The initial situation

The initial situation in the process management of regional banks is mostly similar and has not been very systematic so far. Within the original organizational department, an employee is in charge of processes in addition to their actual job (organizational setup, skills, etc.); but usually only when something is not working or there are regulatory adjustments. This employee has the required “technical knowledge” and can administrate processes in the core banking system. When people have a question about processes, they are often referred to the process description that can be found in the company manual. In the case of real process optimization initiatives by individual employees, the changes are technically implemented after a detailed review carried out by several instances, or lengthy projects are initiated for optimization. A holistic end-to-end process optimization by one employee in the organization is not possible, neither in terms of time nor expertise. Often there is no systematic process management that clarifies responsibilities and drives a comprehensive, regular and strategic process optimization.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Practicable implementation of agile process management

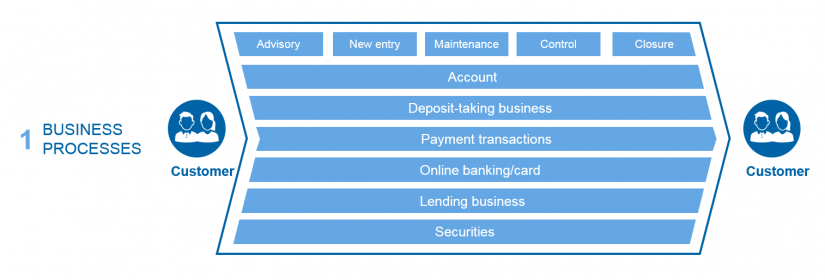

The first step to clearly define responsibilities in process management is to create a process map. The process map structures individual processes on the overall bank level. Business processes are divided into appropriate thematic process clusters so that each process can be clearly allocated to one cluster. Process clusters are defined in such a way that they summarize similar topics and that processes are adequately distributed to the clusters in terms of number and complexity. The “online banking/card” process cluster is one example for this. The basic approach here is: as few as possible, as many as necessary. For regional banks, a number of five to ten process clusters with approx. 50 to 100 processes each is practicable and reasonable.

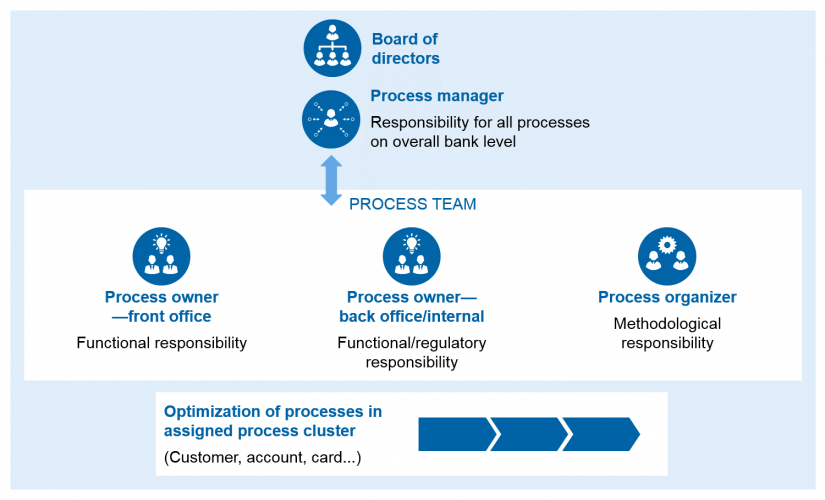

As a second step, the individual process clusters are assigned clear responsibilities. This is why for every process cluster a process team with clear end-to-end responsibility for the associated processes is formed. It consists of a process organizer and a process owner each from front and back office. The process organizer is a member of the Organization or Organization Development Department and has the methodological skills to design the process. The organizer is conceptually and technically responsible for the process design. This means that they are familiar with the process standards and design guidelines and at the same time have technical and administrative core banking system knowledge. Moreover, the process organizer is the central driver of change measures thus ensuring a continuous improvement process. The process owner from the front office has the functional responsibility for the processes of their process cluster. They look at the processes from a customer’s perspective and make sure these are always designed with the customer in mind. By contrast, the process owner from the back office has the functional and regulatory responsibility within the process team. Because team members come from different areas of the business, together they have a holistic end-to-end view of the process.

As a third step, the responsibility for processes and the authority for changes are distributed to the process teams. This is why the process teams are responsible for the assigned processes in their process cluster and should aim at continuously improving them. They are responsible for the end-to-end process optimization and regularly carry out a structured review of the processes. Release changes as well as processing and communicating circulars also fall within the process team’s remit. Furthermore, process teams are contact persons for all employees and managers of the bank and provide assistance and training. The tasks in the process team are to be distributed equally among all members. Responsibility for certain routine tasks can be assigned to specific team members.

All members of the process team are equal—there is no hierarchy within the team. Decisions are made jointly and everyone is equally responsible for the results. The process teams work completely independently in an agile matrix organization. This is the basic requirement to ensure networking and agility for changing the business processes. There are no instructions for regular meetings, process teams manage themselves. This can mean that one process team convenes on a monthly basis while another one meets every two weeks. The type of meeting is also up to the process team. They can meet face-to-face, via phone or video conference. If processes from other process teams are affected, changes must be coordinated with the relevant teams. A unanimous decision must be made within the process teams involved. Internal experts can be consulted at any time.

The process teams are given far-reaching decision-making powers. They independently implement all release changes, legally required changes as well as all non-material changes in the processes. This gives them great creative freedom, which should always be used to create the best possible process for customers. Only material changes in processes that impact the strategy or capacities (also according to MaRisk AT 8.2) need to be communicated to the process manager or to the board. The process manager has the overall and strategic responsibility for all the bank’s processes. He or she is partly responsible for the implementation of the business goals and responsible for process controlling. In case there is a lack of consensus within the process team, the process manager is the escalation authority. This is why the process manager function is located directly below the board in the organizational structure.

Compared to the current situation in many regional banks where process management is centrally anchored in the organization and the work load is distributed on just a few shoulders, tasks are significantly better assigned in an agile process management environment with independent process teams. However, this requires a clear distribution and also transfer of competences and decision-making powers in favor of customer-oriented and rapid process-related changes. Due to the clear responsibilities for processes allocated to a process cluster and the various members in a process team, there is both the time and the expertise to carry out a systematic end-to-end process optimization, to react to changed customer requirements and thus implement sustainable improvements and innovations.