What are platforms?

Traditional marketplaces have existed as long as anyone can remember. Now, however, the possibilities created by digitalization are changing strategic imperatives, which enable digital platforms to play to their full strengths.[1]

- Easy to scale: The cost structures of platforms are characterized by (very) high fixed costs and very low or no marginal costs for additional customers.

- Marginal transaction costs: Marginal transactions costs are either too low to be considered or nonexistent, which facilitates scalability. Thus, platform owners benefit disproportionately from each additional customer.

- Network effects: The (added) value of a platform for providers and for customers depends on the counterparty count. The more providers who use the platform, the bigger the portfolio and the more attractive the platform will become for customers. The more customers who use the platform, the more profitable it will become for providers to offer their services there. Together with the first two imperatives, this creates incentives for collaboration and exponential network effects for successful platforms.

A digital platform provides the infrastructure for connecting providers with customers. Value is not only added by selling services, but also by bringing together competitors, thus increasing availability and comparability for customers.

Return to the main article: “Portals, platforms and ecosystems in corporate banking”

Success factors

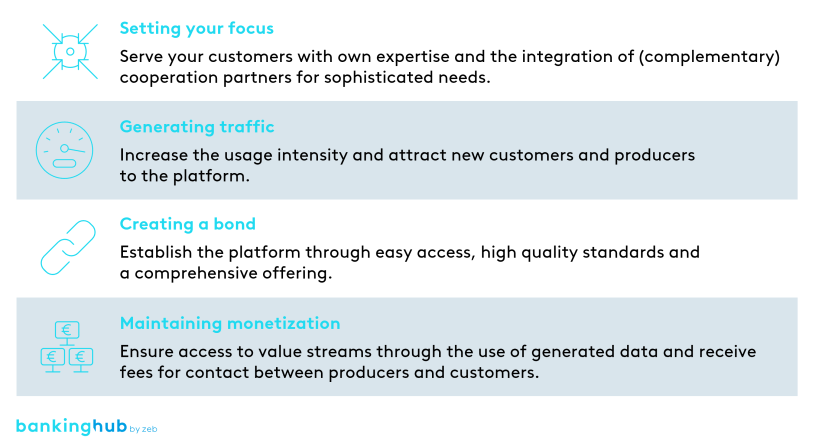

In contrast to portals, platforms are still far from being a market standard, as discussed in the second article. Although the idea of a platform is featured on the strategic agenda of many institutions, aspects such as a lack of expertise deter some banks from actually implementing the concept. This article, therefore, describes the following four success factors as guidelines for the successful development of a platform:

- Setting your focus: companies seek out platforms that may support them in more complex special requirements (e.g. foreign trade financing). Banks should therefore focus their platforms on these needs and specifically address the specific requirements of their customers by contributing their expertise and involving cooperation partners—both from within and outside their own industry.

- Generating traffic: platforms benefit from networking effects. By attracting both new customers and new producers (i.e. providers of services or products on the platform), banks can increase the usage intensity and generate added value for both sides.

- Creating a bond: easy access, high quality standards and a comprehensive range of products and services help to satisfy new customers and producers and to retain them on the platform in the long term.

- Maintaining monetization: we advise banks to establish monetization in the form of fees and data right from the start in order to create a link between producers and customers. This point represents one of the main challenges in setting up a platform, since a trade-off may arise with the aim of achieving the highest possible traffic growth. In addition, the attempt to monetize data can open up an additional source of revenue and gain insight into customer behavior.

Process model

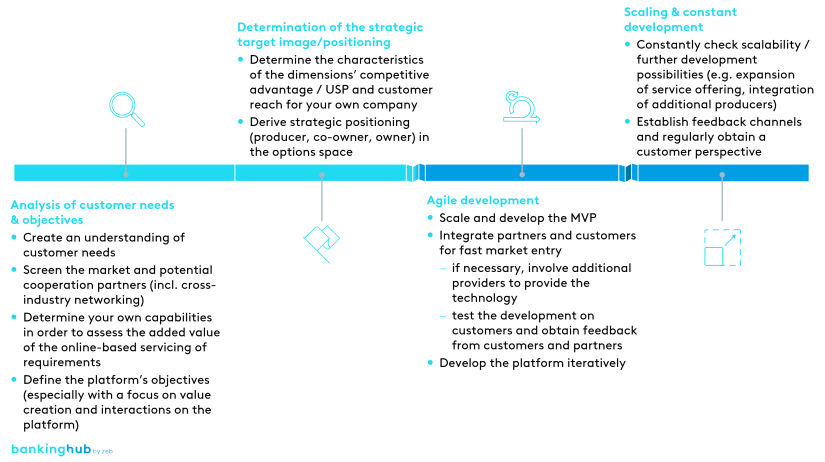

We recommend a four-step approach to implement and safeguard the success factors described above:

