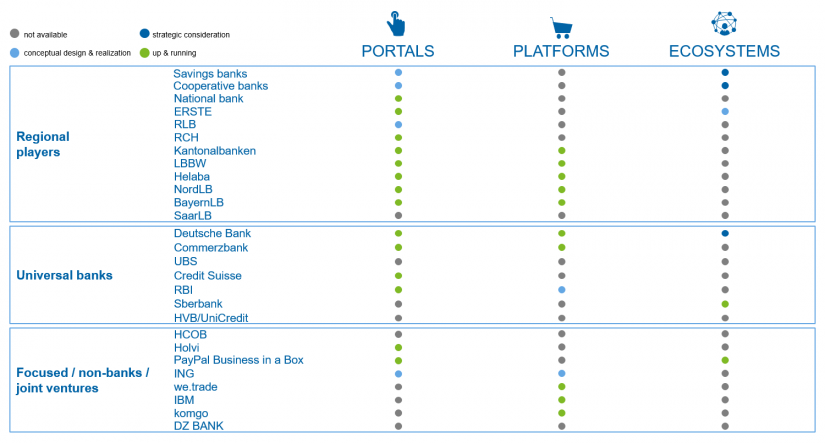

We investigated the range of portals, platforms and ecosystems available for corporate banking on the German-speaking market (Germany, Austria, Switzerland) based on publicly available information in order to provide a structured analysis. We focused primarily on solutions for platforms and ecosystems that are offered by the respective institutions themselves.

This approach, however, overlooks the numerous cases in which institutions merely contribute individual (banking) services to an ecosystem or a platform as participants (e.g. also offering commercial loans on credit comparison platforms such as Compeon).

It is possible and even probable that the observed institutions have deliberately not yet gone public, since their solutions are not yet ready for market. This has to be taken into account when interpreting the results.

Our analysis included a total of 27 institutions from the three groups: regional banks (including publications by associations), universal banks and selected focused providers (e.g. fintech companies).For our analysis of ecosystems, we also took other international examples into account.

We classified the identified offers of the institutions according to their maturity into the following three phases: strategic consideration”(the institution generally strives to design and implement a solution), conceptual design and realization (the institution designs a solution and prepares its launch) and up and running” (the institution already offers a solution on the market). An overview of the results obtained is presented in Figure 1.

Overall, it is clear that the majority of banks already offer portals today. However, only about half of the banks analyzed offer platforms. In the case of ecosystems, the maturity is even lower. Only a few solutions that have a very specific focus can be identified in the market.

