The industry of asset management

In Germany, the correct banking supervisory term for asset management services pursuant to Sec. 1, Para. 1a No. 3 KWG (German Banking Act) is “portfolio management” (Finanzportfolioverwaltung). In contrast to financial or investment advisory services, asset managers not only provide investment proposals in the form of an advisory service, but also make and carry out investment decisions autonomously. In practice, the term asset management tends to be used for the management of institutional mandates and investment funds, while the term wealth management is mostly used in the context of private banking for the management of private individuals’ assets (standardized or individual asset management). In the Anglo-Saxon world, this is referred to as “institutional asset management” or “private wealth management”.

Owing to their business purpose, asset managers either operate as independent companies or as subsidiaries and divisions of banks and insurance companies. They manage the assets of institutional investors (such as pension funds, insurance companies, banks, foundations, charitable or public institutions) and/or private investors.

In addition to managing assets on the basis of corresponding mandates, asset managers primarily use investment funds as product shells, which in turn are subdivided into special funds for exclusively institutional investors and mutual funds for institutional and private investors. The special fund is a unique feature of the German (and Austrian) market, with balance sheet advantages for institutional investors. In other countries, however, institutional mandates are usually managed through segregated accounts.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Current status and trends in asset management in 2024/2025

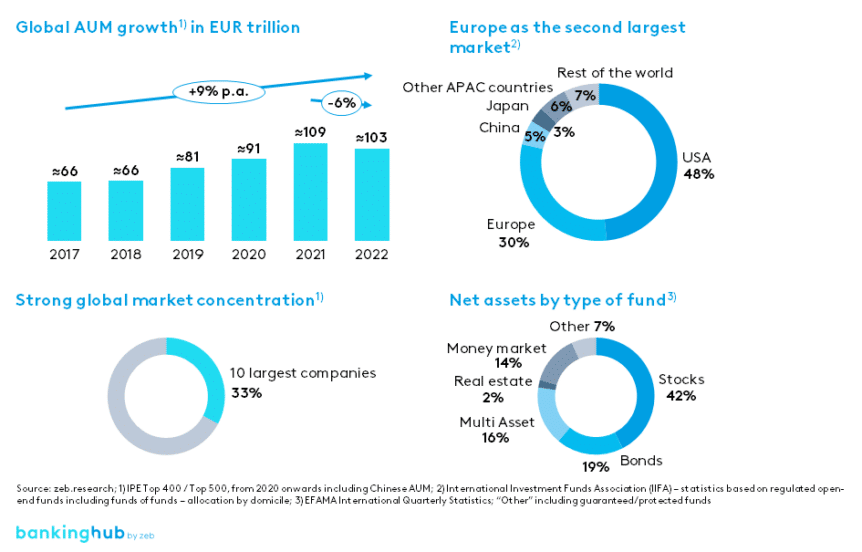

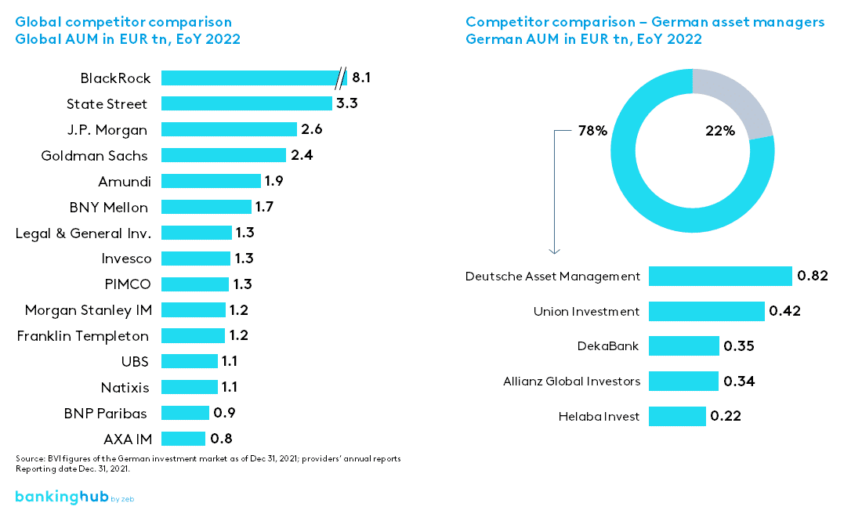

Asset managers manage more than EUR 100 trillion globally (as of: 2021). The US market is by far the largest, with a share of around 50%, followed by Europe with a share of just over 30%. Asia’s market size, which is currently still quite small, contrasts with a market growth of 12%, which is higher than that of Europe.

The asset management industry is characterized by a strong global market concentration. While more than 4,000 companies operate in this sector in Europe alone, the ten largest companies worldwide hold more than 35% of all assets under management.