- Analysis of customer needs & objectives: a customer-centric business model is essential for platforms. Therefore, the first step is to understand the concrete customer needs that could be served by the platform. A look at the market allows banks to assess the current market offering and thus the potential of the platform. In addition, banks can already identify possible cooperation partners. Furthermore, they should also gain an overview of their own expertise and the added value that the platform would create. Based on the analysis results, they should then specify the interactions on the platform and define its objectives and added value.

- Determination of the strategic target image / positioning:

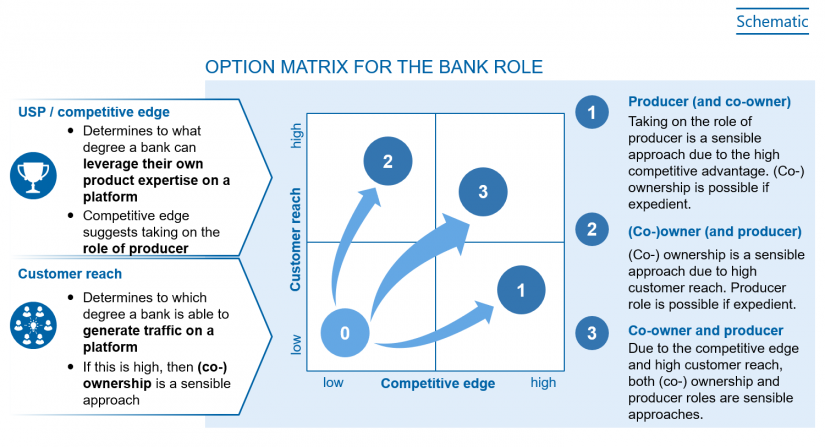

In contrast to portals, platforms combine different players that can position themselves individually. Two dimensions are essentially central to deriving the appropriate positioning:- The competitive edge dimension determines to what degree a bank can leverage its own product expertise on a platform.

- Customer reach as the second dimension determines the extent to which a bank is able to generate traffic on a platform.

The combination of the two dimensions thus results in three strategic positioning options:

- Producer: in case of a high competitive advantage and simultaneously low customer reach, the institution is well advised to position itself as a producer. Products reach a larger customer base through networking via the platform.

- (Co-)owner: in the case of a high customer reach and low competitive advantage, we recommend the bank to position itself as a (co-)owner. By integrating different producers, an owner can quickly make the products of the respective producer available to many customers.

- Producer & (co-)owner: positioning as producer and owner is generally not an either-or question. If both dimensions are pronounced and opportunities exist, banks should consider positioning themselves both as producers and (co-)owners.

- Agile development: similar to portals, banks should develop platforms in an agile way, i.e. quickly build a design that fulfills all essential functions. In the course of the development, they should consider involving a provider to supply the technology. By involving customers and partners, banks can also obtain feedback in order to gradually refine the MVP.

- Scaling & constant development: following the launch, banks need to pay particular attention to scaling the platform in order to establish it on the market in the long term and, following the forces of the platform economy, to generate traffic. To this end, institutions should continuously examine further development possibilities, such as expanding the service offering of existing producers or integrating additional producers. In addition, they should set up feedback channels that enable customers to provide impulses for further development.

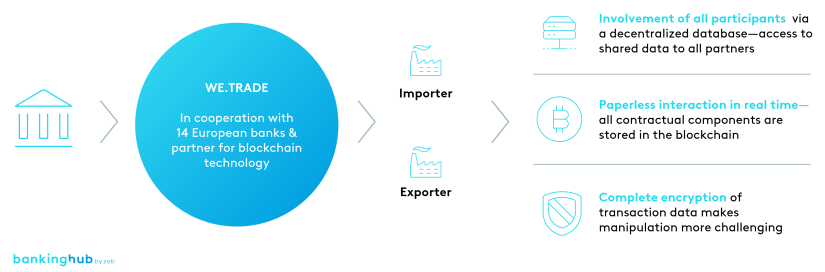

Design example “we.trade”

The “we.trade” platform is a perfect example of a platform design. Because many companies have long perceived international trade finance to be expensive or risky, various European banks joined forces in 2017 to jointly create a solution in a relatively short time that specifically addresses this customer need. Today, 14 European banks as well as IBM (as a provider for blockchain technology) join forces on the platform.