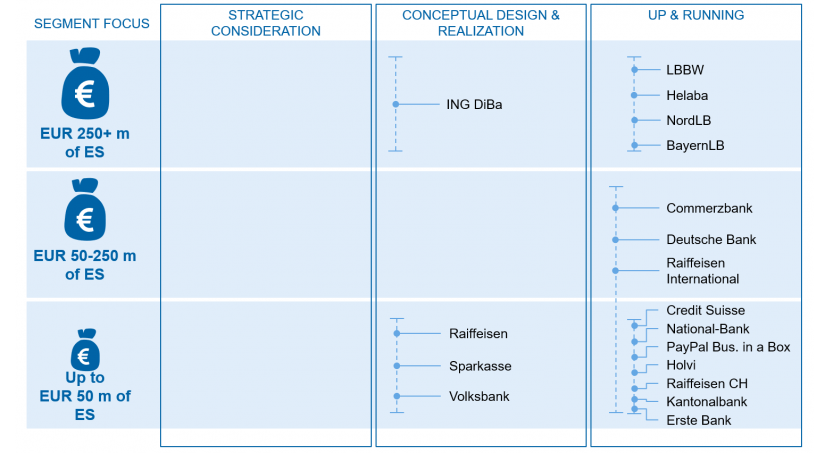

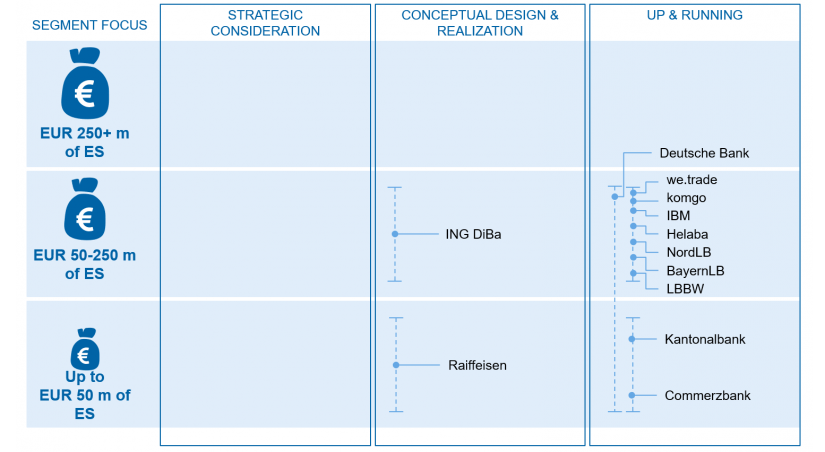

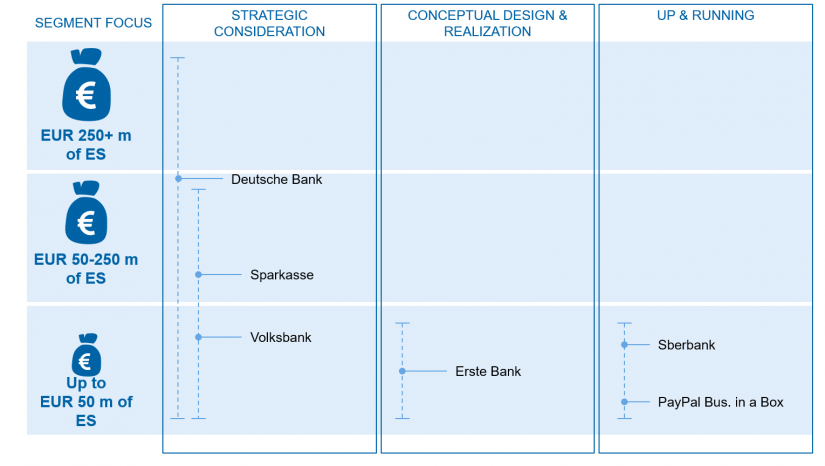

Moreover, offers are becoming much more customer-centric, since they are clearly geared to the specific needs of the various corporate banking segments. Dedicated offerings providing a more general service for small and medium-sized enterprises (SMEs) are available on the market, as are highly specialized solutions for large and major corporate customers that take account of the business model-specific and organizational characteristics (of large international organizations) as well as of a potential capital market orientation. We have therefore classified the observed examples into three corporate banking segments by size class: < EUR 50 m, EUR 50–250 m and > EUR 250 m in external sales.

Below we will provide more detailed information on the state of the market as well as on individual offers from portals, platforms and ecosystems.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Market overview of portals

A large number of the players from the various banking groups have already implemented portals for central banking services as “single points of contact”.

The state banks (Landesbanken) whose solutions serve target customers with external sales of > EUR 250 m are strongly represented. The main focus of these portals is on payments, cash management and derivatives.

In general, universal banks have also recognized the need for portals. The solutions from Deutsche Bank, Commerzbank and Raiffeisen Bank International not only provide corporate customers with standard banking services, but also meet more specific requirements. Commerzbank’s corporate banking portal, for example, covers product areas such as trade finance, factoring or leasing and includes a (treasury) cockpit for corporate customers providing an overview of foreign exchange, derivatives or securities.

Furthermore, solutions from regional players are particularly tailored to SMEs, as can be seen in the solution offered by Kantonalbanken (cantonal banks). Their “Business Finance Manager” provides a multibank-capable financial cockpit that supports SMEs in coordinating relevant activities such as liquidity or cash management.

Alongside these offers, the focused providers have specialized in particular on customers with under EUR 50 m of external sales. Providers such as Holvi or PayPal Business in a Box provide companies with features such as payments or accounting. In this case, the PayPal solution, for example, focuses very strongly on supporting (young) e-commerce providers, and also commercial PayPal loans are linked to the usage intensity of a borrower’s PayPal payments. This straightforward target group orientation, not only in terms of size, but also in terms of the business model, allows a very customer-specific solution design.

With the solutions currently being developed by the savings banks and cooperative banks, further portals are expected which will focus particularly on the customer segment < EUR 50 m and will probably achieve a high customer reach, especially due to the strong market position of both savings banks and cooperative banks. With the implementation of these solutions, portals will eventually become standard in the market

Conclusion

No matter whether smaller corporate customers or large corporates, a portal as a central access point to the usual banking features is considered a must. The upcoming launches of the savings and cooperative banks’ portals will further increase the portals’ reach. They are therefore considered to be standard in today’s market and no longer represent a competitive edge.