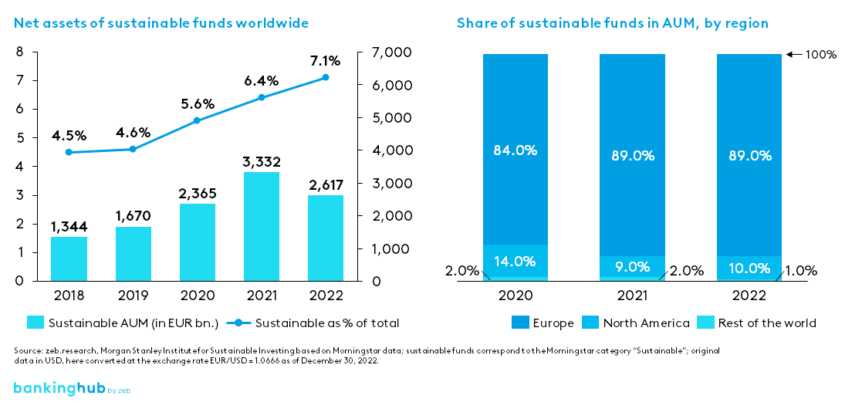

Probably one of the most popular trends in asset management in recent years has been the topic of sustainability. Due to their business model, asset managers are important catalysts for channeling investor flows into sustainable investments. With an annual growth rate of over 60%, the global trend towards sustainable investments has gained momentum until 2021. Europe, with a market share of approximately 80% in all sustainably managed assets, plays a special role as a sustainability driver. The U.S. and Asia lag far behind Europe at about 10% and 1%, respectively. This trend is largely due to the ambitious regulatory agenda and related initiatives such as the EU Commission’s SFDR or the EU taxonomy. Due to the coronavirus pandemic, inflation-related market developments and numerous accusations of greenwashing, there was an initial turnaround in sustainable investments in 2022, with a decline in sustainable net assets.

The European Sustainable Investment Funds Study as well as our dedicated website (Consulting services on ESG integration for asset managers) provide further facts and figures on sustainability in the asset management sector.

Asset management in Europe

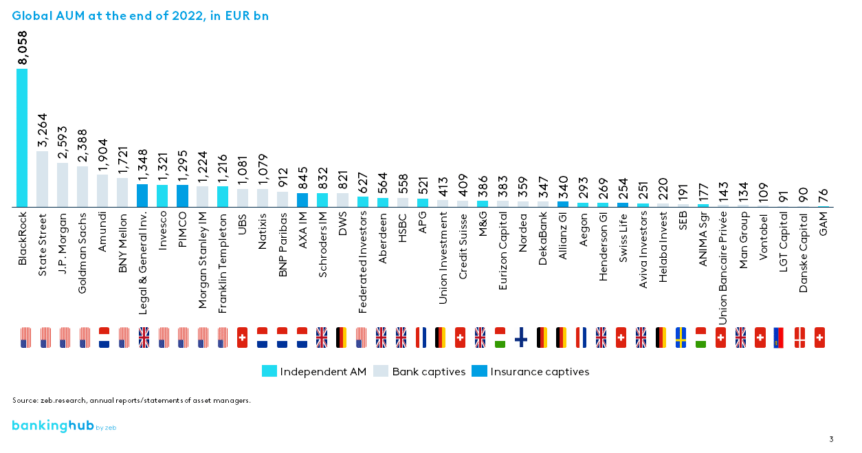

Within the scope of the European Asset Management Study, zeb identified and analyzed the following companies, which are of central importance for the European industry due to their business activities. However, the assets under management shown there include the total assets managed by these companies because most managers do not provide specific country information. In addition, there are other asset managers that also have a strong footprint in Europe, but whose figures are not publicly disclosed.

Asset management in Germany

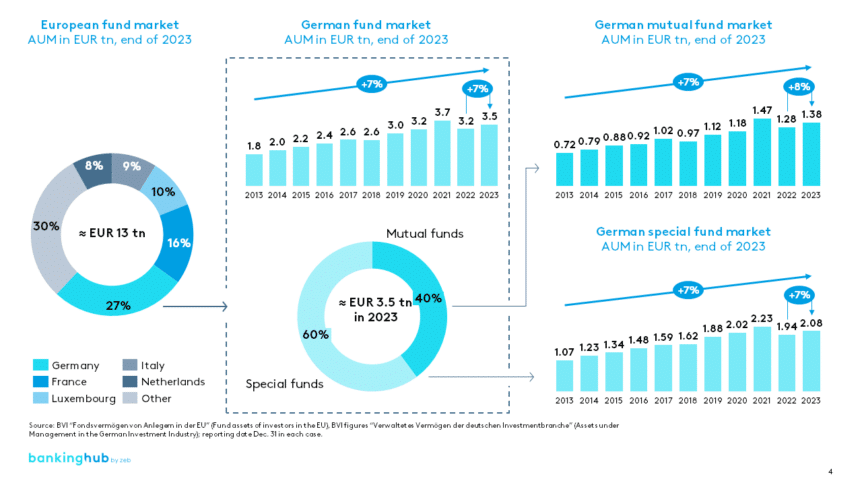

The German fund market, whose statistics are maintained and published by the German fund association BVI, offers a relatively good level of transparency. These statistics reveal that the German fund market is the largest in Europe with approximately EUR 3.5 trillion in assets under management in 2023, and is growing at a rate of around 7% p.a.

An asset manager’s growth is measured by their assets under management (AUM). This entails the performance of the market in which the managed assets are invested and the inflow of net new money (NNM).

Institutional investors hold the largest share of assets under management of approximately 60% in special funds. At 7% p.a., this market segment is slightly underperforming the mutual fund segment, which accounts for about 40% of the market and is growing at 8% p.a.

A competitor comparison in the German fund market reveals that German asset managers are among the medium-sized to small providers in terms of their global AUM but dominate the German fund market. The top five German providers account for almost 80% of fund assets.

Fit for the future?

zeb supports local and global asset managers in their strategy, sales, IT and regulatory issues in order to ensure a promising positioning for the future.

Find out more on the dedicated asset management website (in German).

Trends of the European asset management industry

Auch die Gesundheit und Trends der europäischen Asset-Management-Branche untersucht zeb jährlich in mehreren Studien und BankingHub-Artikeln.

zeb also examines the health and trends of the European asset management industry in several studies and BankingHub articles every year.

Read more in our European Asset Management Study and the European Sustainable Investments Funds Study.