Market overview of platforms

While portals prove to be the market standard, platforms are considerably less included in the banks’ offerings. Fewer than half of the institutions observed currently offer platforms.

In an increasingly complex business world, companies particularly seek integrated services that reduce this complexity. A look at the solutions on the market confirms this thesis and reveals that numerous institutions use their platforms to solve complex special needs of larger corporate customers by contributing their own specific know-how. BayernLB, for example, contributes its foreign trade finance expertise to the Marco Polo trade finance network to support customers in export-oriented business.

Platforms also serve special requirements, e.g. in the area of supply chain management. IBM and Maersk offer the “Trade Lens” solution, a platform based on blockchain technology that promotes supply chain management and international trade between various participants in the container logistics industry. This basic networking idea is also reflected in the “we.trade” platform, which connects trading partners and banks for the purpose of establishing long-term business relationships. The platform enables confirmation of a company’s creditworthiness as well as automated payments.

Cooperations between different banks, as in the case of we.trade or Marco Polo, not only benefit from the solutions for special requirements, but also from linking their respective corporate customers from various industries. Banks thus bundle their customer reach in order to quickly attain the critical mass to generate network effects for all involved parties.

In general, however, the platforms on the market have so far focused mainly on the customer segment with approx. EUR 50–250 m of external sales. Especially in the < EUR 50 m segment, only few solutions have been established to date. Based on their business model and customer characteristics, regional players such as Sparkasse or Volksbank would generally be in a position to serve this segment, but actual platforms have not yet been set up.

Conclusion

The institutions represented on the market to date apparently succeed in deploying their expertise through platforms to solve their customers’ special requirements. Especially in the case of cooperation between different banks, the involved parties can quickly benefit from network effects. So far, the solutions on the market primarily target customers with external sales of EUR 50–250 m. Platforms are only offered sporadically by institutions and do not yet represent a market standard. Thus, it can be assumed that further institutions will soon offer platforms as a main medium for solving special requirements.

Market overview of ecosystems

Although some institutions have ecosystem concepts on their strategic agendas, publicly available information reveals that only a few companies are actually working on conceptual designs.

Only two of the institutions assessed have already established ecosystems. Solutions such as Sberbank’s “Business Online” enable access to third-party services such as CRM software or business analytics in addition to the management of all finances. Joint service provision as a true ecosystem concept, however, is very limited among the solutions currently observable on the market. Due to the low involvement of partners, network effects, which are of central importance in ecosystems, do not fully take effect.

So far, the solutions on the market are primarily aimed at target customers with up to EUR 50 m of external sales. Specifying the preliminary strategic considerations that exist in banks such as Deutsche Bank or Sparkasse could lead to a high customer reach in the long term. Until then, however, ecosystems will remain scarce and are more likely to be found on strategic agendas than in day-to-day business with corporate customers.

Ecosystems outside Germany are in part much more established. ANZ in Australia, for example, offers an all-in-one service center which supports start-ups by involving various parties from development to accounting while continuously expanding the business model.

Conclusion

To date, the institutions investigated have hardly implemented any ecosystems. We expect financial groups such as savings and cooperative banks to achieve large market shares in the future. Furthermore, it is evident that network effects in ecosystems are still far from being fully effective due to the limited involvement of partners. While both banks and corporate customers consider portals as standard, ecosystems are likely to have a long way to go before they achieve widespread market penetration. In future, banks will have to involve a wide range of partners in order to promote “Beyond Banking“ even more strongly.

Summary, conclusion, outlook about portals, platforms and ecosystems

A look at the market reveals that portals are regarded as the market standard. Corporate customers generally require online access to their banking services, which is why the majority of institutions already offer a corporate banking portal.

Platforms, on the other hand, are much less common on the market. Today’s solutions meet special requirements and contribute to reducing complexity. Ecosystems are also scarce on the market.

Although many banks are interested in the idea of joint service provision and the creation of a network, actual concepts for such solutions have so far only been drafted to a limited extent, partly due to a lack of expertise in setting up such online solutions. We will touch on this in the third article of the series, which will derive concrete recommendations for the development of portals, ecosystems and platforms.